Kastam Tariff Hs Code

Visit the most interesting Tariff Customs Gov pages well-liked by users from your country and all over the world or check the rest of tariffcustomsgovmy data belowTariffcustomsgovmy is a web project safe and generally suitable for all ages. Kastam tariff code malaysia.

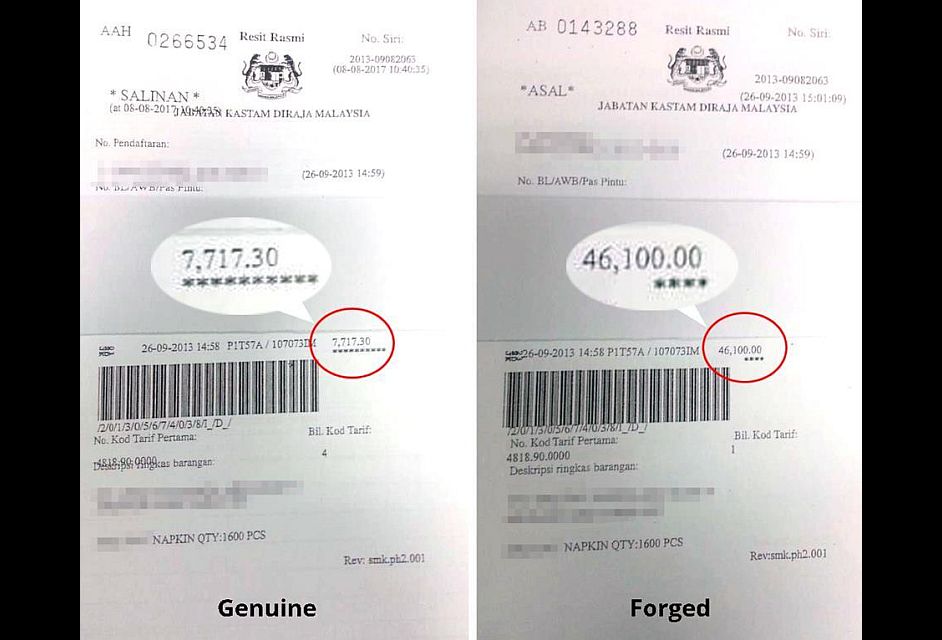

Fake Cors Costing Customs Dearly The Star

We found that English is the preferred language on Tariff Customs Gov pages.

Kastam tariff hs code. Keterangan harmoni Komoditi Coding System biasa dikenal sebagai Kod HS dan ASEAN harmonized Tariff Tatanama AHTN dicipta untuk kegunaan antarabangsa oleh Jabatan Custom untuk mengklasifikasikan komoditi ketika diisytiharkan di sempadan kastam oleh pengeksport dan pengimport. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint. Internet Explorer 9 Google Chrome v18 DISCLAIMER.

The legal basis of the Customs Tariff is Regulation EEC No. Fire-hose - China Customs HS Code China Import Tariffs for fire-hose page 1. Section notes if any are attached to the first chapter of each section.

Visit us online to get the various hs codes and commodity description. The list of commodity codes or also called commodity tariff numbers is called the Harmonized System HS hence the term HS code. 18 7019 Glass fibres including glass wool and articles thereof for example yarn.

The tariff classification of an air pump from Taiwan. Harmonized Commodity Description Coding System commonly known as HS Codes and ASEAN Harmonized Tariff Nomenclature AHTN were created for international use by the Custom Department to classify commodities when they are being declared at the custom frontiers by exporters and importers. The Government and Ministry of Finance shall not be liable for any loss or damage caused by the usage of any information obtained from this web site.

Exchange Rate IMPORT Effective Date. Page down to view chapter after selecting Cover. 265887 on the tariff and statistical nomenclature and on the Common Customs Tariff.

Pakistan Customs follow the HS Code Harmonized System Codes or PCT Codes Pakistan Customs Tariff Codes for Classification of Goods these code consist of eight digits where first two represent Chapter and second two represent Sub- chapter and after decimal place four digit represent code of item. The tariff classification of pumps for bait tanks and live wells from Taiwan. 8708 Parts and accessories of the motor vehicles of headings no8701 to 8705.

Therefore when an 8 digits HS Code is shown as a result of your search you need to take the first 6 digits of that HS Code into consideration if the country of interest is not a part of European Union Customs Territory. Commodity codes classify goods for import and export so you can. HS Code Item Description.

-- Choose -- PDK 2017 PDK 2017 ATIGA ACFTA AHKFTA MPCEPA MJEPA AKFTA AJCEP AANZFTA AINDFTA MNZFTA MICECA D8PTA MCFTA MAFTA MTFTA. 13042020 to 19042020 Country Currency ISO 13. Therefore when an 8 digits HS Code is shown as a result of your search you need to take the first 6 digits of that HS Code into consideration if the country of interest is not a part of European Union Customs Territory.

HS Codes Kod PDK AHTN Codes Kod AHTN Declared UOM UOM yang telah diikrarkan Product Description Deskripsi produk 4421 4421 KG ICE-CREAM STICKS 4421 4421 KG ICE-CREAM SPOONS 4421 4421 KG WOOD PAVING BLOCKS 4421 4421 KG MATCH SPLINTS 4421 4421 KG WOODEN PEGS 4421 4421 KG PINS FOR FOOTWEAR 4421 4421 KG JOSS STICKS. Please importantly note that eight digits HS Codes presented within FindHSCodes search results are based on European Union Customs Tariff Nomenclature. Fill in declarations and other paperwork.

Clicking on a link will load the corresponding Adobe pdf file. 1300 888 500 Customs Call Centre 1800 888 855 Smuggling Report 03 8882 21002300 Head Quaters HEADQUARTERS. 2011 - BloggerInformation for Malaysia Import and Export Jabatan Kastam Diraja Malaysia for tariff code 0401 30 110 and 2202 90 100 onlyPU a 275 Perintah Duti Kastam 2012 Tuna TextilesPU a 275 Perintah Duti Kastam 2012 - Free ebook download as PDF File pdf Text File txt or read book online for free.

AHTN is used for trade transaction between Malaysia and. The classification of imported exported manufactured goods. Search Customs Tariff.

Add research word or search here Search for quick links by typing the search term at the top. Lookup Indonesian customs tariff code or harmonized system code Chapter Code Chapter Description Chapter 01 HS Code for Live animals Chapter 02 HS Code for Meat and edible meat Chapter 03 HS. Classification of goods for import and export purposes either manufactured produced locally is based on the Customs Duty Order 1996 effective 1st January 1996 which in turn was based on the Harmonized Commodity Description and Coding System or in short Harmonised System HS.

Look up commodity codes duty and VAT rates. 36 8413 Pumps for liquids whether or not fitted with a measuring device. DECLARATION OF HS CODE IN COST ANALYSIS AND CERTIFICATE OF ORIGIN COO Starting 1st April 2017 Perintah Duti Kastam PDK 2017 has been implemented to replace the PDK 2012.

Thanks for your patience. The links below correspond to the various sections in the Table of Contents for the Harmonized Tariff Schedule. Please importantly note that eight digits HS Codes presented within FindHSCodes search results are based on European Union Customs Tariff Nomenclature.

Act Regulation and Order Currently Being Upload. Therefore exporters are required to consult the Royal Malaysia Customs Department RMCD to obtain the accurate tariff code for their respective finished products and raw.