Malaysia Kastam Dropship For Lmw

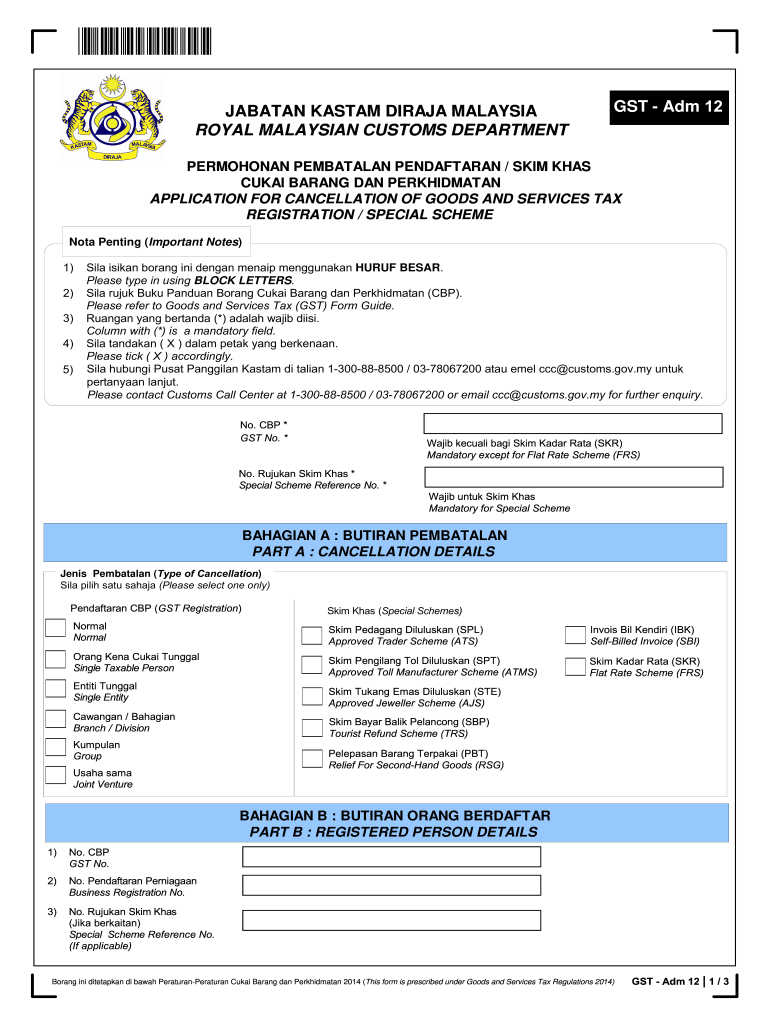

Of Malaysia on another vessel aircraft within the same free zone Reg. Under GST system a person operating in a FIZ or having LMW status is treated as any person carrying out a business in Malaysia where normal rules of GST apply.

LMW K1 K9 Relief from charging GST under Paragraph 56 3 b of the GST Act 2014 Customs duties exempted Importation of services 15.

Malaysia kastam dropship for lmw. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya Hotline. In Licensed Manufacturing Warehouse Manufacturing License Application by 1nDustryMalysia. Designated Areas DA means.

Syarikat terlibat dalam apa-apa kes tuntutan sivil muflis dan lain-lain. Ad Find The Best Suitable Suppliers For Your Required Products. Take from Kastam Diraja Malaysia website.

Ad Everything You Need To Start Selling Online Today. Licensed Manufacturing Warehouse LMW Posted on March 8 2020. Ad Everything You Need To Start Selling Online Today.

Iii any Licensed Manufacturing Warehouse LMW under section 65A of the Customs Act 1967. Posted by Public opinion at 547 AM. Ad Source High Quality Products and Start Selling on Your Online Store.

Under the GST Act imported services means any services by a supplier who belongs in a country other than Malaysia or who carries on business outside Malaysia. The purpose of LMW is to give Customs duty exemption to all raw. Two Thousand and Four Hundred Ringgit Malaysia for licence under Section 65 and a nominal two Ringgit Malaysia for licence under Section 65A.

Goods exported from Malaysia transported to FIZ or Labuan or moved to LMW for repair and subsequently re-imported or returned by the same route is subject to sales tax unless an exemption is claimed by the importer under item 36 Schedule A of the Sales Tax Person Exempted from Payment of Tax Order 2018. It is for a period of two years subjected to renewal. LMW GST Treatment on LMW GST Implications to Manufacturing GST Treatment for LMW GST Implication on Goods Supplied from LMW Accounting for Output Tax and Customs Duty GST Special Valuation GST Implication on Services Acquired by a LMW Farming Out Within Malaysia Farming Out Outside Malaysia.

Click and See For Yourself. The Largest Directory of Wholesale Deals in the UK. 2 FZ Act Transit -Goods taken from any country and brought into Malaysia whether or not transshipped in Malaysia for the sole purpose of being carried to another country S2 CA.

Specialize for cross border trucking between Singapore to Malaysia and Thailand for various oil and gas companies be it small packages to Multi Axle transportation. LMW is a manufacturing unit factory granted to any person for warehousing and manufacturing approved products on the same premise. -Unloading transferring from one vessel aircraft to another for the purpose of shipment out of Malaysia within the same free zone Reg.

This means that acquisition of goods locally or imported by the person operating in a FIZ or having LMW status is subject to GST. Pegawai sedang berkhidmat dalam perkhidmatan penolong penguasa kastam adalah layak dipertimbangkan oleh. It is primarily intended to cater for export oriented industries.

And iv Joint Development Area JDA under section 2 of the MalaysiaThailand Joint Authority Act 1990. Borang Kastam Jked 2 Lmw Sst Customs Compliance Consulting And Advisory åå Facebook - Permohonan lesen hendaklah dikemukakan kepada pegawai kanan jabatan kastam dan eksais diraja yang. The Largest Directory of Wholesale Deals in the UK.

Sell the Best Products Sourced from Dropshipping Suppliers on Your Online Store. Click and See For Yourself. GST shall be levied and charged on the taxable supply of goods and services.

Sistem Maklumat Kastam SMK. Kebakaran kemusnahan dan bencana alam. 32 Syarikat GPB hendaklah memaklumkan kepada pegawai kastam yang mengawal syarikat dengan segera apabila berlaku perkara-perkara berikut yang menjejaskan barang-barang dikecualikan duti cukai.

Marine Department Malaysia - Safety of Life at Sea SOLAS Shipper Registration and Renewal Services. Gudang Pengilangan Berlesen GPB adalah syarikat yang dilesenkan di bawah Seksyen 65A Akta Kastam 1967 untuk menjalankan aktiviti pengilangan. GST shall be levied and charged on the taxable supply of goods and services.

Download form and document related to RMCD. In Malaysia a Manufacturing Bonded Warehouse is known as Licensed Manufacturing Warehouse LMW established under the provision of section 6565A of the Customs Act 1967. Licensed Manufacturing Warehouse LMW is a warehouse license under the provision of section 6565A of the Customs Act 1967 Malaysia.

Ad Find The Best Suitable Suppliers For Your Required Products. 2 FZ Act Transit - Goods taken or sent from any country and brought into Malaysia by land sea or air whether or not landed or transhipped in Malaysia for the sole purpose of being carried to. Licensed Manufacturing Warehouse LMW in Malaysia.