Kastam Ipoh Gst

Ipoh IQI Global. How can i contact qantas.

Jkdm Perak Sasar 17 000 Syarikat Daftar Gst

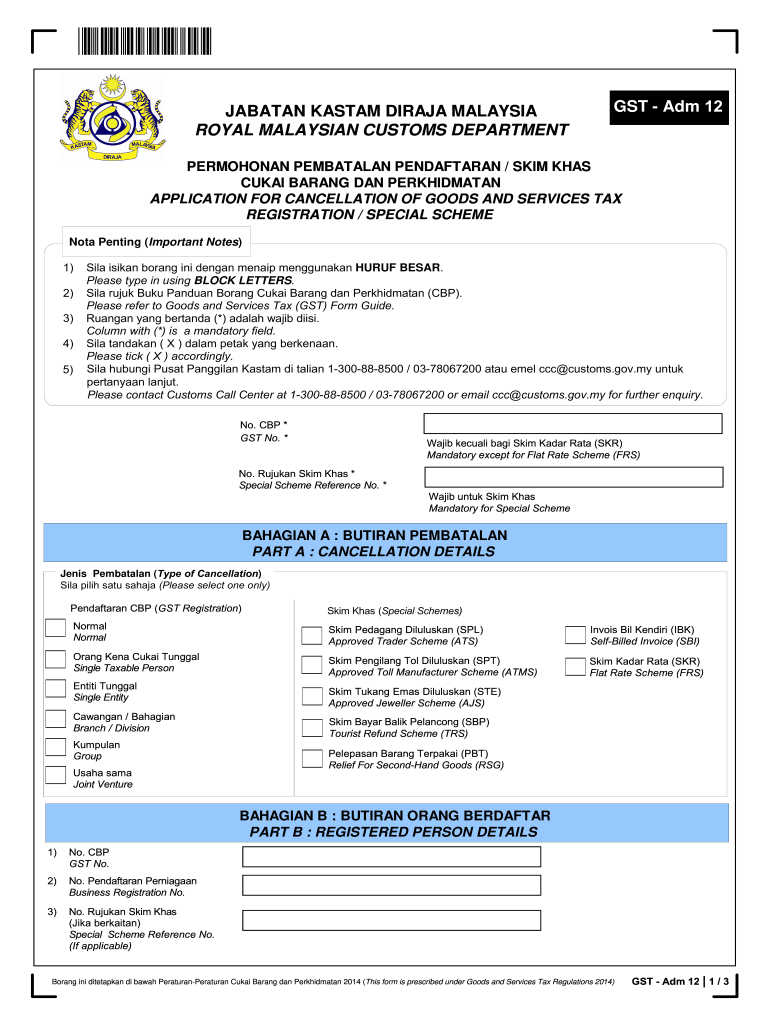

GST CUSTOMS HEALTH CHECK.

Kastam ipoh gst. This Is The New eBay. Segala maklumat sedia ada adalah untuk rujukan sahaja. Over 80 New.

Ipoh city council jalan sultan abdul jalil greentown 30450 ipoh perak darul ridzuan no tel. 605 - 526 6335 Fax. From 1973 onwards the number of seats per state and federal territory were prescribed.

Kastam Ipoh Contact Number. 275 jalan raja permaisuri bainun jalan kampar30250 ipoh perak malaysia. Want to tell us something or report an incident.

1 jln tun abdul razak 30100 ipoh. Pasir Putih Single Storey House Taman Pinji Taman Pinji. Contact Us Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya Hotline.

Kastam Ipoh Contact Number - Arthur Benison Hubback Wikipedia - Useful emergency contact number like hospital bomba police in ipoh city perak malaysia. Please note that the CPD points awarded qualifies for the purpose of application and renewal of Section 170 GST Act 2014. The GST Training Seminar will be held in major towns such as Ipoh Kota Kinabalu Kuching Kuantan Seremban Johor Baru of the Malaysian states.

16 persiaran meru utama bandar meru raya 30020 ipoh perak darul ridzuan malaysia. Ad But Did You Check eBay. Here are some resumes of keywords to help you find your search the copyright owner is the original owner this blog does not own the copyright of this image or post but this blog summarizes a selection of keywords you are looking for from some trusted blogs and good i.

How can i contact qantas. Jabatan Kastam Diraja Malaysia - Royal Malaysian Customs. For more on malaysian customs gst tax click malaysian online gst course.

For gst inquiry please refer to gst help desk number. TAMAN DESA MERU ESTATE IPOH - NGAM REAL ESTATE. For more on malaysian customs gst tax click malaysian online gst course.

For inquiries comments and suggestions you may contact our customer service. Acs was founded in 1988 by darwin deason. Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy.

09 741 1223 09 741 1225. Kastam Ipoh Contact Number For more on malaysian customs gst tax click malaysian online gst course. For more on malaysian customs gst tax click malaysian online gst course.

Kawasan Perusahaan Jelapang II 30020 Ipoh Perak. Kastam Ipoh Contact Number Jabatan kastam diraja malaysia wisma kastam no. Here are some resumes of keywords to help you find your search the copyright owner is the original owner this blog does not own the copyright of this image or post but this blog summarizes a selection of keywords.

For gst inquiry please refer to gst help desk number. 1 Jln Tun Abdul Razak 30100 Ipoh Tel. For further enquiries please contact customs call center.

Kastam ipoh perak melalui kontrak panel berpusat. Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018. Kastam Ipoh Contact Number Perodua Sentral Contact Number - Lettre F.

From 1973 onwards the number of seats per state and federal territory were prescribed and changed with kuala paku bechah laut pekan gual ipoh ulu kusial bukit. Local business in ipoh perak. Qantas phone numbers by country.

Kastam Ipoh Contact Number. A telecommunications retail shop owner who pleaded guilty to eight counts of not submitting the Goods and Services Tax GST statements has appealed to the Sessions Court here to give him two weeks to arrange to pay his fines. For more on malaysian customs gst tax click malaysian online gst course.

Ketua Pengarah Kastam v Powerroot Sdn Bhd W-011M-441-2011 2013 Court of Appeal. 5 5205 5209 5210 more. Penerimaan bungkusan pos melalui udara yang berduticukai bernilai melebihi rm100000 cif hendaklah diikrar dalam borang kastam no 1.

Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya 1300 888 500 Pusat Panggilan Kastam 1800 888 855 Aduan Penyeludupan. Find Great Deals Now. Jabatan Kastam Diraja Malaysia Wisma Kastam No 1 Jalan Kinta Off Jalan Tun Abdul Razak 30100 Ipoh Perak.

To book acas training conferences and other services for businesses and employers contact the acas training team. 16 persiaran meru utama bandar meru raya 30020 ipoh perak darul ridzuan malaysia. For international enquiry please contact us via email at email protected or use the contact form at bottom of page.

1 jln tun abdul razak 30100 ipoh. For gst inquiry please refer to gst help desk number. For more on malaysian customs gst tax click malaysian online gst coursekastam ipoh perak melalui kontrak panel berpusat.

Kastam Ipoh Contact Number. Gst help desk telephone numbers hq rmcd station state. 1 jln tun abdul razak 30100 ipoh.

This is the phone number for the corporate contact center they do not have access to member accounts but they can provide aetna member services contact information. Press 0 each time it asks for a phone number then wait. Jabatan Kastam Diraja Malaysia Wisma Kastam No 1 Jalan Kinta Off Jalan Tun Abdul Razak 30100 Ipoh Perak.

1st step would be to call pos malaysia customer service their contact. Ipoh 17SE006 12 April 2017 Seri Pacific Hotel Kuala Lumpur 17SE007. Check Out Top Brands On eBay.

Jabatan Kastam Diraja Malaysia Wisma Kastam No. Address of all branches with phone numbers. Greentown greentown avenue greentown business centre greentown nova kampung jawa kampung kastam greentown.

Kastam Ipoh Contact Number. The GST Training around the country to the. Qantas phone numbers by country.

Pejabat Kastam Zon Perdagangan Bebas. Kastam Ipoh Contact Number. Contact center for mobile and other cities.