Kastam Register Gst

GST is known as Value Added Tax VAT that is claimable by GST registered business. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2.

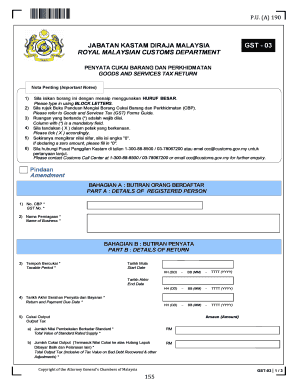

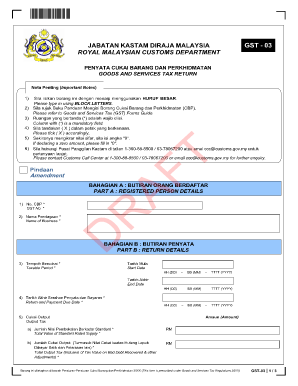

Gst 03 Form Fill Online Printable Fillable Blank Pdffiller

GST online registration is free from Kastam website.

Kastam register gst. KASTAM CERTIFIED GST POINT OF SALE TUKAR ATOM APPROVED PARTNER Contact Us Tommy Lee KL 0124513115 Mr. B SERVICE TAX. Warranty Registration Register your ARMS LITE to receive news and updates Please fill up all required information to register your ARMS LITE.

Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy. Eligible from Registration. Imposition of penalties will start for the taxable period for which tax payments are due and payable on 3112016.

Contact us should you need our help or advice in your companys GST registration. Can I as a business owner and customer of BTMU recover the GST charged by BTMU from Kastam. In accordance with amendments made to Section 41 of the Goods and Services Tax Act 2014 with effect from 112016 failure to pay the amount of goods and services tax to be paid within the period specified will be penalized.

GST is a broad based consumption tax covering all sectors of the economy ie all Malaysian-made goods and services including imports except specific goods and services which are categorized under zero rated supply and exempt supply orders as determined by the Minister of. PERMOHONAN PENDAFTARAN CUKAI BARANG DAN PERKHIDMATAN. In Malaysia a person who is registered under the Goods and Services Tax Act 2014 is known as a registered person.

Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya 1300 888 500 Pusat Panggilan Kastam 1800 888 855 Aduan Penyeludupan. Registration and collection of the 8 certificate of attendance on your behalf is not allowed. DOWNLOAD Download form and document related to RMCD.

The electronic acquisition system better known as ePerolehan will facilitate government procurement. With effect from 1 April 2015 the Goods and Services Tax GST will be enforced in Malaysia at the rate of 6. Please note that the CPD points awarded qualifies for the purpose of application and renewal of Section 170 GST Act 2014.

Debt as a percentage of GDP on a downward trajectory. GST paid can only be recovered from Kastam if you are a GST-registered and supported by a valid tax invoice from BTMU. 12 rows No.

Pahang Darul Makmur. ABDUL GHAFAR BIN MOHAMAD. GST can be recovered from Kastam by anyone who is GST-registered and in the course of carrying out a business.

A registered person is required to charge GST output tax on his taxable supply of goods and services made to his customers. So hurry up for needing to register. GSTGST Malaysia GST Course GST Training GST Customs Malaysia GST registration GST refund GST rate GST return GST form GST relief file GST GST.

Sesuai dipapar menggunakan Chrome versi terkini dengan paparan 1280 x 800 Hak Cipta Terpelihara 2015Jabatan Kastam Diraja MalaysiaHak terpelihara. Go to Single Payment Go to Bill Payment and Click Pay Bill Select Account to be debited Click on Non-Registered if bill not yet pre-registered Select Jabatan Kastam Diraja Malaysia under biller category Proceed to key in your companys GST payment details and. Semakan Syarikat Berdaftar GST Berdasarkan Pendaftaran Syarikat Nama Syarikat atau Nombor GST Check For GST Registered Company.

BUTIRAN LELONG JUALAN UNTUK MELUNASKAN HUTANG BAGI PRINSIPAL BERDAFTAR CBP Auction Sale In Satisfaction Of Debt Details For GST Registered Principal. Please present your identification card upon registration and collection of certificate of attendance for verification purposes. REGISTER LOGIN GST shall be levied and charged on the taxable supply of.

GST is levied on the supply of goods and services at each stage of the supply. One of the benefits of registering for GST is that you can claim the GST incurred on your purchases subject to the conditions for claiming input taxHowever if you are a partially exempt business PDF459KB or an organisation with business and non-business activities PDF 696KB you will not be able to claim your input tax in full as the input tax attributable to the making of exempt. 1 JALAN PERIGI NENAS 71 KS II TAMAN PERINDUSTRIAN PULAU INDAH.

Retrieve Saved Request. GST Offices Telephone No. Download GST-01 Guidelines here.

Steps to make your companys GST payment via Hong Leong Online Business. 16-07-2021 Anda perlu menambah customsgovmy kepada emel pegawai bagi tujuan penghantaran emel. JABATAN KASTAM DIRAJA MALAYSIA SELANGOR NO.

1 Jabatan Kastam Diraja Malaysia. View our GST video summary to better understand our services that we provide. PERMOHONAN PENDAFTARAN KUMPULAN USAHA SAMA.

Goods and Services Tax. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya Hotline. He is allowed to claim back any GST incurred on his purchases input.

Commitment towards fiscal consolidation. Though some of our clients want us to register for them paying a small fee for relieving themselves from the registration hassles that they might encounter. WISMA KASTAM SULTAN AHMAD SHAH.

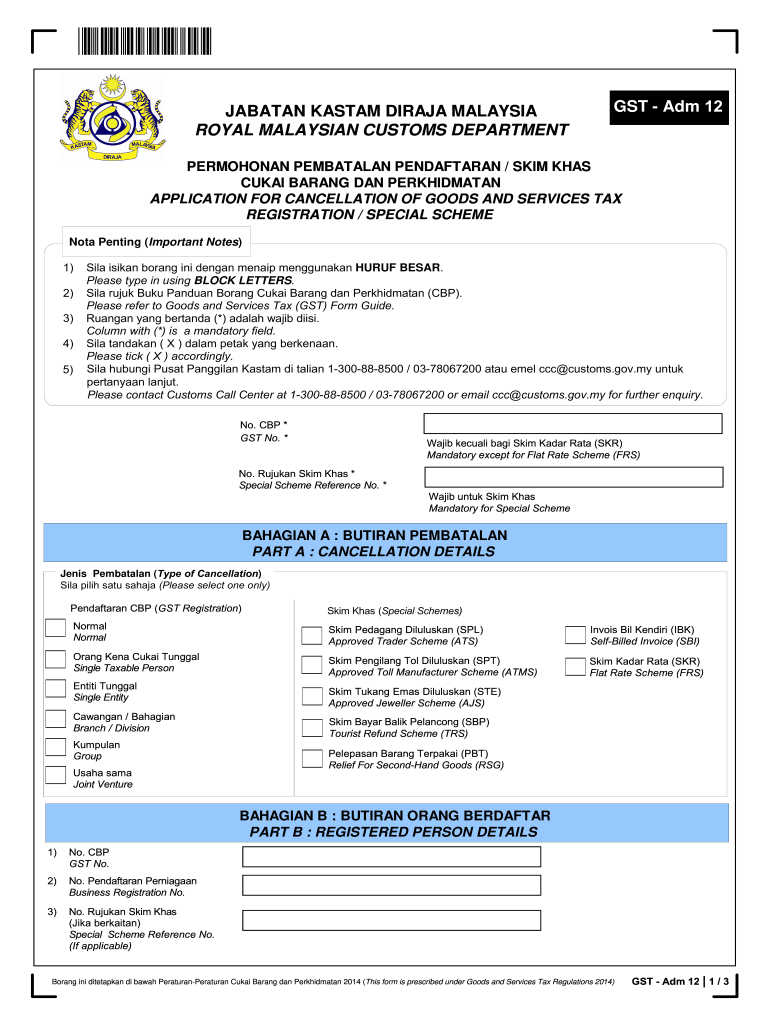

Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018. PENDAFTARAN BAGI CAWANGAN ATAU BAHAGIAN Registration Of Branch Or Division. GST - 04A.

ARAS 4 WISMA KASTAM SAS. Segala maklumat sedia ada adalah untuk rujukan sahaja. JABATAN KASTAM DIRAJA MALAYSIA PAHANG.

Pengarah Kastam Negeri WK54. Check With Expert GST shall be levied and charged on the taxable supply of goods and services. GST registered person who fulfilled the required criteria to be registered but were not registered by 1st September 2018 need to apply for registration within 30 days from the commencement date.

Application For Goods And Services Tax Registration. Application For Group. GST Calculator GST shall be levied and charged on the taxable supply of goods and services.

Fiscal policy continues to support growth.

Surat Pembatalan Sst 2020 2021 Fill And Sign Printable Template Online Us Legal Forms

0 comments: