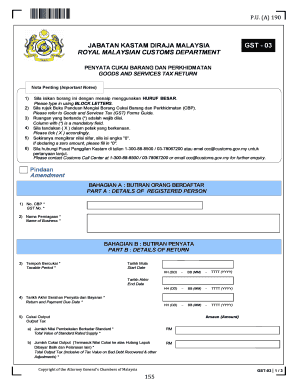

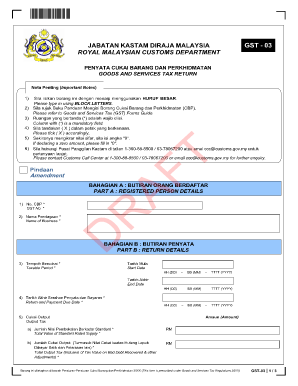

Register Kastam Number

Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy. When you are carrying bicycles on your rack if the brake lights on the vehicle are not visible from 200 metres away under normal weather conditions you must attach an additional brake light to the rack that is visible from 200 metres.

Salesforce Blog News Tips And Insights From The Global Cloud Leader Accounting And Finance Accounting Services Financial Management

3 Jabatan Kastam Diraja Malaysia Jalan Maharani Peti Surat No 1 84007 Muar.

Register kastam number. RMCD is ready to accept application for registration from 1 June 2014. To check the list of products registered with the DCA visit the official website of the National Pharmaceutical Regulatory Agency wwwnpragovmy. REGISTER LOGIN GST shall be levied and charged on the taxable supply of.

Jabatan Kastam Diraja Malaysia Pusat Pemprosesan Kastam Kompleks Kastam Kelana Jaya No22Jalan SS63 Kelana Jaya. For Courier the Courier Declaration is to be sent by Courier Agent. Bagi barang yang bernilai kurang RM 20000.

Click on the Registered Product Search Quest 3 and enter the details of the product to start the search. Registration can be done by themselves or they can appoint FA to register on behalf of them. UCustoms also will be used for complete electronic licensing processes by the Cross Border Regulatory Agencies CBRA known as Other Government AgenciesOGA Permit Issuance Agencies PIA and other players in the government agencies and private sectors related to.

After registration application has been approved an approval letter will be generated by the system stating the service tax registration number the effective date. Taksiran duticukai dibuat atas JK78. MYT 830am - 430pm Except Public Holidays Email Us mystodscustomsgovmy.

The electronic acquisition system better known as ePerolehan will facilitate government procurement. As announced by the Government GST will be implemented on 1 April 2015. Sales and Service Tax Registration Number Under Deskera Books.

The new SST in Malaysia is a single-stage tax system which means that an amount will. To ensure a smooth implementation of GST businesses are encouraged to submit their application for early registration. Public Holiday.

HS Code Item Description. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya Hotline. Monday-Friday for states weekend falling on SaturdaySunday 830 am - 530 pm Sunday-Thursday for states weekend falling on FridaySaturday 830 am - 530 pm GST HELP DESK TELEPHONE NUMBERS HQ RMCD STATION STATE.

The recently introduced Sales and Services Tax SST in Malaysia came into effect beginning 1 September 2018. Please make your selection. 2 Jabatan Kastam Diraja Malaysia Jalan Jeragan 83000 Batu Pahat.

The SST is a replacement of the previous Goods and Services Tax GST in Malaysia which prior to this imposed a 6 tax rate on all taxable goods and services. Fiscal policy continues to support growth. Registration kiosks are provided at the SST Division in all RMCD offices throughout Malaysia.

The address to is as follows. SISTEM MAKLUMAT KASTAM SMK JABATAN KASTAM DIRAJA MALAYSIA JKDM-CUSDEC REGISTRATION NUMBER- 1. JABATAN KASTAM DIRAJA MALAYSIA SELANGOR NO.

Debt as a percentage of GDP on a downward trajectory. UCustoms is a fully integrated end-to-end and customs modernization solution that delivers single window for goods clearance. The services provided by the service provider from Group G number 1-8 excludes the said services if provided in connection with.

Malaysia Sales Sales Tax SST. Check With Expert GST shall be levied and charged on the taxable supply of goods and services. SST Deregistration Process in Malaysia.

1-300-888-500 General Enquiries GST HELP DESK. Penerimaan bungkusan pos melalui laut dan darat yang bernilai melebihi RM 20000 CIF hendaklah diikrar dalam borang Kastam no 1. GST registered person who fulfilled the required criteria to be registered but were not registered by 1st September 2018 need to apply for registration within 30 days from the effective date.

Retrieve Saved Request. GST Calculator GST shall be levied and charged on. For first-time users kindly proceed to our Maybank branch to register for an M2E account.

For Postal the declaration is to send by Post Malaysia to uCustoms via integration based on CN23. Semakan Syarikat Berdaftar GST Berdasarkan Pendaftaran Syarikat Nama Syarikat atau Nombor GST Check For GST Registered Company By Company Registration Company name or GST Number Senarai Barangan Bercukai Tidak Bercukai List of Taxable Non-taxable Items. EVENT CALENDAR Check out whats happening.

The registration number starts with MAL followed by eight numbers and ending with the letter TAX or N. 16-07-2021 Anda perlu menambah customsgovmy kepada emel pegawai bagi tujuan penghantaran emel. Customs Processing Centre by post.

LOG IN LOOK UP REGISTRATION Customs Call Centre 603 7806 7200 Monday to Friday. 1 JALAN PERIGI NENAS 71 KS II TAMAN PERINDUSTRIAN PULAU INDAH. GST for Banking Services.

Berkunjung ke cawangan JPJ berdekatan anda. Users that have not obtained the CUSDEC registration number is required to contact Careline DNT to obtain the number. The myGST account number refers to your GST registration number.

Related information can be found and downloaded from these. COMPLAINT. Trying to get tariff data.

Prosedur menerima dan menghantar bungkusan pos adalah seperti berikut. Bicycle rack number plates have the same registration number as your motor vehicle and cant be used on any other vehicle. The current browser does not support Web pages that contain the IFRAME element.

Cara Permohonan Pemindahan No Plat Kenderaan Beli nombor plate pilihan anda. Local trader must register as a user in uCustoms if they want to do Import or Export. Jabatan Kastam Diraja Malaysia Jalan Dua Pejabat Kerajaan 86000 Kluang.

Goods and Services Tax. -- Choose -- PDK 2017 PDK 2017 ATIGA ACFTA AHKFTA MPCEPA MJEPA AKFTA AJCEP AANZFTA AINDFTA MNZFTA MICECA D8PTA MCFTA MAFTA MTFTA. Please select payee - Jabatan Kastam Diraja Malaysia JKDM and make the relevant GST payment via the Bill Payments section after log-in.

Commitment towards fiscal consolidation. Lakukan pemeriksaan puspakom pada kenderaan anda. Surat pengesahanpersetujuan daripada Kastam bagi Labuan dan Langkawi.

Careline DNT to notify Users on system breakdown with 30 minutes. AGENCY Browse other government agencies and NGOs websites from the list. Dokumen pengenalan diri asal dan salinan wakil sekiranya wakil hadir.

The payment can be made by bank draftcheque in the name of Ketua Pengarah Kastam Malaysia.