Malaysia Import Duty And Sales Tax Rate

In order for the recipient to receive a package an additional amount of. The ad valorem rates of import duties defined in terms of a fixed percentage of value ranging from 0 to 60.

October 2020 Sales Tax Rate Changes

Malaysia - Import Tariffs.

Malaysia import duty and sales tax rate. Sales tax is an ad valorem tax and different rates apply based on group of taxable goods. The Ministry of Finance announced on July 16 2018 the SST is chargeable on the manufacture of taxable goods in Malaysia and the importation of taxable goods into Malaysia at the rate of 5 percent or 10 percent or a specific rate. Duty Rates Duty rates in Malaysia vary from 0 to 50 with an average duty rate of 574.

Raw materials machinery essential foodstuffs and pharmaceutical products are generally non-dutiable or subject to duties at lower rates. Malaysia as if it were a customs duty or an excise duty and as if such importation of taxable goods are dutiable and liable to customs duty or excise duty. In taxes will be required to be paid to the destination countries government.

Laptops electric guitars and other electronic products. Firms should be aware of when exporting to the market. Duties Sales Tax All 30 0 NIL 0 NIL 10 Notes.

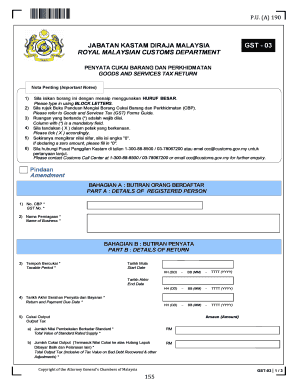

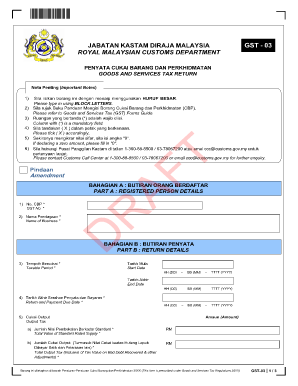

Sales Tax Imports are subject to GST at a standard rate of 6 of the sum of the CIF. MFN Most Favoured Nation rate ATIGA ASEAN Trade in Goods Agreement Updated. -- Choose -- PDK 2017 PDK 2017 ATIGA ACFTA AHKFTA MPCEPA MJEPA AKFTA AJCEP AANZFTA AINDFTA MNZFTA MICECA D8PTA MCFTA MAFTA MTFTA.

Goods subject to specific rate. The incidence of tax is provided under section 22 of the Sales Tax Act 1972. Excise tax is an additional tax that needs to be paid when purchases are made on a specific item or good.

Sales tax is only applicable to taxable goods that are manufactured or imported into Malaysia. MFN Most Favoured Nation rate ATIGA ASEAN Trade in Goods Agreement DISCLAIMER. The table is meant for informational purposes and as ageneral guide only.

Raw materials machinery essential foodstuffs and pharmaceutical products are generally non-dutiable or subject to duties at lower rates. Excise duties are imposed on a selected range. 1 Sept 2018 MALAYSIA.

However at the same time not all products are necessary to be taxed. Please make your selection. Malaysia - Import TariffsMalaysia - Import Tariffs.

The SST is also applied to the importation of taxable goods into Malaysia at the rate of 5 or 10 percent or a specific rate depending on the category of products. Prescribed drugs can only be imported into or exported from the country by virtue of a licence issued by the Ministry of Health Malaysia. Amongst others for purchases from the duty free shops the total value of goods is increased from RM500 to.

If the full value of your items is over. The Goods and Service Tax GST has been repealed and the old Sales and Service Taxation SST with possible modification will commence in 2018. Subject to an importexport license from the relevant authorities Meat Edible Meat Offal Subject to an importexport license from the relevant authorities This Guide merely serves as information.

For example if the declared value of your items is. For example if the declared value of your items is. Please refer to Sales Tax Goods Exempted From Tax Order 2018 and Sales Tax Rates of Tax Order 2018.

Browse discover thousands of brands. Payment Of Sales Tax. The shipment is cleared through customs based on the origin country the value and quantity but not its purpose.

In this case it would be on the imported car. Import duties are generally levied on an ad valorem basis but may also be imposed on a specific basis. Read customer reviews find best sellers.

The import tax on a shipment will be. Excise Duties Customs Duties and Sales Tax on goods imported and purchased from any duty free shops at the international airports in Malaysia. DUTIES TAXES ON MOTOR VEHICLES A PASSENGER CARS INCLUDING STATION WAGONS SPORTS CARS AND RACING CARS CBU CKD CBU CKD IMPORT DUTY IMPORT DUTY LOCAL TAXES CBU CKD.

TARIFF SCHEDULE OF MALAYSIA Tariff schedules and appendices are subject to legal review transposition and verification by the Parties. Some goods are not subject to duty eg. Goods subject to 5.

Import and export of illicit drugs eg. Please refer to Royal Malaysian Customs Department for. Morphine heroine candu marijuana etc are strictly prohibited.

The import tax on a shipment will be. The ad valorem rates of import duties range from 2 to 60. SALES TAX ON GOODS IMPORTED INTO MALAYSIA Goods imported into Malaysia - Sales tax is to be charged at the time of importation when the goods are declared and duty tax paid at the time of customs clearance.

In order for the recipient to receive a package an additional amount of. Heres a look at just how much excise tax you can be charged for passenger vehicles in Malaysia. The only authentic tariff commitments are those that are set out in the Tariff Elimination Annex that accompanies the final signed Agreement.

In addition to duty imports are subject to sales tax VAT and in some cases to excise. Malaysias tariffs are typically imposed on an ad valorem basis with a simple average applied tariff of 61 percent for industrial goods. The sales tax rate is at 510 or on a specific rate or exempt.

Dutiable shipments are subject to a customs duty which is a tariff or tax imposed on goods when transported across international borders. HS Code Item Description. It is the excise tax.

Sales Tax is imposed on imported and locally manufactured taxable goods. Goods subject to 20. Page 3 of 130.

Exported manufactured goods will be excluded from the sales tax act. The MOF announced on July 16 2018 that the Sales and Services Taxation SST is chargeable on the manufacture of taxable goods in Malaysia. Includes information on average tariff rates and types that US.

Malaysia applies tariff rate quota TRQ on selected agricultural products such as chicken milk and cream hen. Rate of Sales Tax 6. Duties Sales Tax All 30 0 NIL 0 NIL 10 Notes.