As provided in Section 3 of. MAXIMUM - The system will.

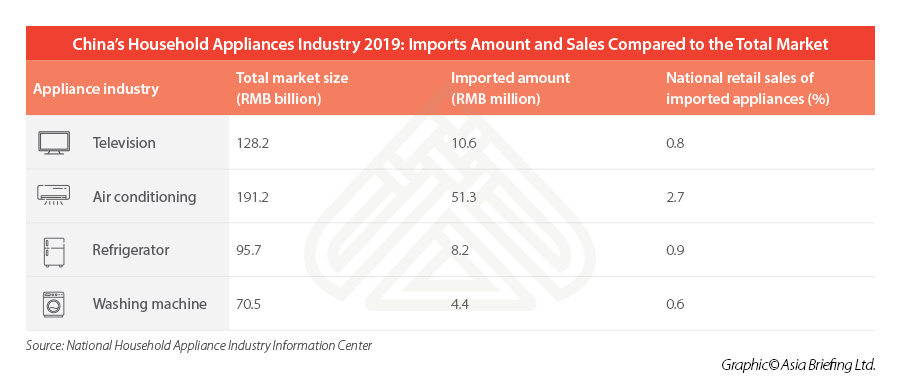

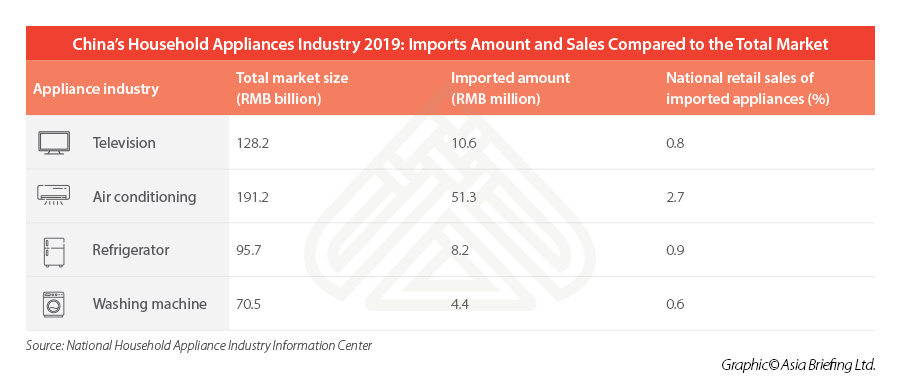

China Reinstates Import Tax Reduction And Exemption For 20 Commodities

Akademi Kastam Diraja Malaysia AKMAL Information Technology Division.

Malaysia car import duty calculator. However residents who have a My Second Home. One reason for that is the fact that Japanese cars are right-hand-drive like Kenyas. Duties Taxes Calculator to Malaysia.

The following strategies are supported. Shipping and customs costs. Sales tax on imported goods is charged when the goods are declared and duty tax paid at the time of.

These excise duties imposed on foreign manufactured cars have made them. 11 rows Import Duty Calculator. The following is the Royal Malaysian Customs gazetted CBU vehicle price list for alot of cars that are normally brought into Malaysia in CBU form.

Meanwhile the import duty can go up to 30 which varies based on the vehicles manufacturing country. Importing a used car from other Left Hand Drive LHD countries such as the US and Europe may violate this. Excise duty is between 60 and 105 regardless of CKD or CBU calculated based on the car and its engine capacity while import duty can reach up.

There are many charges associated with importing a vehicle from overseas. These rates can be quite high and excise duties can be up to 100 percent when importing a foreign vehicle. Malaysian motor vehicle import duties is an article describing the excise duty on imported.

The Malaysian Car Industry. Government officials working or studying overseas at least obtained a diploma. I Taxable goods manufactured in Malaysia by any registered manufacturer at the time the goods are sold disposed of other than by sales or used other than as a material in the manufacture of goods.

Every country is. MINIMUM -- The system will return the minimum duty rate found in the tariffs based on the number of HS digits the caller provides in the request. The car industry is a major part of the Malaysian economy.

Cc Other Charges. Malaysias car industry is dominated by two local manufacturers which are heavily supported by the government through National Car Policy eg. Import duty and taxes are due when importing goods into Malaysia whether by a private individual or a commercial entity.

Duties taxes on motor vehicles a passenger cars including station wagons sports cars and racing cars cbu ckd cbu ckd import duty import duty local taxes cbu ckd cbu ckd local taxes b other motor cars c commercial vehicles import duty local taxes cbu ckd cbu ckd. Import duty must be paid on any vehicles imported into Malaysia. Direct import concept solution D concept car import tax malaysia car import agent Malaysia car import rules and regulations car import duty import car from australia to Malaysia malaysia car import tax calculator how to import a car shipping car to malaysia recond car AP car car from japan car from uk car from australia vehicle import duty importing a vehicle can i import a car from japan.

To import a car into Malaysia you must apply for an Approval Permit AP from the Ministry of International Trade and Industry MITI Guidelines to Apply for Import License For Personal Motor Vehicles Of Malaysian Citizens Working Or Studying. Most cars in Malaysia are locally produced as high import duties make importing foreign cars expensive. Enter CIF Value in Rs.

Its fast and free to try and covers over 100 destinations worldwide. Calculate the Duty and Tax Costs of a Shipment utilizing Pricing Strategy. Why buy a used Car from Japan to Kenya.

Email your quote today. OverseasMalaysian citizens that are eligible to apply. Want to save time.

Please complete information below. Sales tax is imposed on taxable goods manufactured in Malaysia by any registered manufacturer at the time the goods are sold disposed of other than by sales or used other than as a material in the manufacture of goods. This sales tax exemption on purchases of new vehicles was previously granted from 15 th June 2020 until 31 st December 2020 and was further extended by another 6 months to 30 June 2021 by the MoF as an incentive to spur car sales at a time when the industry is contending with the impact of.

Ship it with us today. Estimate your tax and duties when shipping from United States to Malaysia based on your shipment weight value and product type. At present the excise duty is set at between 60 to 105 for both locally assembled and imported cars and it is calculated based on the car model and engine capacity.

Exporting from which country. Please refer to the new National Automotive. Import duty and VAT is calculated on the invoice provided to show how much you paid for the vehicle first it is converted into GBP using the current exchange rate set each month by customs for this purpose we then add on a nominal adjustment for shipping usually around 500 you then multiply this amount by the duty rate applicable for your vehicle.

Goods manufactured in Malaysia and on goods imported into Malaysia. Most secondhand cars for sale in Kenya are originally from Japan. You now know how much duty.

You can use a free online import duty calculator to help you out. 9202018 92506 am. Toyota tops that list.

To calculate the approximate costs of road tax. When shipping a package internationally from United States your shipment may be subject to a custom duty and import tax. This is a ZIMRA car import duty calculator Car Type.

Its importance has increased since the establishment of Proton in 1985 and Perodua in 1993. Garis Panduan Pemberian Penerimaan Hadiah JKDM. Car Import Cost Estimate Calculator.

Calculate import duty and taxes in the web-based calculator. The Import Direct Car Sales shipping calculator calculates the importing costs associated with your vehicle import. Both manufacturers are heavily supported by the government.

Things To Know When Shipping To Malaysia. Shipping costs include the costs of customs both in the country youre exporting from and in Singapore quarantine inspection fees cleaning international freight port service charges and. Ii Imported goods when the goods are declared and duty tax paid at the time of customs clearance.

Charges that contribute to the total car import cost include. For details about import duties and local taxes from the Malaysian Automotive Association. In Malaysia sales tax for vehicles has been set at 10 for both locally assembled and imported cars.

Malaysia Import Duty Calculator. These local manufacturers are Proton and Perodua. The valuation method is CIF Cost Insurance and Freight which means that the import duty and taxes payable are calculated on the complete shipping value which includes the cost of the imported goods the cost of freight and the cost of insurance.

Aside from the sales tax vehicles sold are also charged with other taxes namely excise duty and import duty. Pelan Antirasuah Organisasi JKDM. Users of the API can define a pricing strategy that will be utilized when calculating duties and taxes.

Value and Duty Description. Afghanistan Albania Algeria American Samoa Andorra Angola Anguilla Antarctica Antigua and Barbuda Argentina Armenia Aruba Australia Austria Azerbaijan Bahamas Bahrain Bangladesh Barbados Belarus Belgium Belize Benin Bermuda Bhutan Bolivia.