Royal Malaysian Customs Hs Code

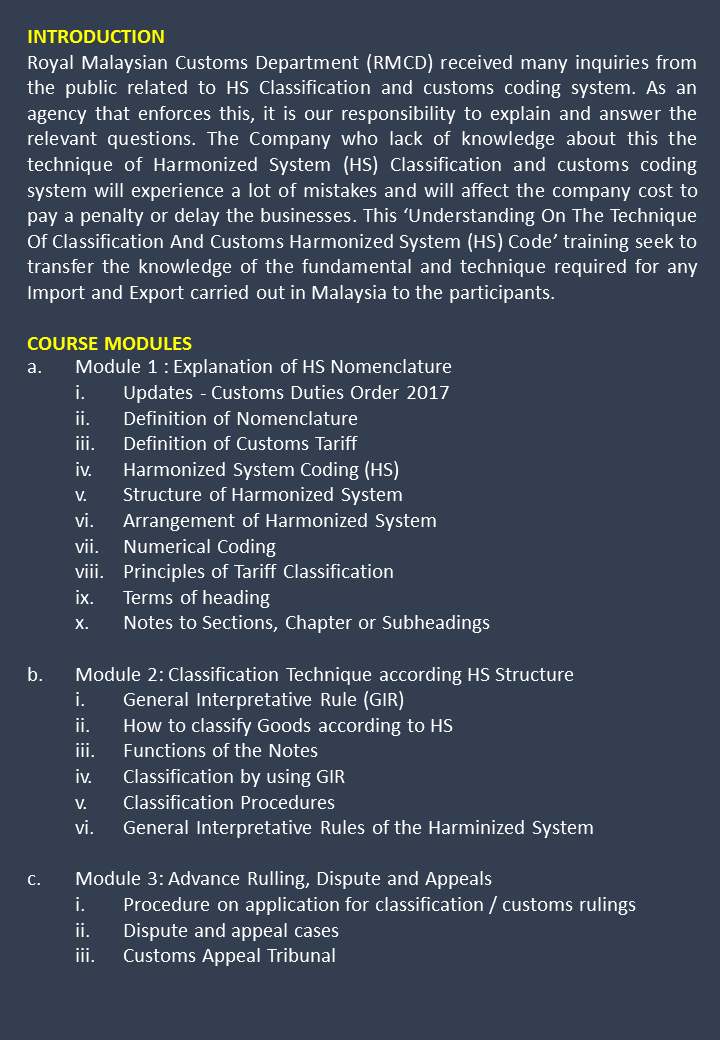

IMPORT DUTY STAGING CATEGORY. The Company who lack of knowledge about this the technique of Harmonized System HS Classification and customs coding system will.

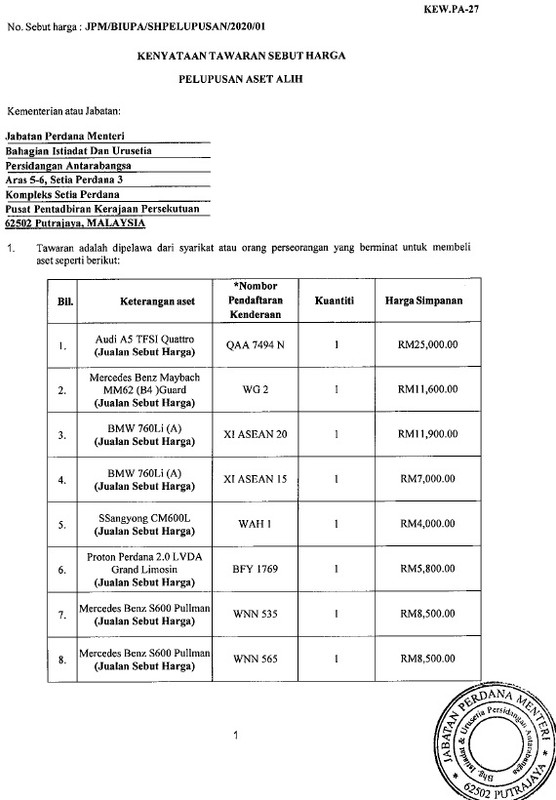

Seminar On Malaysian Customs Classification Of Goods And Harmonized System Hs Code Perkasa Putrajaya

The only authentic tariff commitments are those that are set out in the Tariff Elimination Annex that accompanies the final signed Agreement.

Royal malaysian customs hs code. Royal Malaysian Customs. Royal Malaysian Customs KRDM KDRM Headquarters Technical Services Division Classification Tariff Legislation Branch Level 6 North No3 Persiaran Perdana Ministry of Finance Precinct 2 Federal Government Administration Center 62592 Putrajaya TEL. Hak Cipta Terpelihara 2018 Jabatan Kastam Diraja Malaysia.

Malaysia follows the Harmonized Tariff System HTS for the classification of goods. REGISTER LOGIN GST shall be levied and charged on the taxable supply of. Royal Malaysian Customs Department RMCD received many inquiries from the public related to HS Classification and customs coding system.

The HS consists of 5300 article or product descriptions that appear as headings and subheadings. The HS Code system uses an internationally applied 6-digit number as the basis for local country classification. The new HS Codes includes 233 sets of amendments namely agricultural chemical wood textile base metal machinery transport and other sectors.

Implementation of PDKAHTN 2012 Effective From 31 October 2012. The rates and any applicable exemptions are. Genoa 03rd October 2018 Subject.

Malaysia - Mandatory Requirement of 6 Digit HS code for Export Import Transshipment Manifest 25 September 2018 Please be informed that the Royal Malaysian Customs Department have announced that with effect from 1st October 2018 it is mandatory for the 6 digit HS Code to be declared in the Export Import and transshipment manifest in Malaysia. Malaysia custom hs code Printed international customs forms carnets and parts thereof in English or French whether or not in additional languages Goods eligible for temporary admission into the customs territory of the US under the terms of US. Please be informed that the Royal Malaysian Customs Department have announced that with effect from 1st October 2018 it is mandatory to apply the 6-digits HS Code to be declared in the Export Import and Transhipment manifest in Malaysia.

Please do not hesitate to call our Careline at 1 300. Learn to get the Correct Tariff Codes here. This service is provided free of charge.

DECLARATION OF HS CODE IN COST ANALYSIS AND CERTIFICATE OF ORIGIN COO Starting 1st April 2017 Perintah Duti Kastam PDK 2017 has been implemented to replace the PDK 2012. Please be informed that the Royal Malaysian Customs Department have announced that with effect from 1st October 2018 it is mandatory for the 6 digit HS Code to be declared in the Export Import and transshipment manifest in Malaysia. Trying to get tariff data.

Check With Expert GST shall be levied and charged on the taxable supply of goods. Live horses asses mules and hinnies. Description 2013 2014 2015 2016 2017 2018 2019 2020 and subsequent years Annex 1 Schedule of Tariff Commitments Malaysia HS Code 2012 900 - - - Other 0 0 0 0 0 0.

Royal Malaysian Customs Department EVENT CALENDAR Check out whats happening. This is in conjunction with the implementation of the new Customs operating system named uCustoms where the 6 digits HS Code is one of the. MALAYSIA - Mandatory HS 6-digits commodity code Dear Valued Customers Please be informed that the Royal Malaysian Customs Department have announced that with effect from 1st October 2018 it is mandatory to apply the 6-digits HS Code to be declared in the Export Import and Transhipment manifest in Malaysia.

TARIFF SCHEDULE OF MALAYSIA Tariff schedules and appendices are subject to legal review transposition and verification by the Parties. This website is developed to enable the public to access information related to the Royal Malaysian Customs Department includes corporate information organization and Customs related matters such as Sales and Service Tax SST. To update industries on the implementation of the new HS REGISTRATIONCodes 2017 FMM in collaboration with the Royal Malaysian Customs Department.

Includes customs regulations and contact information for this countrys customs office. Customs duties are paid on an ad valorem basis on imports and exports as provided under the Malaysian Customs Act 1967. For exporters or importers who are not sure of the HSAHTN codes for their products you can refer to the officers at the Malaysia Royal Customs Department Head Office or any of its branch offices for assistance.

For more info please visit. COMPLAINT. No NO 9 DIGIT FULL HS 9D.

Code from the current HS 9-digit to HS Code 10-digit. Failure to classify product correctly will not only involve substantial costs to the business but will also attract customs investigations. DATO SRI ABDUL LATIF BIN ABDUL KADIR Director General Of Customs Royal Malaysian Customs.

Though in practice conflicts can. Visit us online to get the various hs codes and commodity description. Malaysian Customs Classification of Goods entails classifying products into correct tariff codes to determine the amount of duty payable.

All imported and exported goods into the country must be categorized based on the Malaysian Customs tariff numbers. This is in conjunction with the implementation of the new Customs operating system uCustoms where the 6 digit HS Code is one of the mandatory items. As an agency that enforces this it is our responsibility to explain and answer the relevant questions.

Therefore exporters are required to consult the Royal Malaysia Customs Department RMCD to obtain the accurate tariff code for their respective finished products and raw materials. AGENCY Browse other government agencies and NGOs websites from the list. Users are advised to use the latest PDKAHTN 2012 tariff code on the effective date as mentioned above.

In theory all countries using the HS agreement should classify a certain product with the same HS section chapter heading and subheading. Please be informed that the implementation of PDKAHTN 2012 will take effect on 31 October 2012. Note 1b to this subchapter Materials certified to the Commissioner of Customs by authorized military procuring agencies to be.