Malaysia Custom Import Tax Rate

It has been proposed that foreign service providers providing online services to Malaysia consumers will be required to register for service tax with Malaysia Customs and charge service tax. In order for the recipient to receive a package an additional amount of.

How To Calculate Uk Import Duty And Taxes Simplyduty

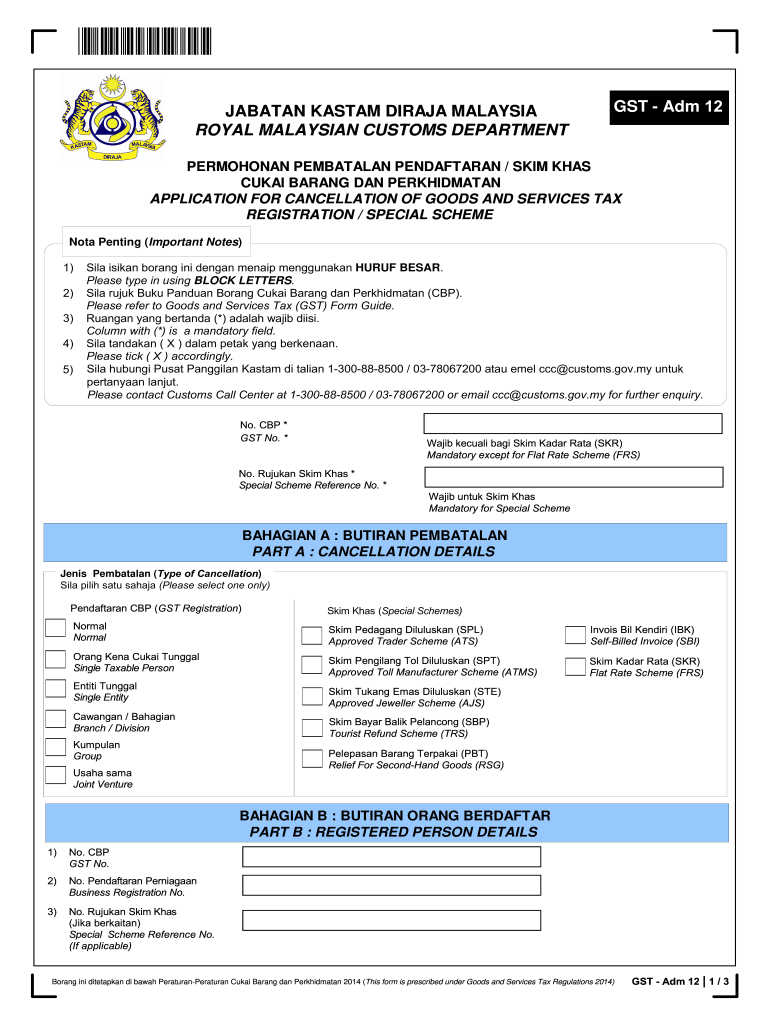

Sales Tax is imposed on imported and locally manufactured taxable goods.

Malaysia custom import tax rate. Page 6 of 130 Page 6 of 130 NAME OF GOODS HEADING CHAPTER EXEMPTED 5 10. Malaysias tariff barriers are largely applied ad valorem ranging from 0 to 50. The SST is also applied to the importation of taxable goods into Malaysia at the rate of 5 percent or 10 percent or a specific rate depending on the category of products.

There are also some products that are taxed based on a per-unit basis eg per-litre or per-kg. Rates vary from 0 to 300 and imports are also subject to a 10 sales tax and excise taxes. Total up cost me nearly RM450.

TARIFF SCHEDULE OF MALAYSIA. Trying to get tariff data. Ccccustomsgovmy For classification purposes please refer to Technical Services Department.

All customs duties and taxes imposed must have been paid before the goods are imported. 630790100 required 20 import duty 10 sales tax RM4980 EMS delivery charges. Goods subject to 5.

Prescribed drugs can only be imported into or exported from the country by virtue of a licence issued by the Ministry of Health Malaysia. To find out how much youll need to pay youll need to check the commodity code for umbrellas and apply the import duty rate for that code 65. TARIFF SCHEDULE OF MALAYSIA.

More information on import declaration procedures and import restrictions is available at the Malaysian Customs website. Malaysia Import Tax Custom Fees. If the full value of your items is over.

For example if the declared value of your items is. Goods subject to specific rate. The rate of service tax is 6.

Morphine heroine candu marijuana etc are strictly prohibited. Exchange Rate IMPORT Effective Date. The only authentic tariff commitments are those that are set out in the Tariff Elimination Annex.

In the case of goods produced in the country taxpayers refer to producers of the goods. Currently the importation of bicycles other than racing bicycles and bicycles designed to be ridden by children falling under the HS tariff code 87120030 00. De minimis rate is the price threshold below which fewer or no taxes are charged on shipments entering the country.

The ad valorem rates are 5 or 10 depending on the class of goods. The Ministry of Finance announced on July 16 2018 the SST is chargeable on the manufacture of taxable goods in Malaysia and the importation of taxable goods into Malaysia at the rate of 5 percent or 10 percent or a specific rate depending on the category of goods. For further enquiries please contact Customs Call Center.

The taxation for a particular country depends on the local GSTVAT as well as the item category and its declared value. The standard VAT rate on imports in Malaysia is set at 10 of the sum of the CIF value duty and any excise applicable. This Guide merely serves as information.

The import tax on a shipment will be. This rate takes into account the value of the shipped goods and the shipping fees. Please refer to Sales Tax Goods Exempted.

According to custom officer sanitary cloth pads HS Code. Import and export of illicit drugs eg. Malaysia import and export customs duty rates calculator.

In Malaysia the de minimis rate is MYR 500 or roughly USD 115 as of the time of this writing. The following goods are absolutely prohibited from exportation. The Ministry of Finance announced on July 16 2018 the SST is chargeable on the manufacture of taxable goods in Malaysia and the importation of taxable goods into Malaysia at the rate of 5 percent or 10 percent or a specific rate depending on the category of goods.

Calculate import duty and taxes in the web-based calculator. Tax will be due on the cost of the goods without shipping which in this case is 28000. In addition to that certain products may be.

65 of 28000 is 1820. 1 300 88 8500 General Enquiries Operation Hours Monday - Friday 830 am 700 pm email. Approximately 75 of imports into Malaysia are not subject to customs duties.

Payment Of Sales Tax. PREPARED BY ROYAL MALAYSIAN CUSTOMS DEPARTMENT. Import taxes and customs duties.

Goods subject to 20. Hak Cipta Terpelihara 2018 Jabatan Kastam Diraja Malaysia. In the case of imported goods taxpayers refers to.

Specific rates of sales tax are currently only imposed on certain classes of petroleum generally refined petroleum. UNITED ARAB EMIRATES. I get shocked because I didnt expected it will be so expensive.

Tariff schedules and appendices are subject to legal review transposition and verification by the Parties. Please refer to Sales Tax Goods Exempted From Tax Order 2018 and Sales Tax Rates of Tax Order 2018. On average the rate for imported industrial goods is 6 which is relatively low compared to other countries in the world.

Service tax is a consumption tax levied and charged on any taxable services provided in Malaysia by a registered person in carrying on ones business. However the average duty rate is less than 81. The incidence of tax is provided under.

The tax duty threshold is the amount at which a person begins paying taxes based on the declared value of an item. Reduction of import duty rate on bicycles. Its fast and free to try and covers over 100 destinations worldwide.

The state agency that has the authority to carry out the collection of excise tax in Malaysia is the Royal Malaysian Customs that falls under the jurisdiction of the Ministry of Finance and derives authority from the Excise Act of 1976. Import tariffs on textiles and other items already produced in Malaysia are applied in order to protect domestic industries.