Kastam Form K1 With Duty

Borang Ikrar Kastam K1 tersebut turut memerlukan dokumen sokongan seperti kebenaran atau Permit dalam kes-kes tertentu seperti import handphone dan lain-lain berkaitan. 1 Pin92002 Customs No1 Rev92002 JABATAN KASTAM DIRAJA MALAYSIA ROYAL MALAYSIAN CUSTOMS DEPARTMENT PENGAKUAN BARANG-BARANG YANG DIIMPORT DECLARATION OF GOODS IMPORTED PREVIEW COPY 2Konsaini.

6 Port Documentations 6 1 Related Documents Ie

Declaration of goods imported.

Kastam form k1 with duty. AGENCY Browse other government agencies and NGOs websites from the list. K2 - Export for dutiable and non-dutiable goods. K1 Use for the importation of goods into the country.

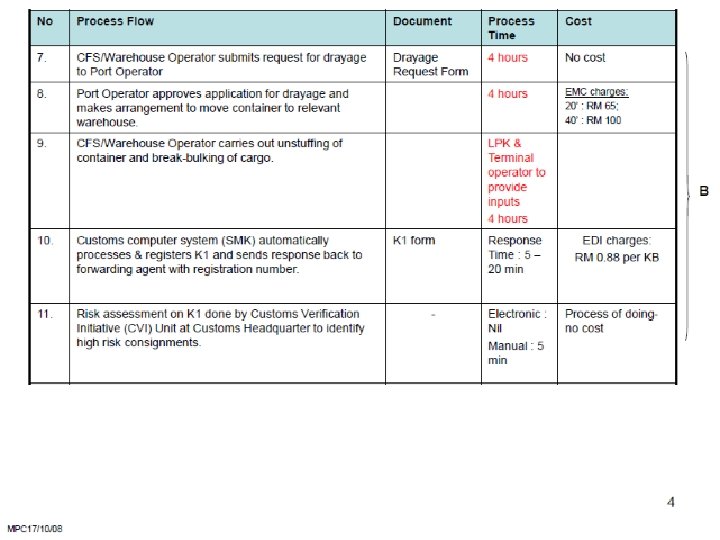

25 FORM K2 SMK STA Self Declaration 26 FORM K2 SMK STA Self Declaration 27 FORM K2 EXPORT. Assessment of goods by Senior Customs Officer to determine dutiestaxes payable which includes the following processes. K1 Import shipments K2 Export Shipments K3 Export to East Malaysia K8 Impoort to Bonded Warehouse K9 Clear out a small dutiable cargo from Bonded warehouse ZB1 Import without duty in port area only ZB2 Export without duty in port area only ZB4 change Trader.

K8 - Declaration of duty not paid goods a By rail - Pasir Gudang declared K8 to rail the containers from Pasir Gudang to Port Klang without paying the duty. 2 5 min. The importation of goods into a FCZ directly from overseas no tax shall be.

Check With Expert GST shall be levied and charged on the taxable supply of goods and services. Ia dikawal secara dokumentasi dan tertakluk kepada semua perundangan dan peraturan Kastam. Inward manifest Form K5 JKED 4.

Port Klang declared K1 to clear the containers by paying duty. Application Form for Customs Ruling. Kastam Form 8 K8 - Declaration of duty not paid goods.

Kastam Form 1 K1 - Import for dutiable and non-dutiable goods. K8 - Declaration of duty not paid goods. K1 - Import for dutiable and non-dutiable goods.

Avoid the need to manually add data. FORM K1 IMPORT CUSTOMS OFFICIAL RECEIPT COR PAPERLESS. NoPermit Import Import Permit No.

REGISTER LOGIN GST shall be levied and charged on the taxable supply of. K1 CONTAINER IDENTIFIER. 2 5 min.

Gudang Pengilangan Berlesen adalah juga suatu kemudahan yang disediakan untuk industri berorentasikan eksport. Import licenses which may be required by a proper officer of customs. Cannot claim back the duty.

How we got Form K1 and K2. Transfer data seamlessly from the completed fields in a document to your apps. 3 form is required for the following circumstances.

Jabatan Kastam Diraja Malaysia Bahagian Cukai Dalam Negeri Putrajaya 23 Ogos 2018. If customs duty not ascertainable fine not exceeding RM50000000 or. K1 GST Payable Form 3 FCZ LMW K1 K9 With ATS GST is suspended No ATS subject to GST payable in K1.

Application permit to move transit duty unpaid goods. COMPLAINT. Receipt of Duty Tax as levied authorized by.

Tarikh Date Pegawai Kastam Yang Hak Proper Officer Of Customs 3. How to apply Exemption for all Schedules under Sales Tax Persons Exempted from Payment Of Tax 2018. Dutiable cargo b Transhipment - From one port tranship from another port.

Transhipment - From one port tranship from another port or to a bonded warehouse by rail or road and vice versa without paying duty. Produce such goods to such officer at any place as the officer may direct. Borang Kastam No7 K7 Malaysian Tourism Tax System MyTTX.

Application Form for Renewal Of Customs Ruling. Bawah section 65A Akta Kastam 1967 dan dikawal secara langsung oleh Kastam Diraja Malaysia. Form K6 JKED 4.

Value MYR Import Duty MYR Excise Duty MYR Sales Tax MYR Anti Dumping Duty MYR 4. Permit to transport duty paid goods within the federation. Tertakluk kepada Akta Hakcipta 1987 Malaysia.

Form K1. B Instruction for physical inspection if necessary. If the import declaration is made at the import station the duty import and GST is to be paid on Customs Form No.

Customs K1 form required supportive documents eg. Permit to remove goods. Avoid the need to manually add data.

481950000 7 OC MARLBORO KS BOX 20 590413 CH 28500 KGM 3734038 1064201 266050 - 133025 - B101080008582010 DOKUMEN PELEPASAN KASTAM. We only found the Form E actually available to exempt the duty how can we claim back the duty. Ad Increase accuracy and eliminate human error.

K1 CUSTOMS RELEASE DOCUMENT. Assessment of goods by Senior Customs Officer to. In case the cargo does not subject to dutytax customs release will be granted.

2 5 min. K3 - Import Export of dutiable and non-dutiable goods within Malaysia. Permit for certain specific cases for example imports hand-phones and etc.

Can save and print after declaration have been made. Transfer data seamlessly from the completed fields in a document to your apps. K1A Applicable upon importation of goods value RM 1000000 K2 Use for export of goods from the country K3 Transportation of Goods Between Peninsular Malaysia Sabah Sarawak and transportation within the same territory Customs No.

Nama dan Alamat Ejen yang Diberikuasa Name and Address of Autorized Agent Kod Ejen Agent Code KodCode 16Tarikh Luput Expiry Date 18NoMuka Surat Manifes Manifest page No. Decalration of goods exported. EVENT CALENDAR Check out whats happening.

A Verification of particulars declared against supporting documents. Personally or by his agent make in the prescribed form and to the officer of customs specified in subsection 2 a declaration of the goods to be exported. Notis Hakcipta Hak Cipta 2018 Jabatan Kastam Diraja Malaysia Hak Cipta terpelihara.

Form K4 JKED 4. Senior Customs Officer grants approval to the K1 in SMK and hardcopy for duty payment. Ad Increase accuracy and eliminate human error.

Kastam Form 2 K2 - Export for dutiable and non-dutiable goods.