Malaysia Import Duty Rate 2020

Malaysias tariff schedule under the malaysia-india comprehensive economic cooperation agreement miceca hs code chapter 1 - live animals page 39. Tariff schedules and appendices are subject to legal review transposition and verification by the Parties.

Tariff And Vat On Masks And Medical Supplies Import And Ship From China Bestforworld Logistics Co Ltd Bestforworld Logistics Co Ltd

TARIFF SCHEDULE OF MALAYSIA.

Malaysia import duty rate 2020. This rate takes into account the value of the shipped goods and the shipping fees. The tax duty threshold is the amount at which a person begins paying taxes based on the declared value of an item. Merchandise trade and tariff statistics data for Malaysia MYS imports from partner countries including trade value number of products Partner share Share in total products MFN and Effectively Applied Tariffs duty free imports dutiable imports and free lines and number of trade agreements for year 2019.

Live animals-primates including ape monkey lemur galago potto and others. That dollar amount reflects a 124 increase since 2016 but a -74 downtick from 2019 to 2020. Imports also registered a decrease of 80 y-o-y to RM684 billion.

Purchases of intermediate goods accelerated 207 percent vs 134 percent in August boosted by. Any meat bones hide skin hoofs horns offal or any part of the animals and Poultry. Malaysia import duty rate 2020.

Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya. In Malaysia the de minimis rate is MYR 500 or roughly USD 115 as of the time of this writing. Egg in the shells.

MATRADE publishes Malaysias monthly quarterly and annual trade statistics covering Malaysias export and imports by commodities or countries. The only authentic tariff commitments are those that are set out in the Tariff Elimination Annex. Fully imported EVs subject to 10 excise duty MAA.

This Guide merely serves as information. For Peninsular Malaysia - 3 levy rate for the CPO threshold value of RM2500 per metric tonne ii. The importations of goods specified below are prohibited except under an import licence or permit from relevant authorities.

Malaysia services export is 4099101839689 in BoP current US and services import is 4362374500090 in Bop current USMalaysia exports of goods and services as percentage of GDP is 6522 and imports of goods and services as percentage of GDP is 5778. Ccccustomsgovmy For classification purposes please refer to Technical Services Department. TARIFF SCHEDULE OF MALAYSIA.

Imports to Malaysia climbed 265 percent year-on-year to a five-month high of MYR 8470 billion in September 2021 exceeding market estimates of 154 percent and after a 125 percent rise a month earlier with domestic demand strengthening further as local COVID-19 situations were under control. Begin typing your search above and press return to search. Laptops electric guitars and other electronic products.

14 000 - - Geese 0 0 0 0 0 0 0 0 0105. PREPARED BY ROYAL MALAYSIAN CUSTOMS DEPARTMENT. EXPORT_DUTY_RATE_DEC 2020pdf 1539 KB The Malaysian Government announced on 5 th June 2020 the fully exemption from export duties for exports of CPO CPKO and RBDPKO from July to December 2020 under the Short-term Economic Recovery Plan PENJANA.

Based on the average exchange rate for 2020 the Malaysian ringgit. 2020 and subsequent years Annex 1 Schedule of Tariff Commitments Malaysia HS Code 2012 900 - - - Other 0 0 0 0 0 0 0 0 0105. Sales Tax Imports are subject to GST at a standard rate of 6 of the sum of the CIF value duty and any excise if applicable.

Some goods are not subject to duty eg. Trade statistics covering Malaysias export and imports by commodities or countries. For Sabah and Sarawak - 15 levy rate for the CPO threshold value of RM3000 per metric tonne.

On a month-on-month m-o. More information on import declaration procedures and import restrictions is available at the Malaysian Customs website. In April 2020 Malaysias imports exceeded the value of its exports due to the imports of floating structures from Republic of Korea which was valued at RM101 billion.

Legoland Nusajaya Malaysia Located in Southeast Asia near powerful trade partners including Thailand Singapore Vietnam and the Philippines Malaysia imported US1898 billion worth of goods from around the globe in 2020. The statistics are available in various formats such as online databases printed materials and CD-ROMs. 94 - - Fowls of the species Gallus domesticus.

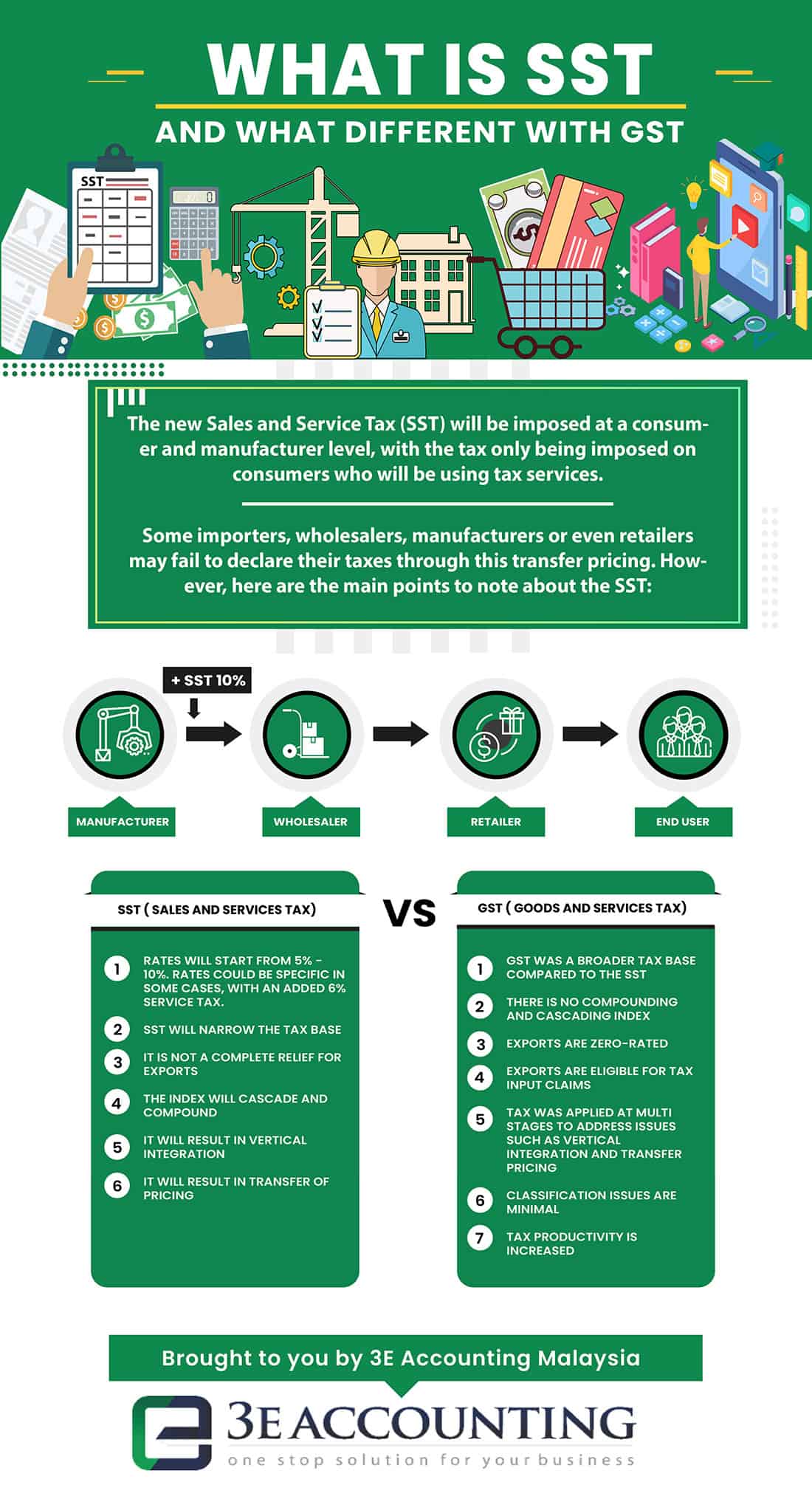

The SST is also applied to the importation of taxable goods into Malaysia at the rate of 5 percent or 10 percent or a specific rate depending on the category of products. 1 300 88 8500 General Enquiries Operation Hours Monday - Friday 830 am 700 pm email. 15 000 - - Guinea fowls 0 0 0 0 0 0 0 0 - Other 0105.

For further enquiries please contact Customs Call Center. Excise duty is between 60 and 105 regardless of CKD or CBU calculated based on the car and its engine capacity while import duty can reach up. - - - Weighing not more than 2 kg.

Malaysia Import Tax Custom Fees The taxation for a particular country depends on the local GSTVAT as well as the item category and its declared value. Duty Rates Duty rates in Malaysia vary from 0 to 50 with an average duty rate of 574. Some goods may be zero-rated or exempt from GST.

The Ministry of Finance announced on July 16 2018 the SST is chargeable on the manufacture of taxable goods in Malaysia and the importation of taxable goods into Malaysia at the rate of 5 percent or 10 percent or a specific rate depending on the category of goods. In Hybrids EVs and Alternative Fuel Local News By Mick Chan 18 September 2020 305 pm 37 comments.