Malaysia Import Duties Rate

Tariff schedules and appendices are subject to legal review transposition and verification by the Parties. Excise duties are imposed on a selected range of goods manufactured and imported into Malaysia.

Government Mulls Lower Excise Duty For Cars How Low Will Prices Go How Realistic Is It Insights Carlist My

Based on the commitments under AFTA Cambodia Lao PDR Myanmar and Viet Nam eliminated duties on all products in 2015 with flexibility of 7 of tariff lines up to 2018.

Malaysia import duties rate. Electronic Pre-Alert Manifest ePAM Pre-Arrival Processing PAP INDIVIDUALS. These products are not subject or import duties reduction or elimination. The SST is also applied to the importation of taxable goods into Malaysia at the rate of 5 percent or 10 percent or a specific rate depending on the category of products.

Merchandise trade and tariff statistics data for Malaysia MYS imports from partner countries including trade value number of products Partner share Share in total products MFN and Effectively Applied Tariffs duty free imports dutiable imports and free lines and number of trade agreements for year 2019. Duties for tariff lines where there is significant local production are often higher. PREPARED BY ROYAL MALAYSIAN CUSTOMS DEPARTMENT.

1 300 88 8500 General Enquiries Operation Hours Monday - Friday 830 am 700 pm email. This Guide merely serves as information. In order for the recipient to receive a package an additional amount of.

Malaysia has placed 82 Tariff Lines TLs which comprise of alcoholic beverages and arms weapons in the General Exclusion List. If the CIF value which means your goods value shipping fees and insurance fees exceeds MYR 500 then youll have to pay import duties in the range of 0 to 25 and sales. The Ministry of Finance announced on July 16 2018 the SST is chargeable on the manufacture of taxable goods in Malaysia and the importation of taxable goods into Malaysia at the rate of 5 percent or 10 percent or a specific rate depending on the category of goods.

Prescribed drugs can only be imported into or exported from the country by virtue of a licence issued by the Ministry of Health Malaysia. For example if the declared value of your items is. The only authentic tariff commitments are those that are set out in the Tariff Elimination Annex.

Malaysias tariff barriers are largely applied ad valorem ranging from 0 to 50. Malaysia import and export customs duty rates calculator. In many cases the average duty rate is around 6.

If the full value of your items is over. For Malaysian Exporters Discover global business opportunities. Tariff quotas in 57 Imports in billion US 2019 2037 156 1881 Ag.

Export Readiness Assessment Tool ERAT Beginners Guide to Exporting. Understanding Free Trade Agreements. Import taxes and customs duties.

How Much are the Taxes if my Goods Surpass the De Minimis Rate in Malaysia. On average the rate for imported industrial goods is 6 which is. Summary and duty ranges Total Ag Non-Ag WTO member since 1995 Simple average final bound 209 536 149 Total 843 Simple average MFN applied 2020 57 87 52 Non-Ag 819 Trade weighted average 2019 39 86 35 Ag.

The ad valorem rates of import duties range from 2 to 60. Goods that are subject to excise duty include beerstout cider and perry rice wine. Morphine heroine candu marijuana etc are strictly prohibited.

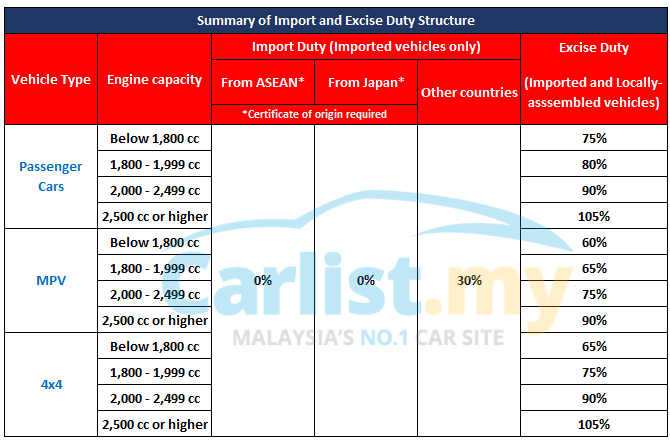

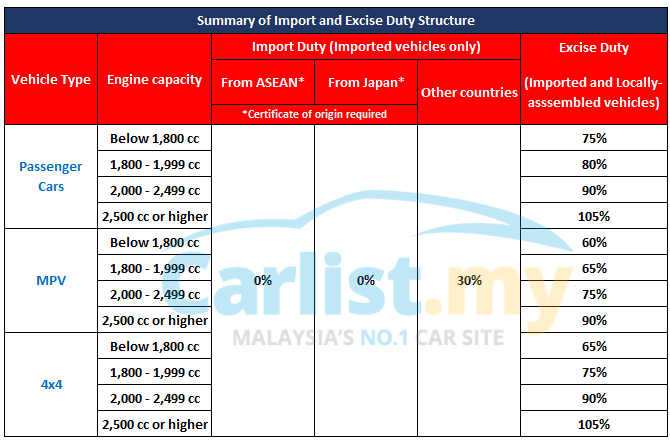

Excise duty is between 60 and 105 regardless of CKD or CBU calculated based on the car and its engine capacity while import duty can reach up. Raw materials machinery essential foodstuffs and pharmaceutical products are generally non-dutiable or subject to duties at lower rates. Borang Kastam No7 K7 Malaysian Tourism Tax System MyTTX ATA Carnet.

Import and export of illicit drugs eg. The import tax on a shipment will be. Malaysia Part A1 Tariffs and imports.

Some goods are exempt from duties such as electronic products like laptops and electric guitars. Its fast and free to try and covers over 100 destinations worldwide. Hak Cipta Terpelihara 2018 Jabatan Kastam Diraja Malaysia.

Special safeguards in 55 Duty-free 0. Malaysia Import Tax Custom Fees The taxation for a particular country depends on the local GSTVAT as well as the item category and its declared value. The ad valorem rates of import duties defined in terms of a fixed percentage of value ranging from 0 to 60.

Calculate import duty and taxes in the web-based calculator. However the amount of duty rates charged in advance by different movers vary. The complete list of the applicable duties can.

For further enquiries please contact Customs Call Center. Ccccustomsgovmy For classification purposes please refer to Technical Services Department. Find import duty rates in Malaysia also with the list of all hs products and their tariff details.

Trying to get tariff data. Rules Of Origin ROO Kemudahan Partial K8. Malaysia applies tariff rate quota TRQ on selected agricultural products such as chicken milk and cream hen eggs cabbages.

In Malaysia the import duty rates can range from as low as 0 to as much as 50. The tax duty threshold is the amount at which a person begins paying taxes based on the declared value of an item. The Ministry of Finance announced on July 16 2018 that the SST is chargeable on the manufacture of taxable goods in Malaysia.

TARIFF SCHEDULE OF MALAYSIA. Services For Exporters. PROCEDURE GUIDELINES Currently selected.

Approximately 75 of imports into Malaysia are not subject to customs duties. Raw materials machinery essential foodstuffs and pharmaceutical products are generally non-dutiable or subject to duties at lower rates. TARIFF SCHEDULE OF MALAYSIA.

The rates generally range from zero to 40 per cent with much higher rates imposed on alcohol and tobacco products.

Malaysia Imports Value Electrical Electronic Products Economic Indicators Ceic

0 comments: