Jabatan Kastam Negeri Sarawak Kuching

Portal perantara untuk pelbagai berita semasa berita keluarga berita terkini hal ehwal semasa berita mutakhir. Jabatan Kastam Diraja Malaysia Sarawak Jabatan Kastam Diraja Malaysia Sarawak Facebook.

National Task Force Realises Total Defence Concept My Military Times

Bahagian perkhidmatan farmasi jabatan kesihatan negeri sarawak.

Jabatan kastam negeri sarawak kuching. None listed See when people check in People tend to check in during these times. Tingkat 1 2 Bangunan Sultan Iskandar Jalan Simpang Tiga 93550 Kuching Sarawak. Sakura Tupong Guest House No.

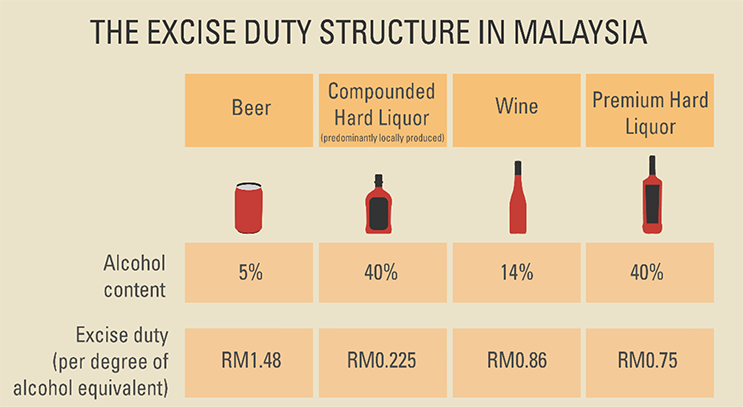

Jabatan Kastam Diraja Malaysia Sarawak Rampas Rokok Dan Minuman Keras Tidak Sah Di Limbang Kamek Miak Sarawak Sarawak News. Facebook rating 400 8 votes 7385 like s. Jabatan kastam diraja malaysia stesen limbang 98700 limbang.

Hotels near Jabatan Kastam Diraja Malaysia Sarawak. Pengarah Kastam Negeri Sarawak. Bau bekenu belaga belawai belingan betong bintulu bitangor dalat daro debak engkelili igan julau kabong kanowit kapit kuching lawas limbang.

9482 likes 286 talking about this. Jabatan kastam diraja malaysia sarawak wisma kastam medan raya jalan tun abdul rahman yaakub petra jaya 93050 kuching sarawak. Jabatan pendidikan negeri sarawak kuching malaysia.

Immigration Department is located at-. Jabatan Kastam Diraja Malaysia Sarawak. Sarawak presents RM503 mln in grants to federal agencies battling Kastam Malaysia در توییتر Kuching 5 Februari 2018 - Tuan Yang KUNJUNGAN HORMAT PENGARAH MARITIM NEGERI SARAWAK KE ATAS PENGARAH Jabatan Kastam Diraja Malaysia Sarawak Kuching 2021 Kastam kenal pasti 12 ejen penipu akan senarai hitam dalam masa.

Jabatan Kastam Diraja Malaysia Sarawak. Portal perantara untuk pelbagai berita semasa berita keluarga berita terkini hal. JANAH BINTI HAJI RIYUK.

Jabatan Kastam Diraja Malaysia Sarawak Kuching Malaysia. Homestay Petrajaya Kuching 4412 Jalan Tunku Lorong B Petra Jaya Kuching. 34 JABATAN PENGANGKUTAN JALAN JPJ NEGERI SARAWAK LOT 200 KM 185 JALAN KU HING SERIAN 93250 KUCHING SARAWAK NORIZAN BIN JILI PENGARAH M54 norizanjpjgovmy psarawakjpjgovmy 082-628 713 082-628 715 httpwwwjpjgovmy 35 JABATAN PENYIARAN KAWASAN SARAWAK TINGKAT 8 BANGUNAN RTM.

17 rows 47 jabatan kesihatan negeri sarawak jabatan kesihatan negeri sarawak jalan diplomatik. 11 4 2017 Majlis Perlancaran Cbos Jkdm Sarawak Di Wisma Kastam Negeri Kuching Sarawak Thumbnails. 62 Kampung Tupong Batu Jalan Merdeka 7 Petra Jaya Kuching.

Experiencedewan undangan negeri. Jabatan kastam diraja malaysia sarawak. 6 7 Main Bazaar Kuching.

Jabatan pendidikan negeri jpn sarawak alamat. PEJABAT PENGARAH KASTAM NEGERI SARAWAK. Dewan undangan negeri sarawak is located in kuching.

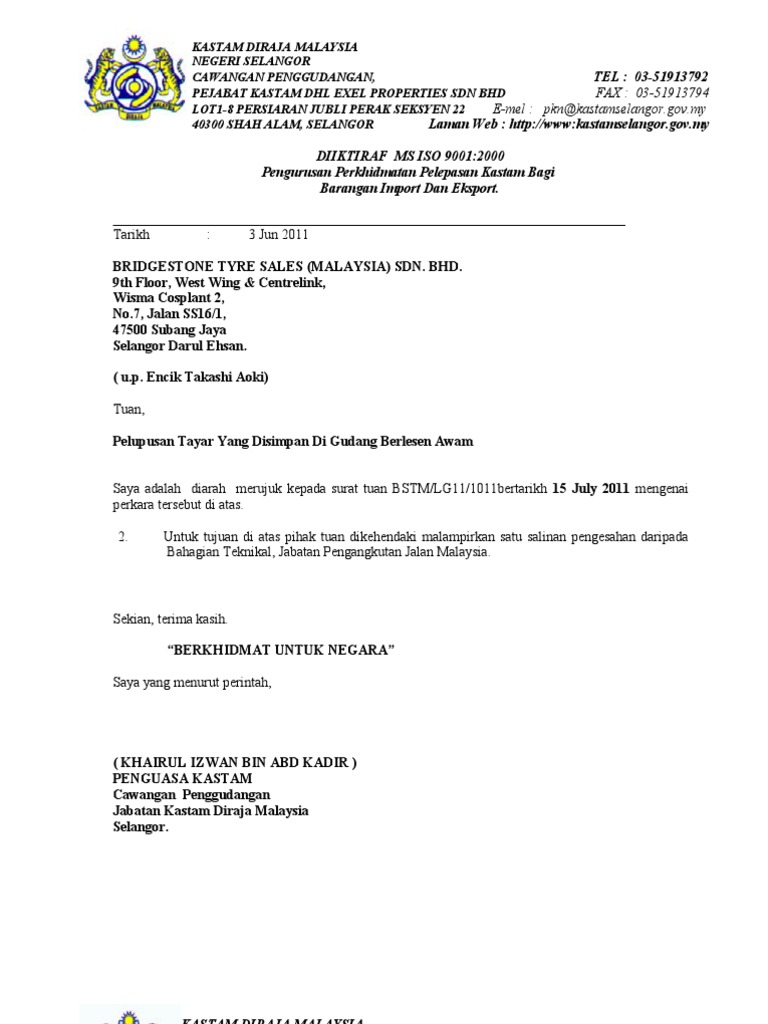

NAMA JAWATAN GRED. JABATAN KASTAM DIRAJA MALAYSIA Bahagian Khidmat Pengurusan dan Sumber Manusia Aras 8 Wisma Kastam Medan Raya Jalan Tun Abdul Rahman Yaakub Petra Jaya 93050 Kuching MALAYSIA. Jabatan pendaftaran pertubuhan negeri sarawak kementerian dalam negeri bahagian miri bintulu dan limbang tingkat 1 blok a wisma persekutuan fasa 2 jalan cahaya lopeng 98000 miri sarawak.

Jalan Tun Abdul Rahman Yaakub Medan Jaya MASJA 93050 Kuching Sarawak. You may contact via email at proimigovmy. Jabatan kastam diraja malaysia cawangan kawalan sempadan kompleks imigresen kastam kuarantin dan keselamatan icqs sungai tujuh baram 98000 miri sarawak telephone.

January 4 at 705 PM Kuching Malaysia. Kuching city mall commercial centre sublot 35 off jalan penrissen road 93250 kuching sarawak. Wisma Kastam Diraja Malaysia.

Address Ibu Pejabat Kastam Diraja Malaysia Sarawak Jalan Tunku Abd Rahman Yakub Petrajaya 93050 Kuching Sarawak Malaisie. The Ranee Boutique Suites 4 No. Jabatan Kastam Diraja Malaysia Sarawak is at Sarawak Timber Industry Development Corporation STIDC.

JALAN PRAMLEE 93614 KUCHING SARAWAK. It can be reach via phone 6082-23 0280 or fax 6082-42 8606. PEJABAT PENGARAH KASTAM NEGERI SARAWAK.

40961 likes 13348 talking about this 2581 were here. 9081 likes 342 talking about this 3059 were here. Categories Public Government Service Government Organization State.

5 Januari 2021- Kunjungan Hormat ke atas Haji Hashim Bin Haji Bojet Pengurus Besar Perbadanan Kemajuan Perusahaan Kayu Sarawak oleh YBrs.