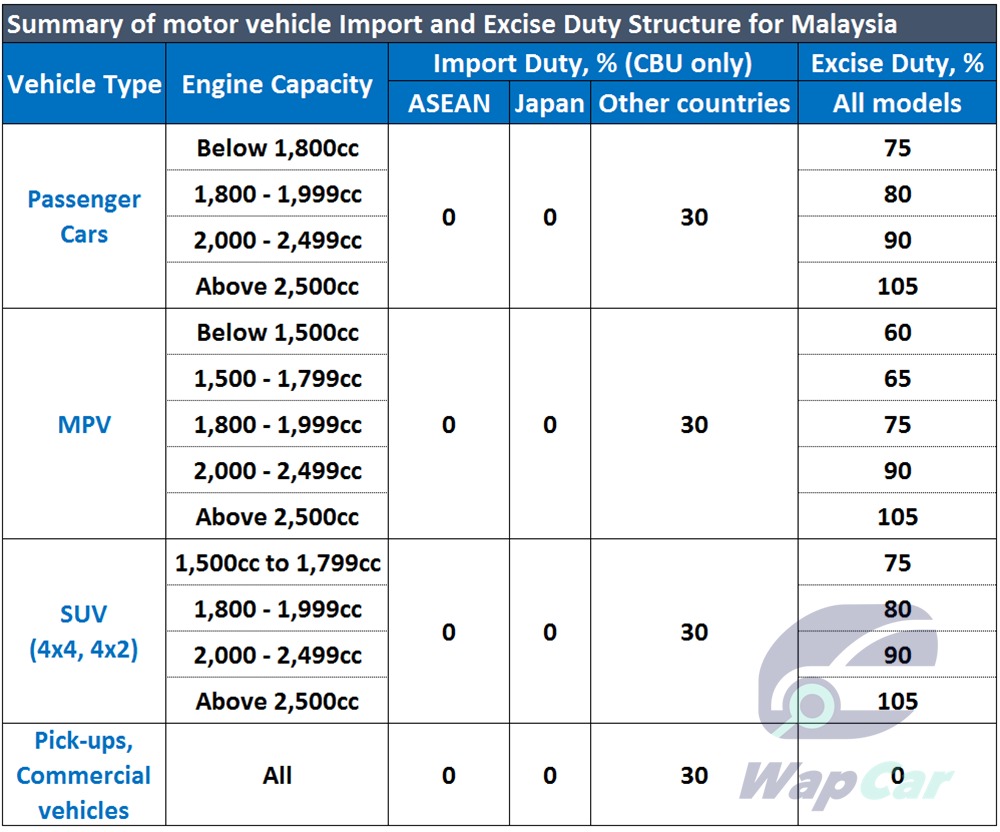

Malaysia Import Duty Rates

The Ministry of Finance announced on July 16 2018 that the SST is chargeable on the manufacture of taxable goods in Malaysia. In order for the recipient to receive a package an additional amount of.

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Malaysia Import Tax Custom Fees The taxation for a particular country depends on the local GSTVAT as well as the item category and its declared value.

Malaysia import duty rates. The only authentic tariff commitments are those that are set out in the Tariff Elimination Annex. In Malaysia the import duty rates can range from as low as 0 to as much as 50. For Malaysian Exporters Discover global business opportunities.

These products are not subject or import duties reduction or elimination. In addition to duty imports are subject to sales tax VAT and in some cases to excise. Special safeguards in 55 Duty-free 0.

In many cases the average duty rate is around 6. TARIFF SCHEDULE OF MALAYSIA. Morphine heroine candu marijuana etc are strictly prohibited.

A wide variety of malaysia import duty rates options are available to you such as local service location applicable industries and shipment type. Trying to get tariff data. Some goods are not subject to duty eg.

Laptops electric guitars and other electronic products. For further enquiries please contact Customs Call Center. The SST is also applied to the importation of taxable goods into Malaysia at the rate of 5 percent or 10 percent or a specific rate depending on the category of products.

Raw materials machinery essential foodstuffs and pharmaceutical products are generally non-dutiable or subject to duties at lower rates. PREPARED BY ROYAL MALAYSIAN CUSTOMS DEPARTMENT. Rules Of Origin ROO Kemudahan Partial K8.

Borang Kastam No7 K7 Malaysian Tourism Tax System MyTTX ATA Carnet. Some goods are exempt from duties such as electronic products like laptops and electric guitars. Export Readiness Assessment Tool ERAT Beginners Guide to Exporting.

Import and export of illicit drugs eg. However the amount of duty rates charged in advance by different movers vary. Some duties are also based on quantity measurements like weight or volume.

If the full value of your items is over. Malaysia applies tariff rate quota TRQ on selected agricultural products such as chicken milk and cream hen eggs. 5 Free Calculations Per Day At Simply Duty you get to use our duty calculator free of charge every day.

Malaysia has placed 82 Tariff Lines TLs which comprise of alcoholic beverages and arms weapons in the General Exclusion List. Exporting from which country. Import duties are generally levied on an ad valorem basis but may also be imposed on a specific basis.

1 300 88 8500 General Enquiries Operation Hours Monday - Friday 830 am 700 pm email. The ad valorem rates of import duties defined in terms of a fixed percentage of value ranging from 0 to 60. Electronic Pre-Alert Manifest ePAM Pre-Arrival Processing PAP INDIVIDUALS.

Afghanistan Albania Algeria American Samoa Andorra Angola Anguilla Antarctica Antigua and Barbuda Argentina Armenia Aruba Australia Austria Azerbaijan Bahamas Bahrain Bangladesh Barbados Belarus Belgium Belize Benin Bermuda Bhutan Bolivia. Ccccustomsgovmy For classification purposes please refer to Technical Services Department. Malaysia Import Duty Calculator.

Use this quick tool to calculate import duty taxes for hundreds of destinations worldwide. The import tax on a shipment will be. Hak Cipta Terpelihara 2018 Jabatan Kastam Diraja Malaysia.

Import duties are levied on goods that are subject to import duties and imported into the country. The rate of service tax is 6. Please complete information below.

Based on the commitments under AFTA Cambodia Lao PDR Myanmar and Viet Nam eliminated duties on all products in 2015 with flexibility of 7 of tariff lines up to 2018. The Ministry of Finance announced on July 16 2018 the SST is chargeable on the manufacture of taxable goods in Malaysia and the importation of taxable goods into Malaysia at the rate of 5 percent or 10 percent or a specific rate depending on the category of goods. Merchandise trade and tariff statistics data for Malaysia MYS imports from partner countries including trade value number of products Partner share Share in total products MFN and Effectively Applied Tariffs duty free imports dutiable imports and free lines and number of trade agreements for year 2019.

Malaysia Part A1 Tariffs and imports. The tax duty threshold is the amount at which a person begins paying taxes based on the declared value of an item. Exemption of DutiesTaxes.

Duty Rates Duty rates in Malaysia vary from 0 to 50 with an average duty rate of 574. This Guide merely serves as information. Tariff schedules and appendices are subject to legal review transposition and verification by the Parties.

Tariff quotas in 57 Imports in billion US 2019 2037 156 1881 Ag. Duties for tariff lines where there is significant local production are often higher. Services For Exporters.

Raw materials machinery essential foodstuffs and pharmaceutical products are. The ad valorem rates of import duties range from 2 to 60. For example if the declared value of your items is.

The rates generally range from zero to 40 per cent with much higher rates imposed on alcohol and tobacco products. The complete list of the applicable duties can. Understanding Free Trade Agreements.

Find import duty rates in Malaysia also with the list of all hs products and their tariff details. PROCEDURE GUIDELINES Currently selected. Prescribed drugs can only be imported into or exported from the country by virtue of a licence issued by the Ministry of Health Malaysia.

You need to check with the mover to confirm the amount of. Summary and duty ranges Total Ag Non-Ag WTO member since 1995 Simple average final bound 209 536 149 Total 843 Simple average MFN applied 2020 57 87 52 Non-Ag 819 Trade weighted average 2019 39 86 35 Ag. TARIFF SCHEDULE OF MALAYSIA.

Import And Export Procedures In Malaysia Best Practices Asean Business News

0 comments: