Malaysia Custom Duty Rate

All customs duties and taxes imposed must have been paid before the goods are imported. Malaysia as if it were a customs duty or an excise duty and as if such importation of taxable goods are dutiable and liable to customs duty or excise duty.

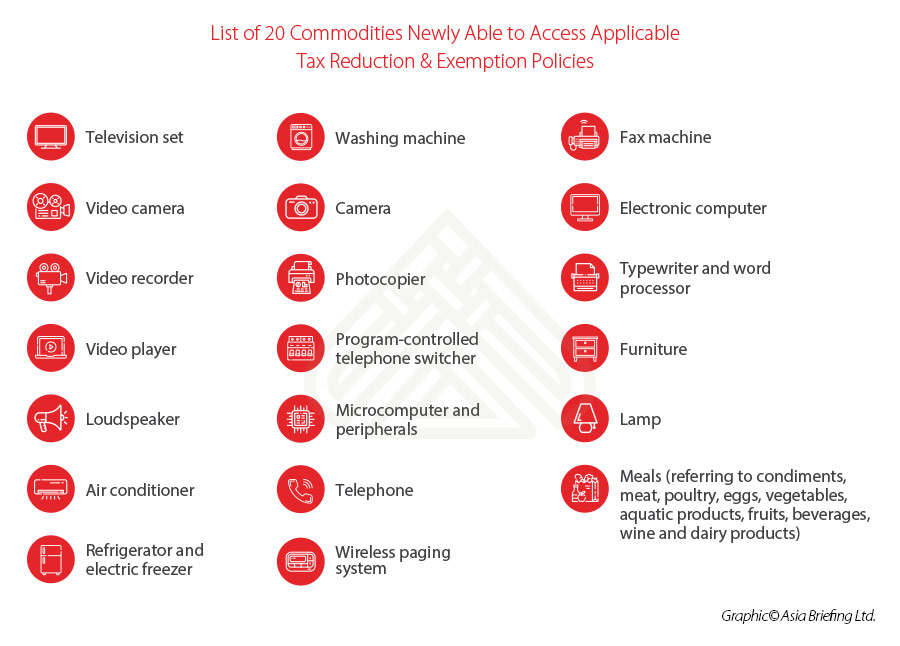

China Reinstates Import Tax Reduction And Exemption For 20 Commodities

Malaysia - Customs and duties.

Malaysia custom duty rate. The calculation of duties depends on the assessable value of a dutiable shipment. Dutiable shipments are subject to a customs duty which is a tariff or tax imposed on goods when transported across international borders. Duty Rates Duty rates in Malaysia vary from 0 to 50 with an average duty rate of 574.

The following are some of the goods which require an export licencepermit from relevant authorities. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya. Hak Cipta Terpelihara 2018 Jabatan Kastam Diraja Malaysia.

Malaysia import and export customs duty rates calculator. 1300 888 500 Customs Call Centre 1800 888 855 Smuggling Report 03 8882 21002300 Head Quaters HEADQUARTERS. At Simply Duty you get to use our duty calculator free of charge every day.

Some goods are not subject to duty eg. In order for the recipient to receive a package an additional amount of. For example if the declared value of your items is.

Sales tax for petroleum is charged on a specific rate. The rates generally range from zero to 40 per cent with much higher rates imposed on alcohol and tobacco products. The Ministry of Finance announced on July 16 2018 the SST is chargeable on the manufacture of taxable goods in Malaysia and the importation of taxable goods into Malaysia at the rate of 5 percent or 10 percent or a specific rate depending on the category of goods.

TARIFF SCHEDULE OF MALAYSIA Tariff schedules and appendices are subject to legal review transposition and verification by the Parties. Rattan from Peninsula of Malaysia. This Guide merely serves as information.

The only authentic tariff commitments are those that are set out in the Tariff Elimination Annex that accompanies the final signed Agreement. Ccccustomsgovmy For classification purposes please refer to Technical Services Department. This rate takes into account the value of the shipped goods and the shipping fees.

Import tariffs on textiles and other items already produced in Malaysia are applied in order to protect domestic industries. PREPARED BY ROYAL MALAYSIAN CUSTOMS DEPARTMENT. The Ministry of Finance announced on July 16 2018 the SST is chargeable on the manufacture of taxable goods in Malaysia and the importation of taxable goods into Malaysia at the rate of 5 percent or 10 percent or a specific rate depending on the category of goods.

Service tax on imported services. Trying to get tariff data. You only need to upgrade if you want more than 5 calculations per day.

Approximately 75 of imports into Malaysia are not subject to customs duties. The taxation for a particular country depends on the local GSTVAT as well as the item category and its declared value. In Malaysia the de minimis rate is MYR 500 or roughly USD 115 as of the time of this writing.

Any animal or bird other than a domestic animal or domestic fowl whether alive or dead or any part thereof. Sales tax is an ad valorem tax and different rates apply based on group of taxable goods. Rate of Sales Tax 6.

The SST is also applied to the importation of taxable goods into Malaysia at the rate of 5 percent or 10 percent or a specific rate depending on the category of. Laptops electric guitars and other electronic products. In many cases the average duty rate is around 6.

Some goods are exempt from duties such as electronic products like laptops and electric guitars. If the full value of your items is over. For exporters or importers who are not sure of the HSAHTN codes for their products you can refer to the officers at the Malaysia Royal Customs Department Head Office or any of its branch offices for assistance.

However the average duty rate is less than 81. The tax duty threshold is the amount at which a person begins paying taxes based on the declared value of an item. Import taxes and customs duties.

However the amount of duty rates charged in advance by different movers vary. Rates vary from 0 to 300 and imports are also subject to a 10 sales tax and excise taxes. For more info please visit.

However it has been proposed by the Malaysia Government that beginning on 1 April 2019 excise duty will be introduced on sweetened beverages that are being manufactured in the form of ready to drink. No NO 9 DIGIT. For further enquiries please contact Customs Call Center.

On average the rate for imported industrial goods is 6 which is relatively low compared to other countries in the world. You need to check with the mover to confirm the amount of. 5 Free Calculations Per Day.

In addition to duty imports are subject to sales tax VAT and in some cases to excise. This service is provided free of charge. Malaysias tariff barriers are largely applied ad valorem ranging from 0 to 50.

The excise duty rate of MYR 040 per litre will be charged on the sweetened beverages. 1 300 88 8500 General Enquiries Operation Hours Monday - Friday 830 am 700 pm email. The import tax on a shipment will be.

In Malaysia the import duty rates can range from as low as 0 to as much as 50. The Ministry of Finance announced on July 16 2018 that the SST is chargeable on the manufacture of taxable goods in Malaysia. The complete list of the applicable duties can be found at the Royal Malaysian.

Malaysia Import Tax Custom Fees.

Essay On Importance Of Animals In 2021 Essay Commercial Freezer Writing Workshop

0 comments: