Hani Tribunal Kastam

Tribunal Perumahan dan Pengurusan Strata TPPS merupakan Tribunal di bawah Kementerian Perumahan dan Kerajaan Tempatan KPKT yang terdiri daripada. Walaubagaimanapun Tribunal berhak untuk menolak permohonan penangguhan ini.

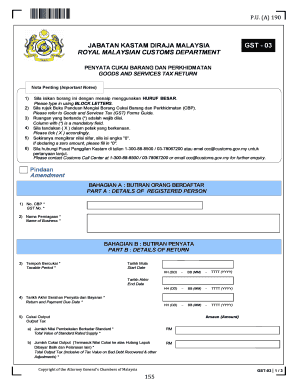

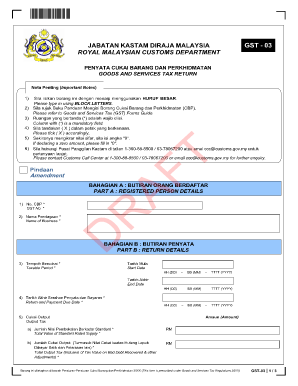

Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya 1300 888 500 Pusat Panggilan Kastam.

Hani tribunal kastam. Di bawah Peraturan-Peraturan Kastam Tribunal Rayuan 2007 jika Perayu tidak hadir pada tarikh masa dan tempat yang ditetapkan tetapi Responden hadir Tribunal boleh jika ia berpuas hati dengan notis pendengaran telah disampaikan dengan sewajarnya menolak Rayuan itu. Perayu boleh memfailkan rayuan di TRK dengan mengisi Borang A Notis Rayuan dan membayar fi pemfailan sebanyak RM10000. What are the decisions that are appealable.

Puan che maizatul akmal binti che mohd noor. This entry was posted in. Soalan Lazim - Tribunal Tuntutan Pembeli Rumah.

Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya 1300 888 500 Pusat Panggilan Kastam. Cik nawal hanim binti mat soonan. All decisions of the Director General of Customs except in any matter relating to compound and seizure of.

03 - 8890 6405. Bilangan kes rayuan yang didaftarkan dan tempoh penyelesaian kes di Tribunal Rayuan Kastam mulai tahun 2007 hingga 31 Disember 2017. Penolong Kanan Pengarah Kastam I WK52.

MENARA KASTAM JOHOR KARUNG BERKUNCI NO780 80990 JOHOR BAHRU. Good command of English BM. Pemfailan rayuan kastam secara atas talian online boleh dilakukan dengan mengisi butir-butir yang diperlukan di dalam Borang A Notis Rayuan yang disediakan di dalam Portal Tribunal Rayuan KastamProses penerimaan rayuan iaitu pendaftaran rayuan dilakukan oleh Pejabat Tribunal melalui Aplikasi My e -TRK yang juga disediakan di Portal Tribunal.

MENARA KASTAM JOHOR KARUNG BERKUNCI NO780 80990 JOHOR BAHRU. MT The number of cases of appeals registered and the Settlement Period of the Customs Appeal Tribunal from 2007 to 31 December 2017. MOHD FADIL BIN MUHAMAD YUNUS.

Previous experience in courier and logistics industry would be an added advantage. Assistant administrative officer nhanimsoonanmofgovmy phone. Any person dissatisfied with the decision of the Director General of Customs made after 1 June 2007 under the Customs Act 1967 Excise Act 1976 Service Tax Act 1975 and Sales Tax Act 1972 can appeal to the Tribunal.

Memastikan penjenisan barangan dibuat dengan tepat dan cepat. Naiktaraf jalan ladang pertanian rh jawi ak abu bintangor sarawak menaiktaraf jalan ladang pertanian di jalan sungai bawang nyelong sarikei menaiktaraf jalan ladang pertanian di jalan yong soon bulat sarikei menaiktaraf jalan ladang pertanian di. JABATAN KASTAM DIRAJA MALAYSIA.

Accountant Generals Department Of Malaysia ANM Human Resources Management Information System HRMIS Public Services Department JPA Ministry Of Finance MOF The Official Portal For Trade Facilitation MyTRADELINK Ministry Of International Trade And Industry MITI MSC Malaysia. Talian Umum 07-207 6000. Menurut Bahagian XIVA Akta Kastam 1967 Tribunal diberi kuasa.

Secretery of tribunal. Kastam Pulau Pinang Pejabat Pengarah Kastam Negeri Wisma Kastam Negeri GAT Lebuh China 10300. Executive Officer Age between 20 40 preferably with tertiary education Several years of good track records and experience in customer management.

Kastam Bayan Lepas LTA Bayan Lepas Kastam Diraja Malaysia Komples Kargo Udara Kedua MAB LTA Batu Maung 11960 Bayan Lepas. Who can appeal to the Customs Appeal Tribunal. Any decision of the Director General of Customs except.

AMBER COURIER CONTROL MOVEMENT ORDER COVID 19. Knowledge of a third language or dialect would be an added advantage Able to. The Customs Appeal Tribunal CAT is an independent judicial body to hear and decide appeals filed against the decision of the Director General of Customs under the Customs Act 1967 the Excise Act 1976 Sales Tax Act 1972 and the Service Tax Act 1975.

JABATAN KASTAM DIRAJA MALAYSIA. Jabatan Kastam Diraja Malaysia Kampong Tekek Pulau Tioman Pahang DA Pejabat Pos 86800 Mersing. Memperoleh dan menerima semua keterangan bersumpah sama ada secara bertulis atau lisan dan memeriksa mana-mana orang sebagai saksi sebagai mana Tribunal berpendapat perlu untuk memperoleh.

Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya 1300 888 500 Pusat Panggilan Kastam. Talian Umum 07-207 6000. Tribunal Rayuan Kastam telah mula beroperasi pada 1 Jun 2007 dan mendengar setiap rayuan di atas prinsip Adil Telus dan Cepat yang menjadi teras fungsi TRK.

Borang A boleh diperolehi secara percuma dari pejabat TRK atau dimuat. Tribunal Tuntutan Pembeli Rumah TTPR yang ditubuhkan di bawah Akta Pemajuan Perumahan Kawalan dan Pelesenan 1966 Akta 118. JALAN KAMPUNG TENGAH KUALA KEMAMAN 24000 KEMAMAN TERENGGANU.

Sukacita dimaklumkan bahawa pejabat kplb negeri sarawak akan mengadakan sebut harga kerja bagi projek jpd seperti senarai di bawah. Mengumpul dokumen bagi menyediakan affidavit untuk kes-kes penilaian kastam yang dibawa ke tribunal rayuan kastam dan mahkamah. 30 CAWANGAN PENJENISAN TARIF DAN GUBALAN.

Mengkaji kes-kes transfer pricing dalam konteks penilaian kastam. Tribunal Rayuan Kastam mempunyai bidang kuasa yang luas dalam mendengar rayuan. JABATAN KASTAM DIRAJA MALAYSIA.