Malaysia Customs Tariff Rate

For certain goods such as alcohol wine poultry and pork Malaysia charges specific duties that represent incredibly high effective tariff rates. Malaysias tariffs are typically imposed on a value-add basis with a simple average applied tariff of 61 percent for industrial goods.

Import And Export Procedures In Malaysia Best Practices Ansarcomp Malaysia

Once the TRQ has been filled one can continue to import the product without limitation but paying a higher tariff rate.

Malaysia customs tariff rate. Malaysia has eliminated duties on 9874 of its tariff lines in our ATIGA Tariff Schedules for 2015. Malaysia - Import Tariffs. Failure to classify product correctly will not only involve substantial costs to the business but will also attract customs investigations.

No NO 9 DIGIT. For enquiries please contact. Normally goods will be released using import duty rate as per Customs Duties Order enforced.

Malaysia tariff rates for 2013 was 444 a 003 increase from 2012. The annual stages referred to in paragraph 4 for the elimination or. For certain goods such as alcohol wine poultry and pork Malaysia charges specific duties that represent considerably higher effective tariff rates.

What is Most-Favoured-Nation MFN rate. Malaysias tariffs are typically imposed on a value-add basis with a simple average applied tariff of 61 percent for industrial goods. This Guide merely serves as information.

Description 2013 2014 2015 2016 2017 2018 2019 2020 and subsequent years Annex 1 Schedule of Tariff Commitments Malaysia HS Code 2012 900 - - - Other 0 0 0 0 0 0. Please make your selection. We now only have 73 tariff lines or less than 1 059 that have duties of 5 to 20 covering tropical fruits and tobacco and highly sensitive products rice respectively.

The Ministry of Finance announced on July. Malaysian Customs Classification of Goods entails classifying products into correct tariff codes to determine the amount of duty payable. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya.

For further enquiries please contact Customs Call Center. Merchandise trade and tariff statistics data for Malaysia MYS imports from partner countries including trade value number of products Partner share Share in total products MFN and Effectively Applied Tariffs duty free imports dutiable imports and free lines and number of trade agreements for year 2019. PREPARED BY ROYAL MALAYSIAN CUSTOMS DEPARTMENT.

Duties for tariff lines where there is significant local production are often higher. Malaysias tariffs are typically imposed on an ad valorem basis with a simple average applied tariff of 61 percent for industrial goods. Malaysia tariff rates for 2016 was 402 a 274 increase from 2014.

Precinct 2 62596 Putrajaya. HS Code Item Description. For Sabah and Sarawak - 15 levy rate for the CPO threshold value of RM3000 per metric tonne.

Preferential Tariff Treatment means special treatment in the form of preferential tariff. Lower rate of customs duty in quota tariff rate. Includes information on average tariff rates and types that US.

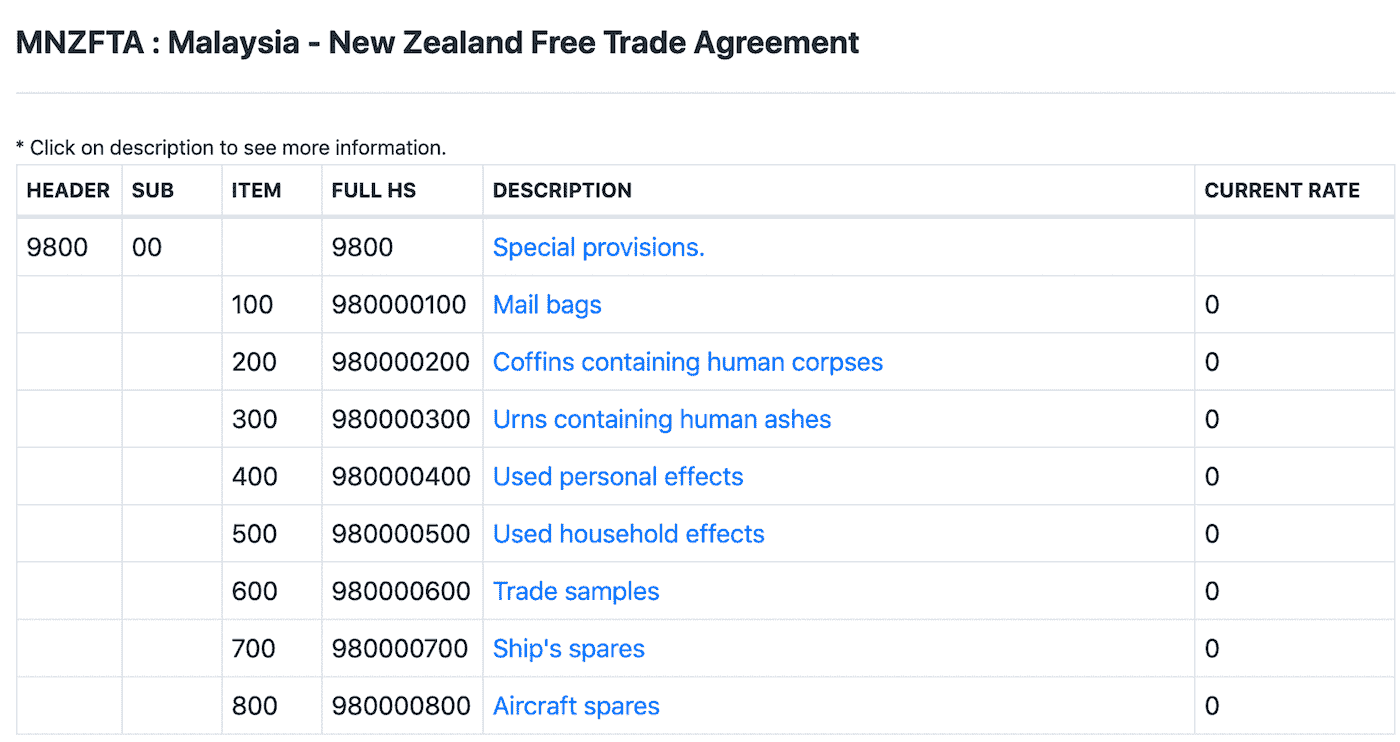

D Subparagraphs a through c apply to the following MCDO provision. -- Choose -- PDK 2017 PDK 2017 ATIGA ACFTA AHKFTA MPCEPA MJEPA AKFTA AJCEP AANZFTA AINDFTA MNZFTA MICECA D8PTA MCFTA MAFTA MTFTA. Royal Malaysian Customs Headquarters.

Exchange Rate IMPORT Effective Date. Trying to get tariff data. Currently the importation of bicycles other than racing bicycles and bicycles designed to be ridden by children falling under the HS tariff code 87120030 00 are subject to import duty at the rate of 25.

1 300 88 8500 General Enquiries Operation Hours Monday - Friday 830 am 700 pm email. Effective from 1 January 2019 import duty rate is. ANNEX 2-D APPENDIX A MALAYSIA 5 the Base Rate of 40 per cent to 20 per cent and these duties shall remain at 20 per cent effective January 1 of year 16.

Ministry Of Finance Complex No. The only authentic tariff commitments are those that are set out in the Tariff Elimination Annex that accompanies the final signed Agreement. 1300 888 500 Customs Call Centre 1800 888 855 Smuggling Report 03 8882 21002300 Head Quaters HEADQUARTERS.

Malaysia tariff rates for 2014 was 128 a 316 decline from 2013. What is Preferential Tariff Treatment. Meat of Fowls of the Species Gallus Domesticus Not Cut in Pieces Frozen.

Tariff-rate quotas TRQs or tariff quotas are predetermined quantities of goods which can be imported at a preferential ie. Malaysia has placed 82 Tariff Lines TLs which comprise of alcoholic beverages and arms weapons in the General. Duties for tariff lines where there is significant local production are often higher.

For Peninsular Malaysia - 3 levy rate for the CPO threshold value of RM2500 per metric tonne ii. Learn to get the Correct Tariff Codes here. Firms should be aware of when exporting to the market.

TARIFF SCHEDULE OF MALAYSIA Tariff schedules and appendices are subject to legal review transposition and verification by the Parties. Ccccustomsgovmy For classification purposes please refer to Technical Services Department. The MOF announced.

H customs duties on originating goods provided for in the items in staging category TRQ shall be governed by the terms of the TRQ applicable to that tariff item as outlined in Appendix A Tariff Rate Quotas of Malaysia to Malaysias Schedule to Annex 2-D. MFN rate is a normal non-discriminatory rate charged on imports excludes preferential tariff rate under free trade agreements. Malaysia tariff rates for 2012 was 441 a 024 increase from 2011.

The Ministry of Finance announced on July 16 2018 the SST is chargeable on the manufacture of taxable goods in Malaysia and the importation of taxable goods into Malaysia at the rate of 5 percent or 10 percent or a specific rate depending on the category of goods. The Ministry of Finance announced on July 16 2018 the SST is chargeable on the manufacture of taxable goods in Malaysia and the importation of taxable goods into Malaysia at the rate of 5 percent or 10 percent or a specific rate depending on the category of goods.

Moving Services In Malaysia Docshipper Malaysia

0 comments: