Kastam Malaysia Sst Faq

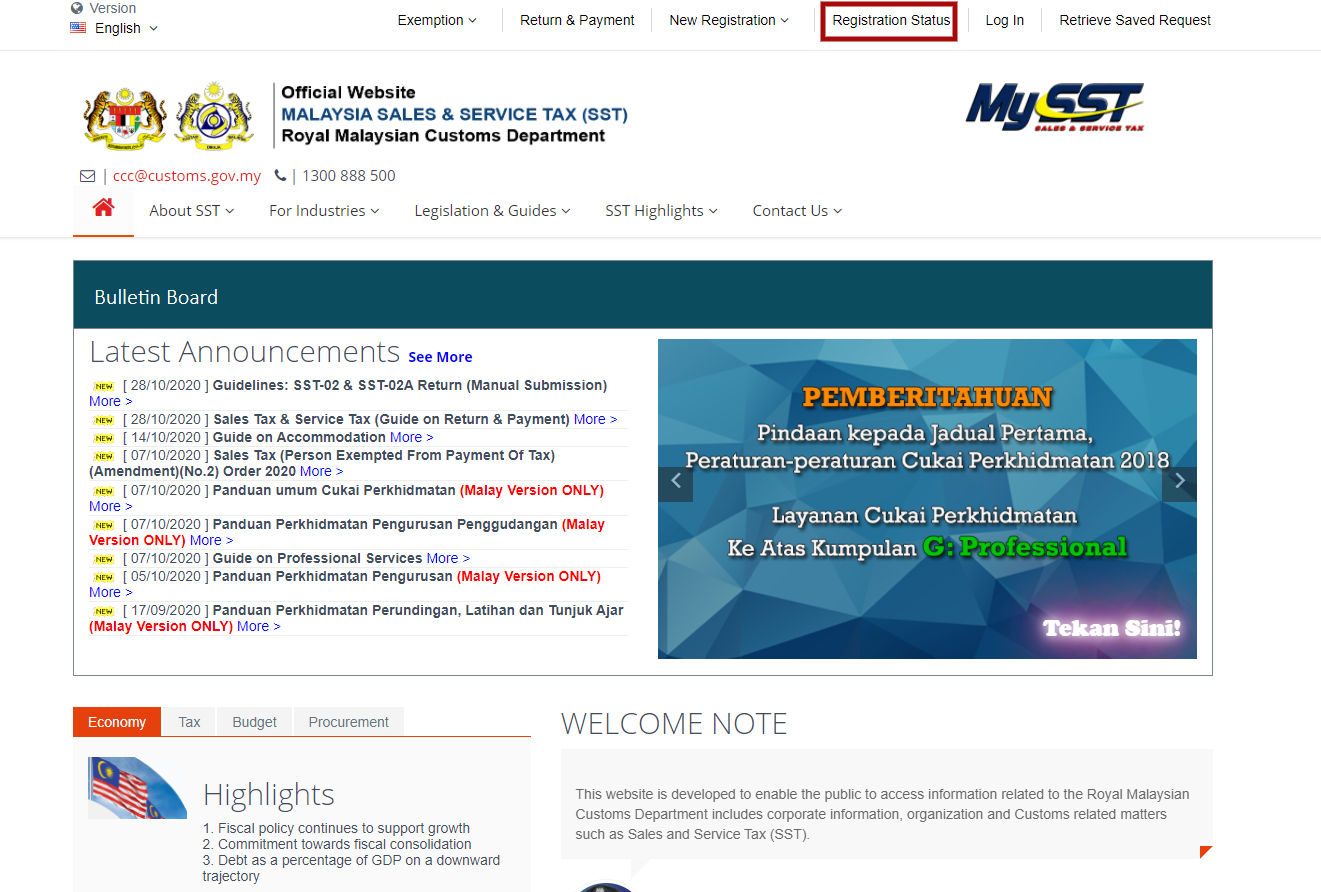

For payment of taxes online the maximum payment allowable is as follows. AGENCY Browse other government agencies and NGOs websites from the list.

Malaysia Sales Sales Tax SST.

Kastam malaysia sst faq. There are no translations available. Fiscal policy continues to support growth. By a taxable person.

Ketua Pengarah Kastam Malaysia. No22 Jalan SS63 Kelana Jaya. GST is charged on all taxable supplies of goods and services in Malaysia except those specifically exempted.

Jabatan Kastam Diraja Malaysia Pusat Pemprosesan Kastam Kompleks Kastam Kelana Jaya No22Jalan SS63 Kelana Jaya 47301 Petaling. Service tax is a tax charged on-. Sales tax a single-stage tax imposed on taxable goods manufactured locally and sold by a registered manufacturer and on taxable goods imported into Malaysia.

Please make your selection. Cheque bank draft and posted to SST Processing Centre or to. Payment of sales tax and service tax can be made electronically through the MySST system Financial Process Exchange FPX or manually by cheque or bank draft.

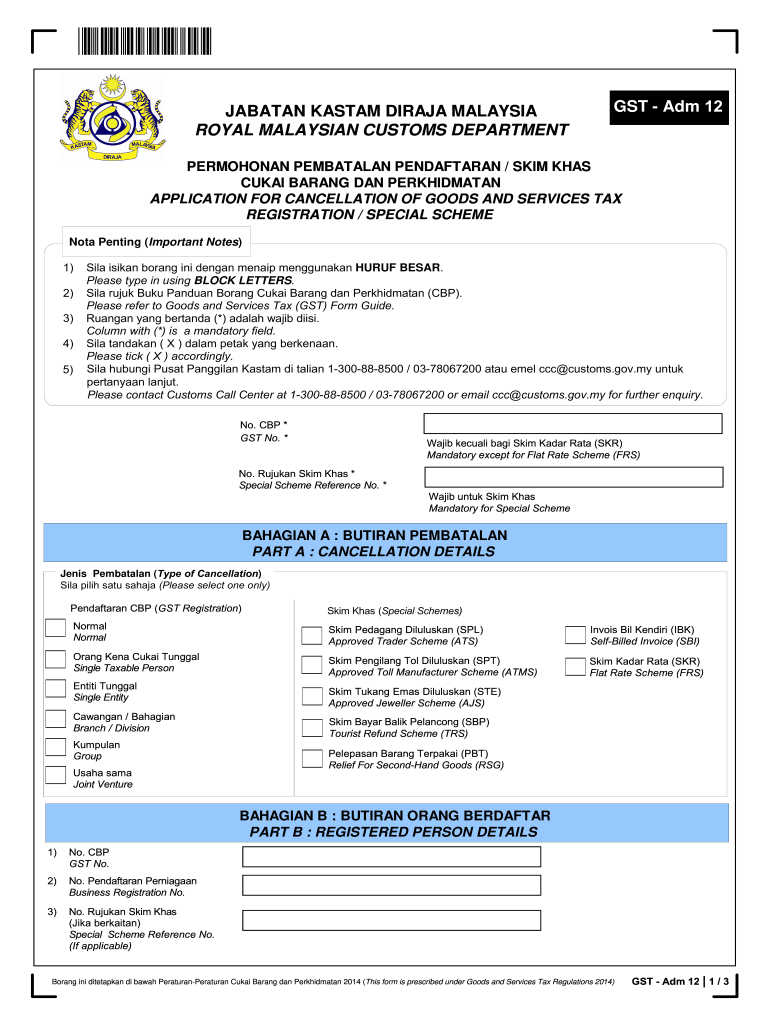

HS Code Item Description. This page is also available in. On 1st September 2018 the netizens of Malaysia witnessed the end of the Goods and Services Tax GST system.

Although the tax would be paid throughout the production and. All supplies of goods and services which are now subject to GST at standard-rated 6 becomes standard-rated 0 effective on 01 June 2018. SST can be filed online through the CJP system or by downloading the Form SST-02 from the MySST portal and mail it to the Customs Processing Centre CPC by post.

47301 Petaling Jaya Selangor. GST Calculator GST shall be levied and charged on. 2 2008 - dikenakan 20.

REGISTER LOGIN GST shall be levied and charged on the taxable supply of. Commitment towards fiscal consolidation. GST shall be levied and charged on the taxable supply of goods and services.

Service tax is a tax charged on- o any provision of taxable services. O made in the course or furtherance of any business. An SST return is submitted without payment or a lesser payment.

Melayu Malay 简体中文 Chinese Simplified Ways To Pay For Sales And Services Tax SST In Malaysia Now Is at Your Fingertips. Any deficiency on the net tax payable. Implemented since September 2018 Sales and Service Tax SST has replaced Goods and Services Tax GST in Malaysia.

The electronic acquisition system better known as ePerolehan will facilitate government procurement. Payment of Malaysia sales and services tax SST is now a straightforward process especially so when it saves the hassle of heading to the Customs in person. Lets uncover it bit by bit.

Made in the course or furtherance of any business. For corporate account payments B2B the amount is RM100 million. Download form and document related to RMCD.

All payments will be in Ringgit. No SST return is made. Barang di Jadual 1 Perintah Cukai Jualan Kadar-Kadar Cukai No.

METHOD OF PAYMENT OF SALES TAX AND SERVICE TAX. GST is also charged on importation of goods and services into Malaysia. Service tax is not charged on imported nor exported services.

Pengurusan tertinggi JKDM diterajui oleh Ketua Pengarah Kastam Turus III dan. Jabatan Kastam Diraja Malaysia Pusat Pemprosesan Kastam Kompleks Kastam Kelana Jaya No22 Jalan SS63 Kelana Jaya 47301 Petaling Jaya Selangor. GST shall be levied and charged on the taxable supply of goods and services.

Debt as a percentage of GDP on a downward trajectory. COMPLAINT. Penalties may be imposed if the following offenses are committed.

FREQUENTLY ASKED QUESTIONS FAQ Service Tax 1. -- Choose -- PDK 2017 PDK 2017 ATIGA ACFTA AHKFTA MPCEPA MJEPA AKFTA AJCEP AANZFTA AINDFTA MNZFTA MICECA D8PTA MCFTA MAFTA MTFTA. As the backbone of the country what do small and medium enterprise SME owners ought to know about SST.

And o in Malaysia. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya 1300 888 500 Pusat Panggilan Kastam 1800 888 855 Aduan Penyeludupan 03-8882 21002300 Ibu Pejabat ccccustomsgovmy. جابتن كستم دراج مليسيا.

JKDM ialah sebuah badan jabatan kerajaan di bawah Kementerian Kewangan MalaysiaJKDM berfungsi sebagai pemungut cukai tidak langsung utama negara memberi fasilitasi kepada perdagangan dan menguatkuasa undang-undang. 2 2008 - kadar spesifik. Payment of tax is made in stages by the intermediaries in the production and distribution process.

The payment can be made by bank draftcheque in the name of Ketua Pengarah Kastam Malaysia. The SST consists of 2 elements. The SST payment must be made within 30 days from the end of the taxable period.

Check With Expert GST shall be levied and charged on the taxable supply of goods and services. O by a taxable person. ODD FYE Months 1st First Taxable Period 1 month 1st Taxable Period 1st to 30th September 2018 One months 2nd Taxable Period 1st October to.

Move the mouse over the button to open the dropdown menu. 1What is Service Tax. Service tax a consumption tax levied and charged on any taxable services provided in.

Trying to get tariff data. Kompleks Kastam Kelana Jaya. 2 2008 - dikenakan 5.

The address to is as follows. Will I be penalized for late payment. Jabatan Kastam Diraja Malaysia Pusat Pemprosesan Kastam Kompleks Kastam Kelana.

Barang di Jadual 3 Perintah Cukai Jualan Kadar-kadar Cukai No. Contact Us Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya Hotline. Since then the Sales and Service Tax SST has been taking the lead.

What does the MOF statement dated 16 May 2018 relate to the imposition of GST at 0 and its impact on GST. IBU PEJABAT KASTAM DIRAJA MALAYSIA NO 22 MENARA TULUS PERSIARAN PERDANA PRECINT 3 62100 PUTRAJAYA. EVENT CALENDAR Check out whats happening.

Importation of goods is also subject to GST at standard-rated 0. With the SST implementation every business owners are required to. How does service tax works.

What is service tax. Any provision of taxable services. Jabatan Kastam Diraja Malaysia.

Barang di Jadual 2 Perintah Cukai Jualan Kadar-Kadar Cukai No. 10 on the 1 st 30 days 15 on the 2 nd 30 days. Jabatan Kastam Diraja Malaysia Tulisan Jawi.

Malaysia Sst Sales And Service Tax A Complete Guide

0 comments: