Kastam Import Rate

29th January 2020 - One new document has been uploaded to the Information Sheets Section. Ad Valorem is the percentage for example 20 of the price of good while specific rate is calculated by the amount of weight or quantity such as 60 per kg or 220 per tonne.

Lembaga Pemasaran Pertanian Persekutuan FAMA Lembaga Perlesenan Tenaga Atom.

Kastam import rate. -- Choose -- PDK 2017 PDK 2017 ATIGA ACFTA AHKFTA MPCEPA MJEPA AKFTA AJCEP AANZFTA AINDFTA MNZFTA MICECA D8PTA MCFTA MAFTA MTFTA. Jabatan Kastam Diraja Malaysia Bahagian Cukai Dalam Negeri Putrajaya 23 Ogos 2018. GUIDE ON IMPORT As at 12 JANUARY 2016 1 INTRODUCTION 1.

Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya 1300 888 500 Pusat Panggilan Kastam. In the second case JKDM raided a. Page 3 of 130.

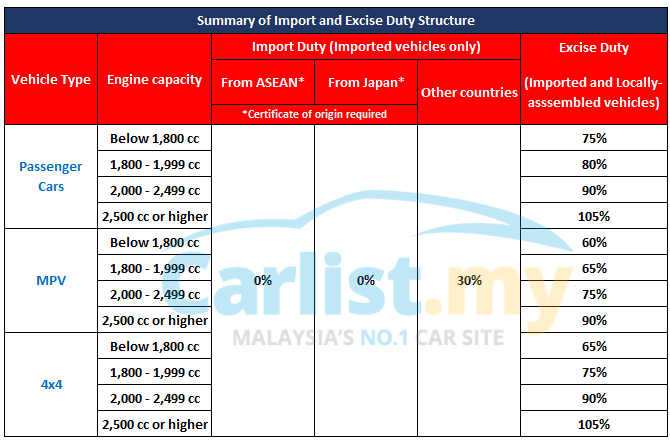

The concept of NTMs is very broad and includes a number of different measures ranging from quantitative restrictions of all kinds technical regulations standards SPS measures customs rules etc. Rates of Exchange for Customs Purposes for November 2019 has been published. Malaysias tariffs are typically imposed on a value-add basis with a simple average applied tariff of 61 percent for industrial goods.

It is the preferential tariffs concessions and other commitments negotiated and agreed upon by each ASEAN Member State within the framework of the ATIGA. Duties for tariff lines where there is significant local. H ATIGA Import Process Flow.

New Rates of Exchange. You can display the historical rates for individual countries by choosing the country you wish to view below. Jabatan Pertanian Bahagian Perlindungan Tanaman dan Kuarantin Tumbuhan Tariff Nomenclature.

Kadar duti yang dikenakan bagi tiap-tiap satu jenis barang yang diimport sedia dinyatakan di ruangan 4 dan 5 Jadual Pertama kepada Perintah Duti Kastam 1996. G Atiga National Guideline 8 JAN 201513 MITI 1512015. Under the exchange Control Act 1953 the importexport currency control is deemed to be a matter relating to customs.

Kadar-kadar duti import adalah berbeza mengikut jenis barang yang diimport. IMPORT EKSPORT Diterbitkan oleh. All of them share the same characteristic of affecting trade.

These commitments are transposed into domestic legislation. Harmonized Commodity Description Coding System commonly known as HS Codes and ASEAN Harmonized Tariff Nomenclature AHTN were created for international use by the Custom Department to classify commodities when they are being declared at the custom frontiers by exporters and importers. 44 rows Exchange Rate IMPORT -- Select A Date -- Import - 09082021 Import - 16082021 Import.

Tiada terjemahan di dalam Bahasa Malaysia. Imports are subject to GST at a standard rate of 6 of the sum of the CIF value duty and any excise if applicable. Notis Hakcipta Hak Cipta 2018 Jabatan Kastam Diraja Malaysia Hak Cipta terpelihara.

E Prosedur ImportEksport Barangan Melalui ATA Carnet. F Syarat dan Prosedur Pengimportan. Most import duties are imposed based on Ad Valorem rate and only some taxes are based on specific rate.

United States Dollar. TARIFF SCHEDULE OF MALAYSIA Tariff schedules and appendices are subject to legal review transposition and verification by the Parties. Malaysia has eliminated duties on 9874 of its tariff lines in our ATIGA Tariff Schedules for 2015.

Non-Tariff Measures. Historical Customs rates of exchange. A resident and non-resident are permitted to carry into and out of Malaysia ringgit notes not exceeding USD 10000 equivalent per person.

The guide on Import is prepared to assist all importers in understanding matters with regards to GST treatment on importation of goods. Goods and Services Tax GST is a multi-stage tax on domestic consumption. Sekirannya pengakuan import gagal dibuat dalam tempoh yang ditetapkan Pegawai Kastam yang hak boleh menyita barangan menurut peruntukan yang diberi di bawah seksyen 114 Akta Kastam 1967 dan melucut hak menurut peruntukan yang diberi di bawah seksyen 126 Akta Kastam 1967 dan boleh dilelong menurut peruntukan yang diberi di bawah seksyen 128 Akta Kastam 1967.

The only authentic tariff commitments are those that are set out in the Tariff Elimination Annex that accompanies the final signed Agreement. Contact Us Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya Hotline. Prescribed drugs can only be imported into or exported from the country by virtue of a licence issued by the Ministry of Health Malaysia.

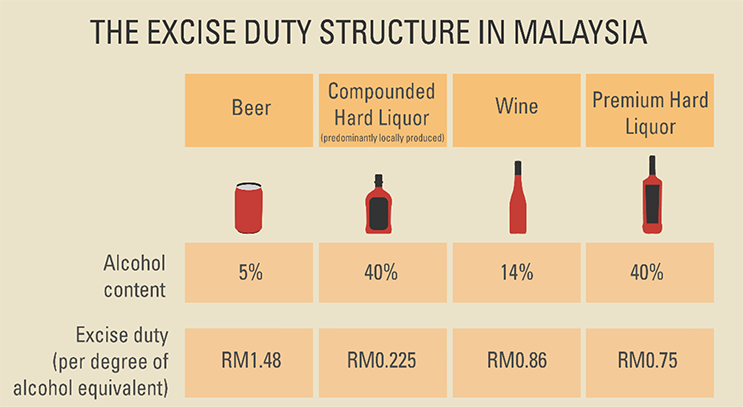

Import and export of illicit drugs eg. He said on Sept 21 at 115 pm Selangor Unit II had raided a warehouse in the PKFZ and seized 494373 litres of liquor with unpaid duty worth RM1854 million. Rates of Exchange for Customs Purposes for December 2019 has been published.

Rates of Exchange for Customs Purposes for January 2020 has been published. Last published date. Subject to an importexport license from the relevant authorities Meat Edible Meat Offal Subject to an importexport license from the relevant authorities This Guide merely serves as information.

Please refer to Sales Tax Goods Exempted From Tax Order 2018 and Sales Tax Rates of Tax Order 2018. Some goods may be zero. Morphine heroine candu marijuana etc are strictly prohibited.

Tariff Code References Know your products HS Code. I Kawalan Ke Atas Manifes Masuk Inward Manifes. HS Code Item Description.

Thus failure to declare would result in an offence under the Customs Act 1967. The tariff nomenclature of each AMSs up to the ten-digit level The explanatory notes where applicable. Overview of Goods and Services Tax GST 2.

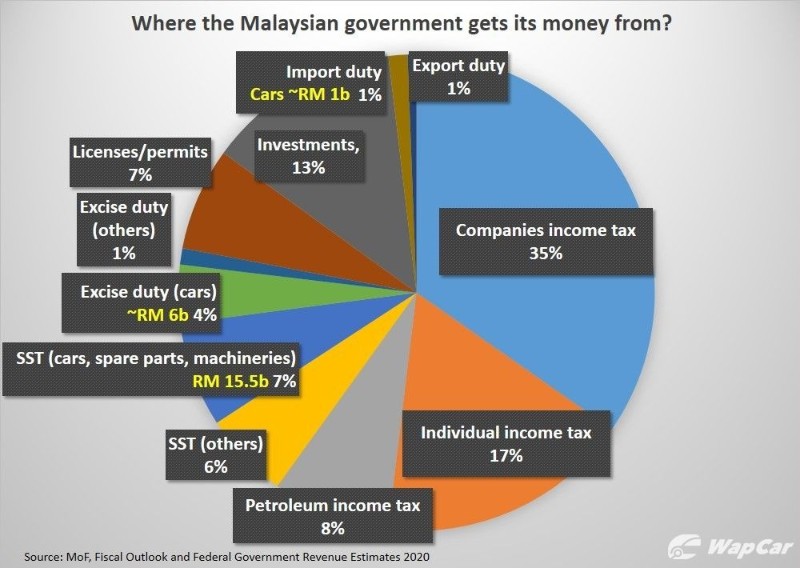

For certain goods such as alcohol wine poultry and pork Malaysia charges specific duties that represent considerably higher effective tariff rates.