Kastam Gst Guide

Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya Hotline. The GST which is also known as Value Added Tax in other countries is a tax on final consumption of goods and services.

This Industry Guide is prepared to assist you in understanding the Goods and Services Tax and its implications on banking services offered by Investment Banks IBs.

Kastam gst guide. Guide on Professional Services. Accounting for GST. If choose Payment for an advance ruling fee hyperlink.

AGENCY Browse other government agencies and NGOs websites from the list. It is recommended that you read the GST General Guide before reading this guide as it requires a fair understanding of the general concepts of GST. No1 Online GST Courses GST Seminar GST Training GST Workshop in Malaysia.

Sample cancellation letter gst. Guide on Credit Card Charge Card. Kastam GST - Kastam GST Malaysia.

Overview of Goods and Services Tax GST 2. All output tax and input tax are to be accounted and claimed based on the time when the invoice was issued or received. GST GUIDE FOR INPUT TAX CREDIT 250413 6 i Supplies Used for Making Taxable Supplies Taxable supplies would include standard-rated and zero-rated supplies.

GST is charged on all taxable supplies of goods and services in Malaysia except those. Bahasa Apakah Cukai Input dan Cukai Output What is input tax. A GST registered retailer can claim GST incurred on its trading stocks which are taxable supplies such as biscuits chocolates soft drinks instant noodles and nuggets.

Check With Expert GST shall be levied and charged on the taxable supply of goods and services. GST Training Malaysia on Goods and Services Tax GST in Malaysia. Example of gst customs letter.

Please tick x accordingly. GST Custom Kastam is the GST office in Malaysia. On the other hand if taxable use increases a further amount of input tax can be claimed.

Legislation Guides Currently selected. Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018. EVENT CALENDAR Check out whats happening.

General Operation Of Goods And Services Tax GST 2. Taxpayer will be required to fill in Enter Acknowledgement Receipt No field 7. Taxpayer will be required to fill in Enter GST No.

Goods and Services Tax GST is a multi-stage tax on domestic consumption. List of Accounting Software Vendors. This guide provides details on the treatment of freight transportation under the Goods and Services Tax GST.

5 years for any capital item other than land and building. GST Calculator GST shall be levied and charged on. Who is GST Customs Malaysia.

Please refer to Sales Tax Goods Exempted From Tax Order 2018 and Sales Tax Rates of Tax Order 2018. This facility may be given to businesses who carry out their. For more information please contact GST Malaysia.

10 years for land and building. GST Guide On Declaration And Adjustment After 1st September 2018. Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy.

GST Kastam - GST Kastam. There are two options of payment method. Guide on Accounting Software.

The period of adjustment shall consist of. COMPLAINT. In addition to the GST General Guide references can also be made from.

This Guide merely serves as information. Sales Tax Imposition Of Tax In Respect Of. Payment Method screen will require taxpayer to choose payment method to make a payment.

Contoh surat permohonan caruman lewat bayar perkeso fclb via. Contoh surat kastam gst. What is output tax.

Or Account ID field. NAME OF GOODS HEADING CHAPTER EXEMPTED 5 10 Shoulder of mutton Fresh Chilled Frozen 0204 02. Apakah cukai barangan dan perkhidmatan.

Adjustment to the input tax that has already been claimed should be repaid if the taxable use decreases over a period. Page 6 of 130. GST Custom Malaysia implements efficient.

GST Customs Malaysia is ready with an online system for GST tax submission and issuing GST refund. The GST training courses are based on GST Customs Malaysia GST Kastam guides and GST Bill GST ActThe GST training cost is claimable from the government under HRDF. GST Malaysia bring GST Training Seminar on GST Customs Malaysia guide to Penang Johor Melaka Terengganu Kelantan Perak Kedah Sabah Sarawak Pahang Seremban 2014 2015 and 2016 PRLog - Feb.

We brought out the big guns real GST Audit Experts. The guide on Import is prepared to assist all importers in understanding matters with regards to GST treatment on importation of goods. Basically all taxable persons will be required to account for GST based on accrual invoice basis of accounting ie.

We consulted Senior Kastam Officers and two industry top GST Audit Experts Derek Wong Kenny Ng to come up with a framework that can help anyone new to GST Audit Compliance and guide them to make a GST return that comply with Kastam rules and regulations. GST Training is based on GST Customs Malaysia Guide. The GST training courses are based on GST Customs Malaysia GST Kastam guides and GST Bill GST ActThe GST training cost is claimable from.

Bayaran balik akan dibuat kepada penuntut dalam tempoh 14 hari bekerja untuk tuntutan yang dikemukakan di atas talian atau 28 hari jika tuntutan dikemukakan secara manual. More 97 17052019 GST Guide On Tax Invoice Debit Note Credit Note And Retention Payment After 1st September 2018. Segala maklumat sedia ada adalah untuk rujukan sahaja.

However certain categories of taxable persons may be allowed to use the payment cash basis of accounting. For more information please go to gst. 19 2014 - KUALA LUMPUR Malaysia-- GST Customs Malaysia is ready with an online system for GST tax submission and issuing GST refund.

REGISTER LOGIN GST shall be levied and charged on the taxable supply of.

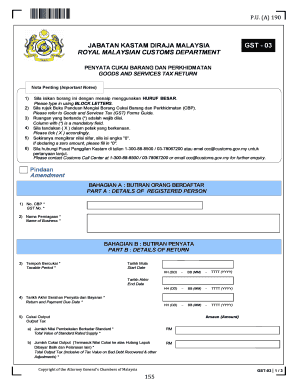

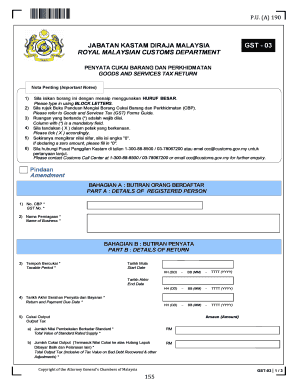

Gst 03 Form Fill Online Printable Fillable Blank Pdffiller

0 comments: