Hs Code Tariff Code Malaysia

Hs Code finder thematic search engine for finding correct tariff classification or to determine harmonized system code HS codes or HTS Code and CAS Number. Sisingamangaraja - Jakarta 12110 - Indonesia Tel.

22 rows HS Code Description Destination Port of Loading Unit Quantity Value INR Per Unit INR Nov.

Hs code tariff code malaysia. The amendments are technical in. Close Please importantly note that eight digits HS Codes presented within FindHSCodes search results are based. The only authentic tariff commitments are those that are set out in the Tariff Elimination Annex that accompanies the final signed Agreement.

Make visual search to learn the correct Customs Tariff Classification for the goods you intend to import or export. Malaysia Vietnam to achieve US18b bilateral trade by 2025 - Malay Mail. Visit us online to get the various hs codes and commodity description.

SECTION I live animals. 1300 888 500 Customs Call Centre 1800 888 855 Smuggling Report 03 8882 21002300 Head Quaters HEADQUARTERS. Though in practice conflicts can.

No NO 9 DIGIT FULL HS 9D. Malaysia - Import TariffsMalaysia - Import Tariffs Includes information on average tariff rates and types that US. The tariff schedule the Schedule in Section A of this Annex contains the following columns.

Description 2013 2014 2015 2016 2017 2018 2019 2020 and subsequent years Annex 1 Schedule of Tariff Commitments Malaysia HS Code 2012 900 - - - Other 0 0 0 0 0 0. Harmonized Commodity Description Coding System commonly known as HS Codes and ASEAN Harmonized Tariff Nomenclature AHTN were. Only 11-digit HS-CODE has the quantity detail.

In Indonesia this code known as a BTKI code Buku Tarif Kepabeanan Indonesia. This arrangement of numbers is useful in figuring out customs tariff code exchange items and many more. TARIFF SCHEDULE OF MALAYSIA Tariff schedules and appendices are subject to legal review transposition and verification by the Parties.

Basically HS commodity code is classified into 2 digits 4 digits and 8 digits. HS codes are categorized into twenty-one sections all around the world which are split into 99 chapters. The HS consists of 5300 article or product descriptions that appear as headings and subheadings.

Trying to get tariff data. Required on official shipping documents for tax assessment purposes a tariff code ensures uniformity of product classification world wide. Please make your selection.

In theory all countries using the HS agreement should classify a certain product with the same HS section chapter heading and subheading. The description of the product which applies to the code. Learn to get the Correct Tariff Codes here.

Know your products HS Code. -- Choose -- PDK 2017 PDK 2017 ATIGA ACFTA AHKFTA MPCEPA MJEPA AKFTA AJCEP AANZFTA AINDFTA MNZFTA MICECA D8PTA MCFTA MAFTA MTFTA. DECLARATION OF HS CODE IN COST ANALYSIS AND CERTIFICATE OF ORIGIN COO Starting 1st April 2017 Perintah Duti Kastam PDK 2017 has been implemented to replace the PDK 2012.

6221 7262991 7243372 Fax. The changes to the HS tariff will be implemented by all 158 member countries of the WCO. Malaysias tariffs are typically imposed on an ad valorem basis with a simple average applied tariff of 61 percent for industrial goods.

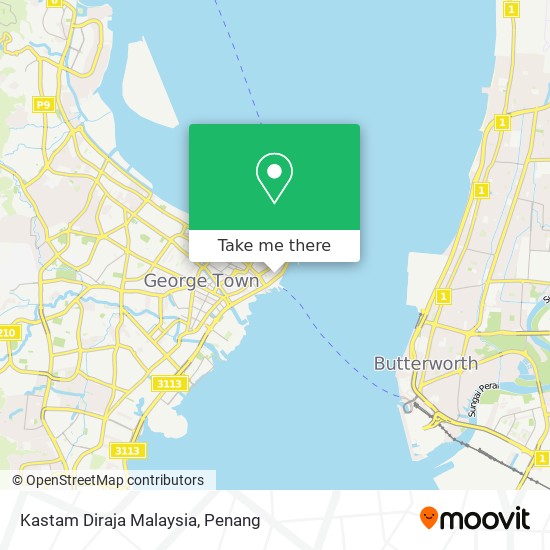

ASEAN Tariff Finder The ASEAN Secretariat - 70A Jl. COUNTRY Oct 2021. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya.

China customs statistics trade data. Malaysian exports in January-October exceed RM1 trillion The Sun Daily View Full coverage on Google News Matrade. Tariff codes exist for almost every product involved in global commerce.

The HS Code system uses an internationally applied 6-digit number as the basis for local country classification. A tariff code is a product-specific code as documented in the Harmonised System HS maintained by the World Customs Organisation WCO. Animal products Chapter 01 live animals Chapter 02 meat and edible meat offal Chapter 03 fish and crustaceans molluscs and other aquatic invertebrates.

At SEAIR Exim Solutions. IMPORT DUTY STAGING CATEGORY. The designation of the tariff lines into either Normal.

HS Code Item Description. Therefore exporters are required to consult the Royal Malaysia Customs Department RMCD to obtain the accurate tariff code for their respective finished products and raw materials.

The code used in the Nomenclature of the HS 2007. Malaysian Customs Classification of Goods entails classifying products into correct tariff codes to determine the amount of duty payable. By Tariff Classification.

Tariff Schedule of Malaysia with respect to Goods Originating in New Zealand 1. Firms should be aware of when exporting to the market. Preparing for 2022 HS Tariff Code changes.

HS Code Customs Tariff Number Taric guide - European Database Find all customs tariff numbers and harmonized codes from the European external trade statistics in German English and French from 2009 until today. Latest China HS Code tariff for malaysia-a-- - Tariff duty regulations restrictions landed cost calculator customs data for malaysia-a-- in ETCN. Live horses asses mules and hinnies.

For Cost Analysis that had been. Failure to classify product correctly will not only involve substantial costs to the business but will also attract customs investigations. 119 rows Please importantly note that eight digits HS Codes presented within FindHSCodes search.

For certain goods such as alcohol wine poultry and pork Malaysia charges.