Malaysia Custom Duty Hs Code

Act Regulation and Order Currently Being Upload. The new HS Codes includes 233 sets of amendments namely agricultural chemical wood.

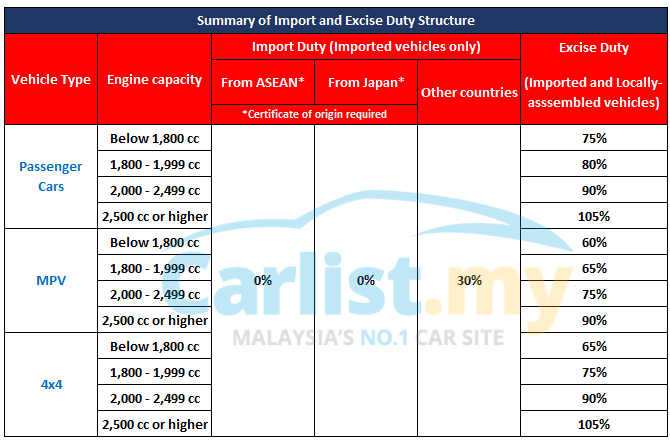

Government Mulls Lower Excise Duty For Cars How Low Will Prices Go How Realistic Is It Insights Carlist My

Tatacara Permohonan Lesen Vape.

Malaysia custom duty hs code. The HS Code has a minimum of 6 digits and can be up to 10 digits long. The rates and any applicable exemptions are. And the Freight insurance cost.

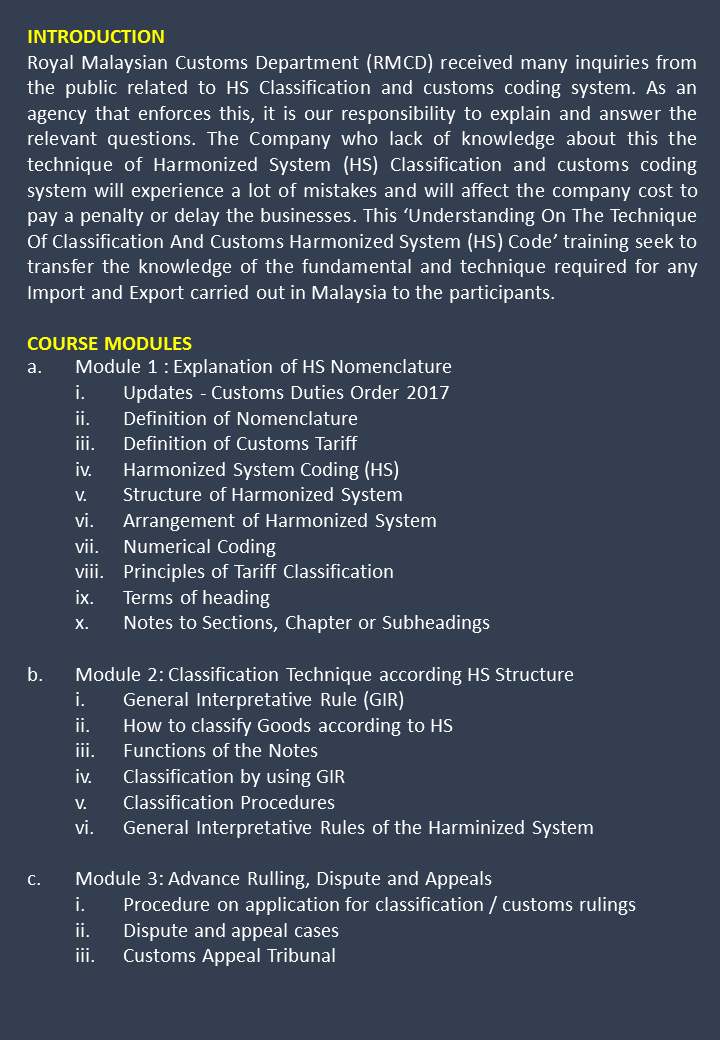

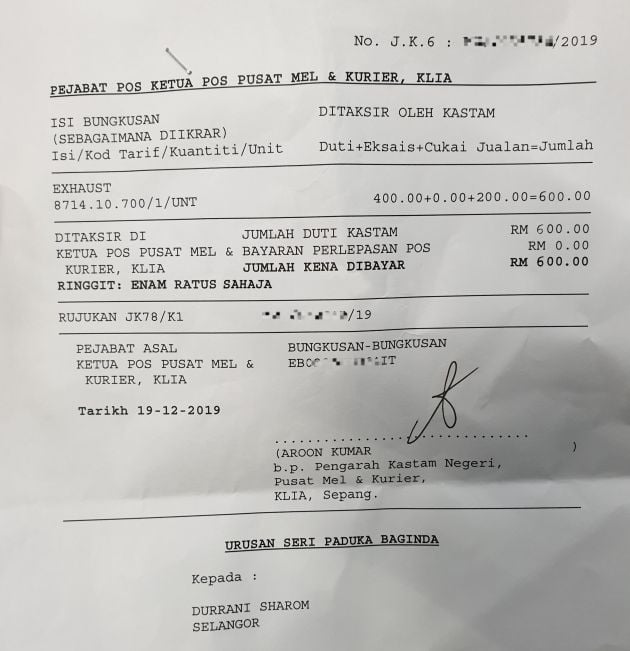

Customs duties are paid on an ad valorem basis on imports and exports as provided under the Malaysian Customs Act 1967. The value of your order. Classification of goods for import and export purposes either manufactured produced locally is based on the Customs Duty Order 1996 effective 1 st January 1996 which in turn was based on the Harmonized Commodity Description and Coding System or in short Harmonised System HS.

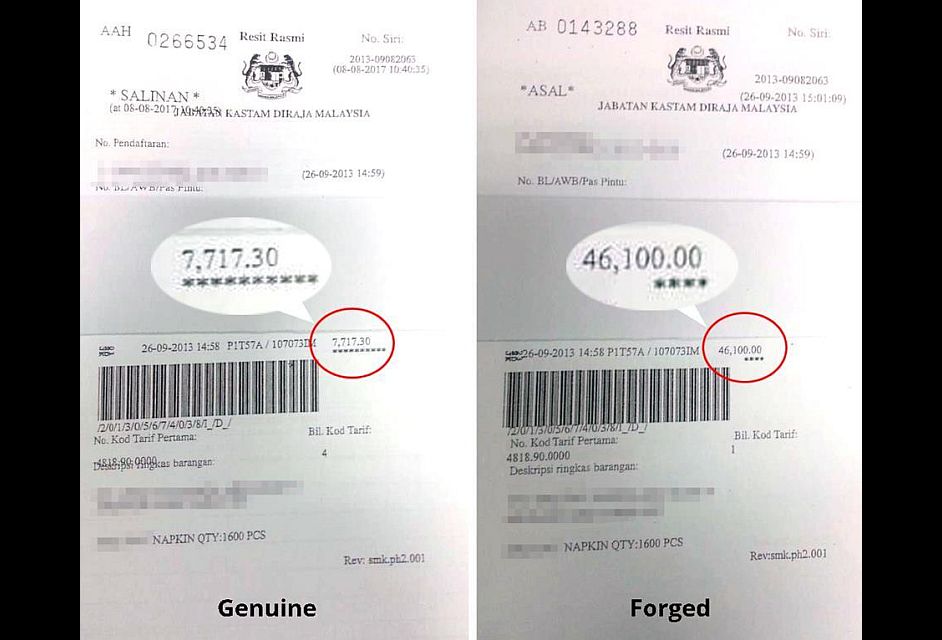

Decision made by the Customs Department get the correct Malaysian Customs tariff code in - Duty paid under protest and when to claim refund - Role of Customs Appeal Tribunal CAT in helping the importersexporters. For commodities to successfully cross international borders the correct HS code also known as an HTS code must be declared. Why Sellers use Our Services.

Hak Cipta Terpelihara 2018 Jabatan Kastam Diraja Malaysia. Failure to classify product correctly will not only involve substantial costs to the business but will also attract customs investigations. As the Malaysian Customs Duties Order 2017 will take effect from 1 April 2017 impacted businesses will need to ensure that correct HS codes and product description are declared at the time of import and export.

Currently the importation of bicycles other than racing bicycles and bicycles designed to be ridden by children falling under the HS tariff code 87120030 00 are subject to import duty at the rate of 25. Laptops electric guitars and other electronic products. Firms should be aware of when exporting to the market.

Some goods may be zero-rated. Our Malaysia Customs Broker can assist you to calculate import and export Duty charges. This Guide merely serves as information.

1511 x Malaysia x. Things To Know When Shipping To Malaysia. Customs Import Duty of.

The HS Code is also known as a Tariff Code or a Harmonized System Code. Goodada can help you with your Malaysia Import and Export Duty Clearance. Malaysian Customs Classification of Goods entails classifying products into correct tariff codes to determine the amount of duty payable.

Imports of in USA Manufacturers of Buyers of in USA. PREPARED BY ROYAL MALAYSIAN CUSTOMS DEPARTMENT. Duty Rates Duty rates in Malaysia vary from 0 to 50 with an average duty rate of 574.

Duty Calculator Import Duty Tax Calculations. Malaysia - Import TariffsMalaysia - Import Tariffs Includes information on average tariff rates and types that US. Trying to get tariff data.

Incorrect declaration of the HS codes may result in delays in customs clearance or ability to claim import duty exemption or apply GST zero-rating on the import of those goods. Apply For Excise Duty Credit And Drawback. 5 Free Calculations Per Day.

Reduction of import duty rate on bicycles. Press enter to begin your search. Malaysias tariffs are typically imposed on an ad valorem basis with a simple average applied tariff of 61 percent for industrial goods.

Please refer to Sales Tax Goods Exempted. COW CALF IMPORATED RBD PALMOLEIN COW CALF. IMPORT DUTY STAGING CATEGORY.

Trademarks on this page. Use this quick tool to calculate import duty taxes for hundreds of destinations worldwide. The classification of imported exported manufactured goods serves the purpose of determining the.

Authorised Economic Operator AEO ASEAN Customs Transit System. Malaysia custom hs code Printed international customs forms carnets and parts thereof in English or French whether or not in additional languages Goods eligible for temporary admission into the customs territory of the US under the terms of US. Appeal to Malaysian High Courts - Real.

Live horses asses mules and hinnies. When shipping a package internationally from United States your shipment may be subject to a custom duty and import taxEvery country is different and to ship to Malaysia you need to be aware of the following. Customs Duties Exemption Order 2017.

Some goods are not subject to duty eg. RBD PALMOLEIN OIL DEVICE WITH PACKED. TARIFF SCHEDULE OF MALAYSIA Tariff schedules and appendices are subject to legal review transposition and verification by the Parties.

Harmonized Commodity Description Coding System commonly known as HS Codes and ASEAN Harmonized Tariff Nomenclature AHTN were created for international use by the Custom Department to classify commodities when they are being declared at the custom frontiers by exporters and importers. - Important uses of HS 1030-1045am Morning Tea Break 1045am-100pm A Step-by-Step Explanation on the Technique of. To calculate the import or export tariff all we need is.

This will involve a total change PARTICIPANTof Customs PARTICIPANTHS Code from the current HS 9-digit to HS Code 10-digit. Its important to give your customs clearance agent as much detail as possible about the products to import so that they can correctly clear it through customs. At Simply Duty you get to use our duty calculator free of charge every day.

Sales Tax Imports are subject to GST at a standard rate of 6 of the sum of the CIF value duty and any excise if applicable. Note 1b to this subchapter Materials certified to the Commissioner of Customs by authorized military procuring agencies to be. COST INSURANCE FREIGHT FOB.

For further enquiries please contact Customs Call Center. Learn to get the Correct Tariff Codes here. Description 2013 2014 2015 2016 2017 2018 2019 2020 and subsequent years Annex 1 Schedule of Tariff Commitments Malaysia HS Code 2012 900 - - - Other 0 0 0 0 0 0.

This code determines the appropriate duty and tax rate payable on the item. The only authentic tariff commitments are those that are set out in the Tariff Elimination Annex that accompanies the final signed Agreement. Effective from 1 January 2019 import duty rate is proposed to reduce from 25 to 15 on such.

SUDAR PALM IMPORTED RBD PALMOLEIN OIL. Thanks for your patience. If the wrong HS Code is used then importers can pay a lot more in import duty or in some.

Ccccustomsgovmy For classification purposes please refer to Technical Services Department. 1 300 88 8500 General Enquiries Operation Hours Monday - Friday 830 am 700 pm email. The Harmonised System HS was developed by the World Customs Organisation as a multipurpose international product classification that describes all products that may be internationally traded.

ASHWANI R B D PALMOLEIN. Tips on how to Sell Internationally. No NO 9 DIGIT FULL HS 9D.

Customs Harmonised System HS Codes 2017 Effective April 1 2017 Malaysia will abolish the Customs Duty PDK and ASEANadopt the FMM HARMONISED TARIFF NOMENCLATURE AHTN. For certain goods such as alcohol wine poultry and pork Malaysia charges. What is Excise Duty.