Kastam Accounting Software Guide

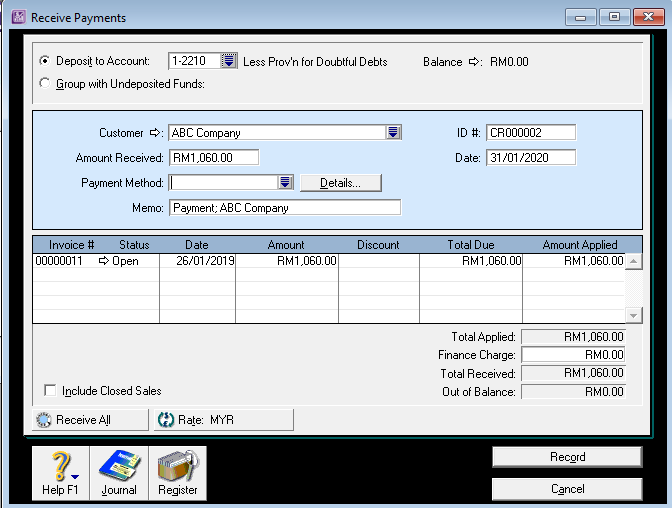

This is how inclusive GST cents are handled in SQL Accounting. All output tax and input tax are to be accounted and claimed based on the time when the invoice was issued or received.

The course caters to people from accounting finance tax audit logistics sales purchases and IT.

Kastam accounting software guide. What You Need To Do. It is the FIRST and ONLY GST Accounting course in Malaysia. However certain categories of taxable persons may be allowed to use the payment cash basis.

Try FreshBooks Today And Find Out. Some tax guides refers to Accounting for GST to mean Filing GST return or. To find the best accounting software for your business follow these four steps.

Ensure Accuracy Prove Compliance And Prepare Fast Easy To Understand Financial Reports. Using an accountingtax software like MYOB will help greatly with this onerous requirement and will greatly save you time and hassles. Tax Code in Chart of Account.

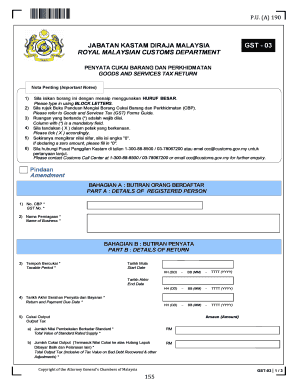

Ad What Makes A Good Small Business Accounting Software. GST is scheduled to be implemented on 1st April 2014 in Singapore. Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy.

Input Output Tax Ledger Report. SPICT Bil 1 2013- Garis Panduan Mengenai Tatacara Memohon Kelulusan Projek ICT Jabatan Kastam Diraja Malaysia JKDM SPICT Bil 2 2010 SPICT Bil 1 2010 dibatalkan. Ad Accounting software with all the time-saving tools you need.

This enhancement can greatly be time saving and hassle free due to minimum paper document submissions. Basis of accounting ie. Expand the Accounting Services You Offer with Dynamics 365 Accounting Software.

PROCEDURE GUIDELINES Currently selected. FAS4GST as enhanced from FASERP has been updated to be GST compliant by adhering to the Guide to Enhance Your Accounting Software to be GST Compliant issued by the Royal Malaysian Customs had on 13 March 2014. Save Time Money - Start Now.

Ad Accounting software with all the time-saving tools you need. The accounting software should allow the user to trace the information in a tax return and reconcile with the accounting and business records. GST Accounting Software Company list approved by RMCD are as follows.

This is how you generate and print input output tax ledger report. The Royal Malaysian Customs Department RMC or known also as Jabatan Kastam Diraja Malaysia acts as the agent of the Malaysian government and. STEP 2See the comparison tables below to identify the accounting software that could potentially.

List of vendor with subsidies GST accounting software for Small and Medium Enterprise SMEs List of Accounting Software and Point Of Sales POS until 19 Oct 2015 View in Web Browser. Ad Use QuickBooks To Track Sales Expenses Profit In One Easy To Use Solution. GST requires businesses who have exceeded the prescribed threshold to register and to keep records of input and output tax.

Ad Review the Best Accounting Software for 2021. Businesses registered for GST may be required by JKDM Jabatan Kastam Diraja Malaysia to produce the GAF GST Audit File report at anytime to verify compliance with their requirements. Hence it is important that the accounting software provides the auditor with adequate audit trail to understand the flow of events and if necessary to reconstruct the events.

For example the accounting software must be able to generate a standard file known as the GST Audit File GAF. Businesses are advised to ensure their Software developers follow the recommendations in this guide. The current browser does not support Web pages that contain the IFRAME element.

Or enhancing their accounting software to be GST compliant. Ad Cloud Bookkeeping Software With The Ability To Access Your Accounts Anywhere. Borang Kastam No7 K7 Malaysian Tourism Tax System MyTTX ATA Carnet.

Explore the following sections to understand your responsibilities and obligations as a registrant under GST. Malaysian Goods and Services Tax GST is similar to Valued Added Tax VAT in other countries and is a new form of tax in Malaysia. Advisory On Accounting Software.

STEP 1Make a list of features you need invoicing payments payroll reports CRM inventory management time tracking number of users mobile app reports etc. Our Integrated Scalable Finance Software Is Designed To Meet The Needs Of Your Business. Title Version Client Name Date Sage GST Diagnostic Tool - User Guide - v11docx 11 Public 06 March 2018 Page 8 of 74 1 Introduction Kastam Malaysia introduced GST Malaysia since 1st April 2015 and there were a lot of new processes.

Certified as GST-compliant by the Jabatan Kastam DiRaja Malaysia with effect from 25 th July 2014. If your current accounting software is able to generate operational and financial information it can be further enhanced to generate a GST Audit File GAF report which is a key requirement for GST auditing. Akademi Kastam Diraja Malaysia AKMAL Information Technology Division.

The recommendations to enhance. Borang Kastam No7 K7 Malaysian Tourism Tax System MyTTX. Any third party without prior written consent from Sage Software Sdn.

All output tax and input tax are to be accounted and claimed based on the time when the invoice was issued or received. Find the Best Accounting Software That Will Help You Do What You Do Better. Ad Use Microsoft Accounting Software to Connect Teams Adapt Faster Deliver Results.

Basically all taxable persons will be required to account for GST based on accrual invoice basis of accounting ie. Businesses report their liability in a specific period called taxable period.