Email Kastam Sst

Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya. HS Code Item Description.

FSP who provides digital services to consumer in Malaysia and the value of.

Email kastam sst. This page is also available in. MD NURAKHIAR B MD NOOR. Penolong Pengarah Kastam WK44.

Melayu Malay 简体中文 Chinese Simplified Ways To Pay For Sales And Services Tax SST In Malaysia Now Is at Your Fingertips. Pejabat timbalan pengarah kastam operasi. Timbalan pengarah kastam operasi wk54.

Tingkat 1 Menara Kastam 80990 Johor Bahru Johor. Contact Us Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya Hotline. This website is developed to enable the public to access information related to the Royal Malaysian Customs Department includes corporate information organization and Customs related matters such as Sales and Service Tax SST.

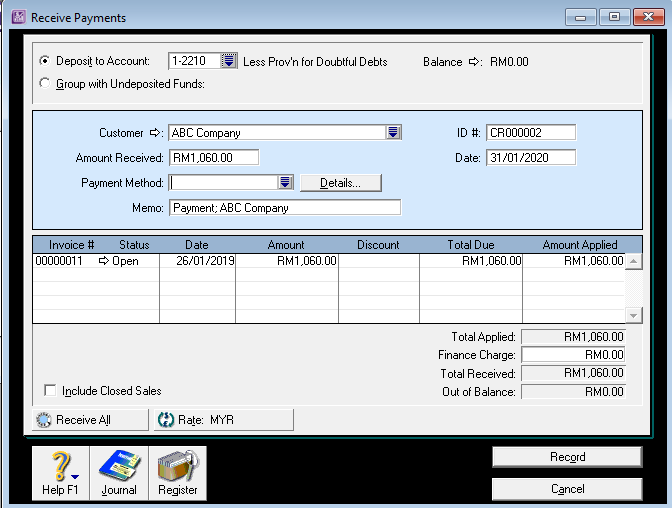

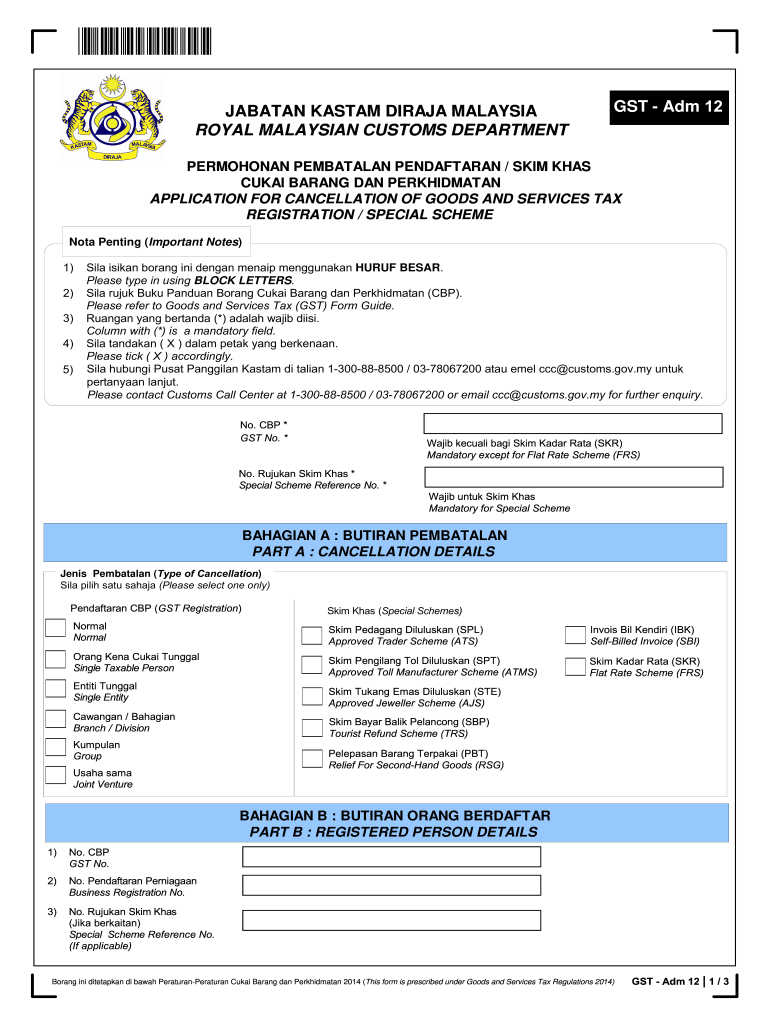

Trying to get tariff data. -- Choose -- PDK 2017 PDK 2017 ATIGA ACFTA AHKFTA MPCEPA MJEPA AKFTA AJCEP AANZFTA AINDFTA MNZFTA MICECA D8PTA MCFTA MAFTA MTFTA. Email protected Figure 1 shows the check list for the documents needed for SST cancellation application.

10 on the 1 st 30 days 15 on the 2 nd 30 days. No22 Jalan SS63 Kelana Jaya. Your browser has been left idle for more than 15 minutes.

MUHAMMAD SAFAR B SHAHRIN. However there is an. Cheque bank draft and posted to SST Processing Centre or to.

Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya 1300 888 500 Pusat Panggilan Kastam 1800 888 855 Aduan Penyeludupan 03 8882 21002300 Ibu Pejabat cccatcustomsdotgovdotmy. 1 300 88 8500 General Enquiries Monday - Friday 830 am 700 pm Saturday Sunday Public Holiday Closed 03-8882 210023002500 Headquarters Putrajaya 800 am 530 pm. 47301 Petaling Jaya Selangor.

1300 888 500 03-78067200. Penolong Pengarah Kastam WK44. Malaysia Sales Sales Tax SST.

Ketua Seksyen Kewangan. Penolong ketua pengarah kastam. Cukai dalam negeri bahagian sst borhan bin ahmad.

Monday - Friday 830 am - 530 pm for states weekend falling on Saturday - Sunday only Sunday - Thursday 830 am - 530 pm for states weekend falling on Friday -Saturday only. Jabatan kastam diraja malaysia. Do it online through the FPX system of the CJP system.

Ketua Pengarah Kastam Malaysia Jabatan Kastam Diraja Malaysia Pusat Pemprosesan Kastam Kompleks Kastam Kelana Jaya No22 Jalan SS63 Kelana Jaya. Jabatan Kastam Diraja Malaysia Pusat Pemprosesan Kastam Kompleks Kastam Kelana Jaya No22Jalan SS63 Kelana Jaya 47301 Petaling. Jabatan Kastam Diraja Malaysia.

With the SST implementation every business owners are required to. DATO SRI ABDUL LATIF BIN ABDUL KADIR Director General Of Customs Royal Malaysian Customs. Bahagian cukai dalam negeri sst tingkat bawah dan 1.

Cawangan kawalan kemudahan. The address to is as follows. The address is as follows.

Jabatan Kastam Diraja Malaysia Pusat Pemprosesan Kastam Kompleks Kastam Kelana Jaya No22 Jalan SS63 Kelana Jaya 47301 Petaling Jaya Selangor. The Director General may allow FRP upon application in writing to account for tax on invoice basis. Please make your selection.

201220172019 Or email to. Payment of Malaysia sales and services tax SST is now a straightforward process especially so when it saves the hassle of heading to the Customs in person. Ketua Pengarah Kastam Malaysia.

Your session has expired or Unauthorized URL accessed. JABATAN KASTAM DIRAJA MALAYSIA ZON TENGAH UNIT I WPKL KOMPLEKS KASTAM WPKL NO22 JALAN SS63 KELANA JAYA 47301 PETALING JAYA SELANGOR. Will I be penalized for late payment.

Sst contact person bahagian cukai dalam negeri ibu pejabat putrajaya. How to pay SST. Cawangan kawalan pemantauan cukai dalam negeri.

Ketua Seksyen Perolehan. Similar to the filing of SST return there are 2 ways to make the SST payment. Tarikh Akhir Dikemaskini.

6 Sila hubungi Pusat Panggilan Kastam ditalian 1-300-88-8500 03-78067200 atau emel ccccustomsgovmy untuk pertanyaan lanjut Please contact Customs Call Center at 1-300-88-8500 03-78067200 or email ccccustomsgovmy for further enquiry. For further enquiries please contact Customs Call Center. 03 7884 0800 Faksimili.

88400 kota kinabalu sabah. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya 1300 888 500 Pusat Panggilan Kastam 1800 888 855 Aduan Penyeludupan. The payment can be made by bank draftcheque in the name of Ketua Pengarah Kastam Malaysia.

Cawangan dasar pelaksanaan cukai jualan. A SALES SERVICE TAX. Kompleks Kastam Kelana Jaya.

This screen will be closed in 10 seconds automatically. Below is our gentle reminder when youre submitting your SST cancellation application. Cawangan dasar pelaksanaan cukai perkhidmatan.

The service tax on digital service chargeable under subsection 11 1 STA is due at the time when payment is received for the service provided to the consumer by the FRP. Payment via chequebank draft must be made payable to Ketua Pengarah Kastam Malaysia and mail to.