Malaysia Import Tax Rates

This Guide merely serves as information. This includes a liability on imported goods a low-value exemption may apply.

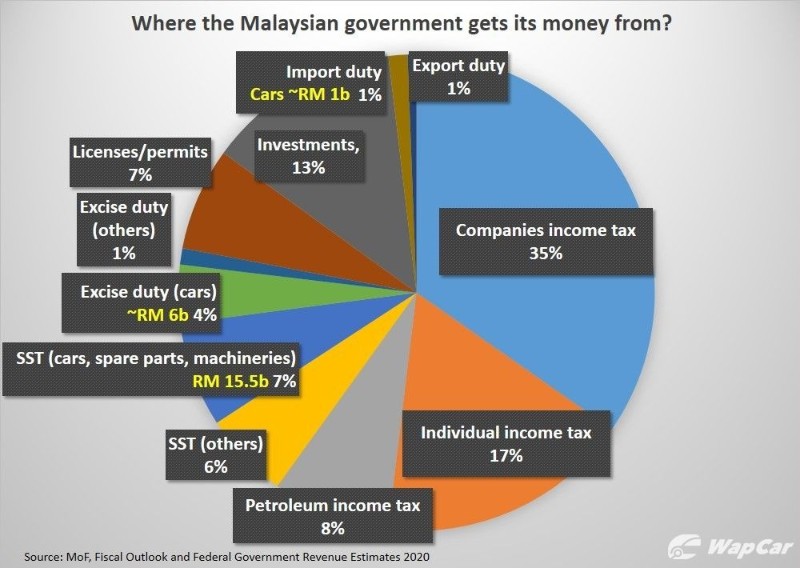

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Any meat bones hide skin hoofs horns offal or any part of the animals and Poultry.

Malaysia import tax rates. The incidence of tax is provided under. More information on import declaration procedures and import restrictions is available at the Malaysian Customs website. Goods subject to 20.

Please refer to Sales Tax Goods Exempted From Tax Order 2018 and Sales Tax Rates of Tax Order 2018. These rates can be quite high and excise duties can be up to 100 percent when importing a foreign vehicle. To calculate the approximate costs of road tax.

Import duties are levied on goods that are subject to import duties and imported into the country. Some goods are not subject to duty eg. For Sabah and Sarawak - 15 levy rate for the CPO threshold value of RM3000 per metric tonne.

NAME OF GOODS HEADING CHAPTER EXEMPTED 5 10. The sales tax rate is at 510 or on a specific rate or exempt. The SST is also applied to the importation of taxable goods into Malaysia at the rate of 5 percent or 10 percent or a specific rate depending on the category of products.

Sales tax is imposed on taxable goods manufactured in Malaysia by any registered manufacturer at the time the goods are sold disposed of other than by sales. The importations of goods specified below are prohibited except under an import licence or permit from relevant authorities. How Much are the Taxes if my Goods Surpass the De Minimis Rate in Malaysia.

Exported manufactured goods will be excluded from the sales tax act. For information from MyEG Malaysian e-Government. The Ministry of Finance announced on July 16 2018 the SST is chargeable on the manufacture of taxable goods in Malaysia and the importation of taxable goods into Malaysia at the rate of 5 percent or 10 percent or a specific rate depending on the category of goods.

TARIFF SCHEDULE OF MALAYSIA Tariff schedules and appendices are subject to legal review transposition and verification by the Parties. However at the same time not all products are necessary to be taxed. Payment Of Sales Tax.

Some duties are also based on quantity measurements like weight or volume. This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practices. De Minimis Rate In The Philippines Janio.

The import tax on a shipment will be. In order for the recipient to receive a package an additional amount of. 5 Free Calculations Per Day At Simply Duty you get to use our duty calculator free of charge every day.

Live animals-primates including ape monkey lemur galago potto and others. Goods subject to 5. The only authentic tariff commitments are those that are set out in the Tariff Elimination Annex that accompanies the final signed Agreement.

Economist Calls To Lift Import And Excise Duties On Cbu Cars In Malaysia Wapcar. Duty Rates Duty rates in Malaysia vary from 0 to 50 with an average duty rate of 574. Sales Tax is imposed on imported and locally manufactured taxable goods.

The ad valorem rates of import duties range from 2 to 60. Malaysia Imports Tariffs by country and region 2019 In 2019 major countries from which Malaysia Imported include China Singapore United States Japan and Other Asia nes. For example if the declared value of your items is.

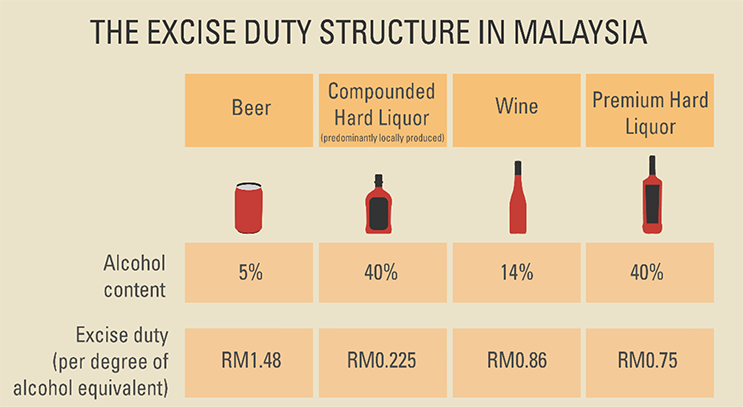

The rate of service tax is 6. In addition to duty imports are subject to sales tax VAT and in some cases to excise. Malaysia Import Tax Custom Fees.

What To Expect If Your Buyandship Shipment Gets Taxed By Kastam Buyandship Malaysia. Road tax can be bought or renewed online. Please check the Data Availability for coverage.

Egg in the shells. No NO 9 DIGIT. If the CIF value which means your goods value shipping fees and insurance fees exceeds MYR 500 then youll have to pay import duties in the range of 0 to 25 and sales.

Shipping To Malaysia Services Costs And Customs. The taxation for a particular country depends on the local GSTVAT as well as the item category and its declared value. The tax duty threshold is the amount at which a person begins paying taxes based on the declared value of an item.

Malaysia Exports 2019 Please note the exports imports and tariff data are based on reported data and not gap filled. Malaysia Import Tax Rate 2019. Import duty must be paid on any vehicles imported into Malaysia.

There are also some products that are taxed based on a per-unit basis eg per-litre or per-kg. This booklet also incorporates in coloured italics the 2022 Malaysian Budget proposals announced on 29 October 2021. These proposals will not become law until their enactment and may be amended in the course of their passage through Parliament.

If the full value of your items is over. Which goods or services. Laptops electric guitars and other electronic products.

Sales tax administered in Malaysia is a single stage tax imposed on the finished goods manufactured in Malaysia and goods imported into Malaysia. Raw materials machinery essential foodstuffs and pharmaceutical products are. The standard VAT rate on imports in Malaysia is set at 10 of the sum of the CIF value duty and any excise applicable.

In addition to that certain products may be. Goods subject to specific rate. Goods SST on goods is charged throughout the B2B chain to the final consumer and is not deductible by tax payers.

Use this quick tool to calculate import duty taxes for hundreds of destinations worldwide. Import duties are generally levied on an ad valorem basis but may also be imposed on a specific basis. For Peninsular Malaysia - 3 levy rate for the CPO threshold value of RM2500 per metric tonne ii.

Page 3 of 130. Sales tax is only applicable to taxable goods that are manufactured or imported into Malaysia.