Malaysia Customs Tax Calculator

Assesable ValueAV CIF Value Landing Charges 1 of CIF Value Basic Duty of Customs AV x BD rate 100. Then it is not negotiabledisputable anymore get the sender to sent separately in envelopes instead of one huge.

Custom Duties Are Levied As Per The Value Or Dimension Of Goods Customs Duties Custom Duties

Estimate your tax and duties when shipping from Malaysia to Malaysia based on your shipment weight value and product type.

Malaysia customs tax calculator. This import duty calculator only applies to imports into the US but it will soon be extended to include the UK and other EU European Union countries. We would like to remind you that the figure provided above is an estimate of duties and tax shipped via express couriers DHL FedEx UPS etc. Things To Know When Shipping To Malaysia.

As a general rule of thumb if both spouses are earning high incomes in the year of assessment it is always recommended to opt for separate assessment to leverage on the tax reliefs and deductibles available. Malaysia Import Duty Calculator. Here are the differences.

GST shall be levied and charged on the taxable supply of goods and services. Ship it with us today. Exporting from which country.

Want to save time. GST shall be levied and charged on the taxable supply of goods and services. The valuation method is CIF Cost Insurance and Freight which means that the import duty and taxes payable are calculated on the complete shipping value which includes the cost of the imported goods the cost of freight and the cost of insurance.

The calculator is designed to be used online with mobile desktop and tablet devices. The taxation for a particular country depends on the local GSTVAT as well as the item category and its declared value. Malaysia calculates using the CIF method which means the import duty and taxes are calculated based on the value of the.

Sales tax administered in Malaysia is a single stage tax imposed on. One of the important things that you must know when shipping from China is that the government put very stringent requirements on articles publications audio and video content. Review the full instructions for using the Malaysia Salary After Tax Calculators which details Malaysia tax.

Regardless of whether or not they are subject to customs. The Malaysian Automotive Association MAA says that new OMV calculations could see CKD car prices go up by varying degrees 0-20 depending on. Excise Tax if any.

USA Customs Import and Export Duty Calculator. This value includes the price paid for goods postage packaging and. This Guide merely serves as information.

E Garis Panduan Pelepasan Barangan Yang Dibawa Masuk Semula Dari Pelabuhan Kastam Dan Pelabuhan Zon Bebas. Additional Duty of CustomsCVD Including Cess if any. Value and Duty Description.

1 300 88 8500 General Enquiries Operation Hours Monday - Friday 830 am 700 pm email. Download form and document related to RMCD. This is not available if your seller using courier service because for courier service if any LOW duty tax for Malaysia it is RM500 the custom will clear it first and bill it to the courier company the courier company will then bill it to you when you get the item.

Its easy to estimate duties on this import duty calculator. To calculate GST value based on the salespurchase value. In Malaysia the goods and services tax GST was introduced on April 1 2015.

For further enquiries please contact Customs Call Center. By providing our team of brokers with several pieces of key information we can determine the rates due and assist you in clearing the products. 6 To calculate GST value based on the salespurchase value.

The system is thus based on the taxpayers ability to pay. To get GST inclusive amount multiply GST exclusive value by 106. Please complete information below.

I Taxable goods manufactured in Malaysia by any registered manufacturer at the time the goods are sold disposed of other than by sales or used other than as a material in the manufacture of goods. Its fast and free to try and covers over 100 destinations worldwide. Hence it is intended only to give you an overviewrange of the amount of duties and taxes payable.

Malaysia Import Tax Custom Fees. Import duty and taxes are due when importing goods into Malaysia whether by a private individual or a commercial entity. Please refer to Sales Tax Goods Exempted From Tax.

Calculate import duty and taxes in the web-based calculator. Malaysian Goods and Services tax history. Select the country of import from the drop-down list.

Duties Taxes Calculator to Malaysia. The Monthly Wage Calculator is updated with the latest income tax rates in Malaysia for 2021 and is a great calculator for working out your income tax and salary after tax based on a Monthly income. Malaysia has created a Free Trade Agreement Calculator to make it easy for you to determine if your goods are eligible for a reduced rate.

For all other countries that do not have FTAs Customs Duties Order 2018 details all applicable rates produced based on the country of origin. How Is US Customs Duty Calculated Using Our Free US Import Duty Calculator. PREPARED BY ROYAL MALAYSIAN CUSTOMS DEPARTMENT.

Enter CIF Value in Rs. Fully Landed Costs are the total amount of costs of a cross border purchase including the price of the goods shipping costs customs duties taxes insurance currency conversion transaction fees and any other service fees that might occur. Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system.

How to calculate Malaysian GST manually. China is known to have stringent customs requirements so shipping from it can be challenging. China to Malaysia.

Import Duty Calculator. Goodadas USA customs import and export duty calculator will help you identify the export tariff rates you will pay for the USA. AMOUNT RM SUBTOTAL RM GST RM TOTAL RM GST RATE.

According to Section 45 of Malaysias Income Tax Act 1967 all married couples in Malaysia have the right to choose whether to file individual or joint taxes. Total Amount Due to the Government. But it doesnt have to be the case if you comply with all the requirements of China Customs.

The tax duty threshold is the amount at which a person begins paying taxes based on the declared value of an item. Just multiple your GST exclusive amount by 006. 300 is GST exclusive value.

Malaysia Corporate Income Tax Calculator for YA 2020 Assessment of income in Malaysia is done on a current-year basis. It is important to note that the burden of computing tax liabilities accurately is on the company and accordingly tax payers are expected to compute taxes while obeying taxation laws and guidelines issued by the Malaysian Inland Revenue Board IRB. When shipping a package internationally from Malaysia your shipment may be subject to a custom duty and import tax.

Afghanistan Albania Algeria American Samoa Andorra Angola Anguilla Antarctica Antigua and Barbuda Argentina Armenia Aruba Australia Austria Azerbaijan Bahamas Bahrain Bangladesh Barbados Belarus Belgium Belize Benin Bermuda Bhutan Bolivia. Leave a Comment Uncategorized. Basic Duty Pref AV x BD Pref rate 100.

To calculate Malaysian GST at 6 rate is very easy. Dhl customs duty calculator malaysia. Ccccustomsgovmy For classification purposes please refer to Technical Services Department.

DHL Duty and Tax Calculator API calculates the total cost of a cross-border shipment. There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make sure you. Every country is different.

300 006 18 GST amount. This means that low-income earners are imposed with a lower tax rate compared to those with a higher income.

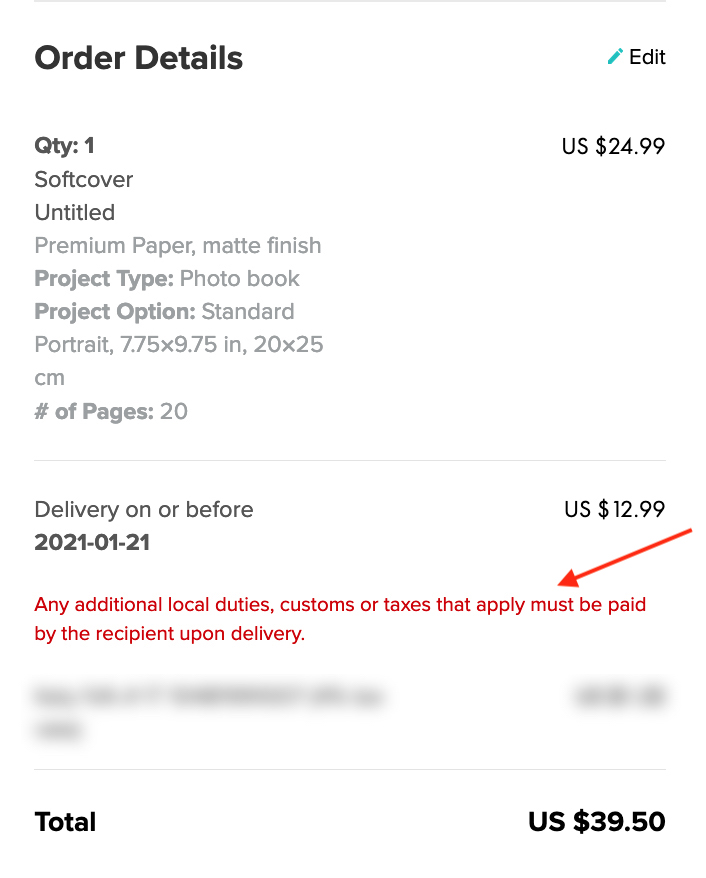

Customs Duties Taxes And Import Fees Help Center

0 comments: