Malaysia Customs Alcohol Limit

CBP officers enforce the Bureau of Alcohol Tobacco Firearms and Explosives ATF laws rules and regulations and are authorized to make on. These items may cost two times as much or more than in your country.

Now Air Asia didnt offer this flight as an official connection so I had to book two separate flights.

Malaysia customs alcohol limit. All customs duties and taxes imposed must have been paid before the goods are imported. Absolutely prohibited strictly prohibited and prohibited with exceptions. However the gift sender must also consider the costs of International shipping packaging insurance and Customs taxesduties in some.

- one pair of new footwear. There is a common expectation about imported items in Malaysia being overpriced on the local market. If youre arrested for driving with a blood alcohol level over this.

- a total max. One to KL 5 hour wait time at airport then the next one KL to. The legal limit for alcohol while driving in Malaysia is 80 milligrams per decilitre or 100 millilitres.

Import taxes and customs duties. One to KL 5 hour wait time at airport then the next one KL to. For Malaysia the limit you can bring in is 1 litre per adult.

On average the rate for imported industrial goods is 6 which is relatively low compared to other countries in the world. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya. The Excise Department denies that officials preyed on Singaporean tourists at the Suvarnabhumi Airport but has.

Imitation or toy guns and firearms. There is no limit for a resident and non-resident to carry into and out of Malaysia foreign currency notes and travellers cheques but need to declare in Customs Form 22 Borang Kastam 22 if total amount exceed USD 10000 equivalent. Increase in excise duty for alcohol seen unlikely in Budget 2020.

The amount of alcohol in you thats enough to get you into hot water is covered under section 45G of the Road Transport Act 1987. Morphine heroine candu marijuana etc are strictly prohibited. In Malaysia imported goods with a CIF value of less than RM 500 are exempt from duties except for alcohol wine and tobacco products from the USA.

THE PUNISHMENT FOR DRUG TRAFFICKING IS DEATH BY HANGING. Answer 1 of 5. The two passengers were stopped after the customs first were slapped with 75000 THB duty that was later reduced to 33000 THB that they paid and four bottles of confiscated whiskey was never returned.

Approximately 75 of imports into Malaysia are not subject to customs duties. This is true about imported alcohol some brands of chocolates and electronics. If you are a returning Malaysian resident you must have been away for not less than 72 hours.

3 pieces of new wearing apparel. Singapore Customs has reminded arriving travellers and returning Singaporeans that duty free allowance for liquor will be revised to two litres down from three from Monday 1 April. Customs issued a public statement via its website and communicated directly.

Of MYR 75- of dutiable food preparations. While federal regulations do not specify a limit on the amount of alcohol you may bring back beyond the personal exemption amount unusual quantities may raise suspicions that you are importing the alcohol for other purposes such as for resale. Prescribed drugs can only be imported into or exported from the country by virtue of a licence issued by the Ministry of Health Malaysia.

Certain health and medicinal food products. CIF value up to MY 500 are exempt of duty with the exception of alcohol wine and tobacco products from USA. How much do you have to declare at customs in Malaysia.

Flying from Gold Coast to Guangzhou with Air Asia X next week. If you need to bring medications check with your shipping. Imports with a shipment value ie.

Can I import wine to Malaysia. Flying from Gold Coast to Guangzhou with Air Asia X next week. Some forms of liquor.

1 liter of wine spirits or malt liquor. It doesnt matter if youve bought it in Japan or the duty free shops at the Malaysian airport. Prescribed limit means a 35 microgrammes of alcohol in 100 millilitres of breath.

The legal limit for alcohol in the bloodstream while driving in Malaysia is 80 milligrams per deciliter or 100 milliliters. Tobacco and Cigarette products. Import and export of illicit drugs eg.

Malaysias tariff barriers are largely applied ad valorem ranging from 0 to 50. Heres an update from the Nation access their piece here. Fireworks and other explosives.

In Malaysia restricted items for imports and exports are classified into three types. In Malaysia only businesses can import wine and beer. Anything that is unsuited with peace or is prejudicial to Malaysias interests.

On year-to-date shares in both listed breweries on Bursa Malaysia namely Carlsberg and Heineken Malaysia. However the enforcement on the new legal drinking age of 21 was held back until 16 October 2018. Exceptions are currently Labuan 24 hours and for Langkawi or Pulau Tioman 48 hours Unless otherwise stated these allowances are per personindividual.

These goods among others are not allowed except with an import licence or permit. - one unit of each portable electrical or battery operated appliance for personal care and hygiene. B 80 milligrammes of alcohol in 100 millilitres of blood.

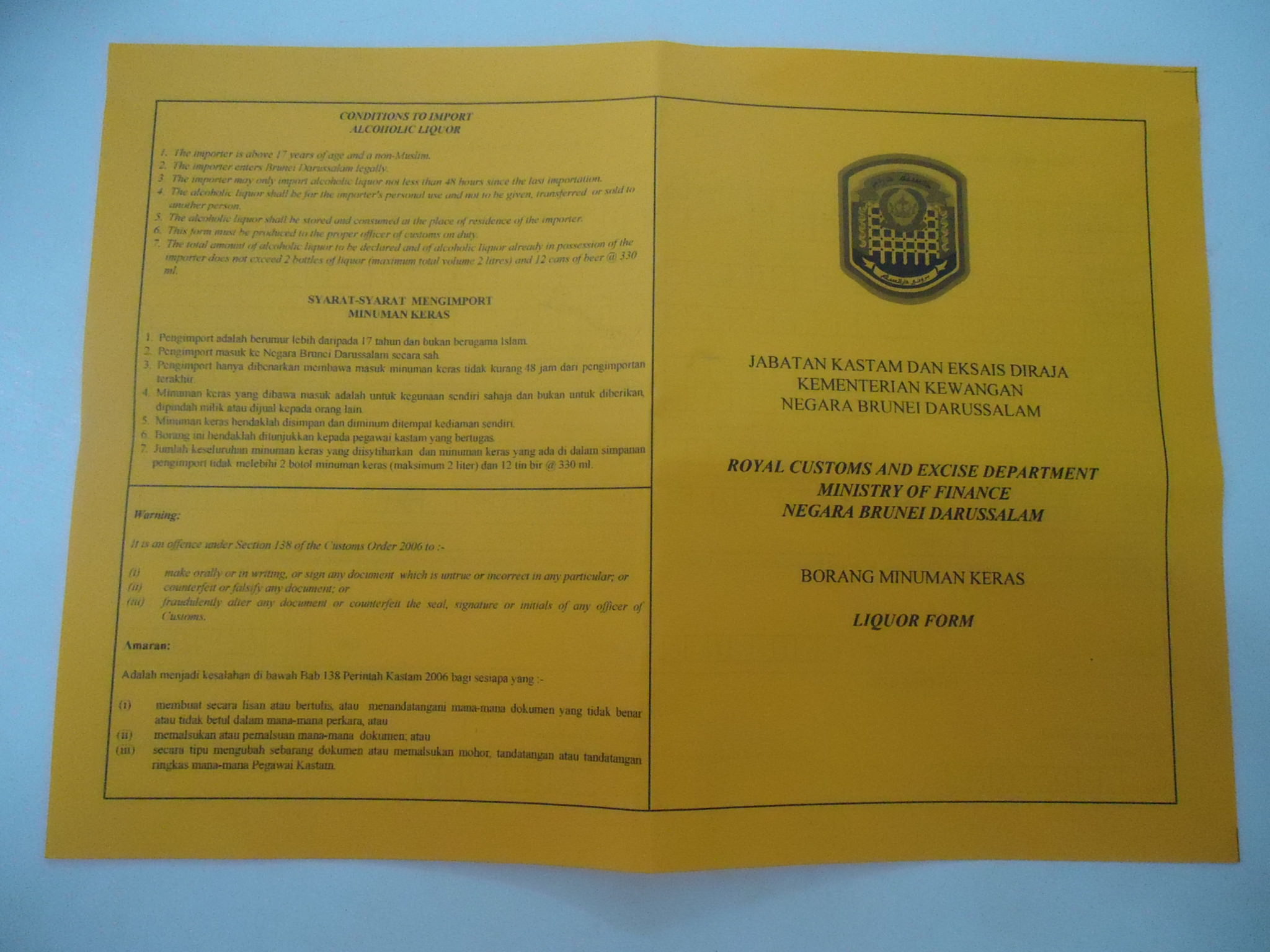

Now Air Asia didnt offer this flight as an official connection so I had to book two separate flights. The Royal Customs and Excise Department cooperates with a number of other agencies and a license and permit from responsible agency is necessary to import the following products. Your bags get scanned on arrival in Malaysia before you leave the airport so if you have alcohol in your checked bag and more alcohol that youve carried onto the plane or bought when.

Or c 107 milligrammes of alcohol in 100 millilitres of urine. Answer 1 of 5. 1300 888 500 Customs Call Centre 1800 888 855 Smuggling Report 03 8882 21002300 Head Quaters HEADQUARTERS.

Animal and animal products. Alcohol Wine spirits or liquors not exceeding 1 litre.