Borang Kastam Jk69

AGENCY Browse other government agencies and NGOs websites from the list. Borang Memohon Lesen Import Jk69 Pnmb2u.

Darul Intensif M Sdn Berhad Photos Facebook

Pada ketika itu kalau kita hendak membawa masuk transceiver dari Singapura kita hanya perlu mengisi borang Kastam JK69.

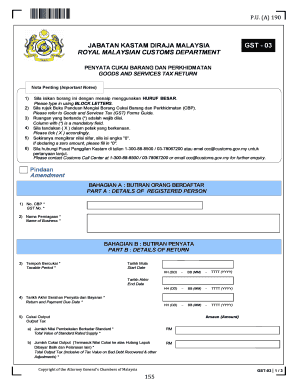

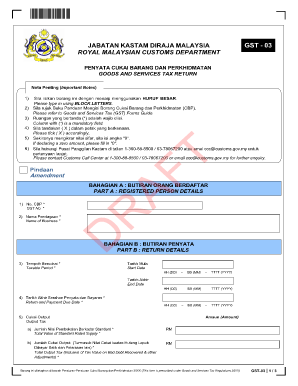

Borang kastam jk69. Borang Kastam No1 3. EVENT CALENDAR Check out whats happening. Check With Expert GST shall be levied and charged on the taxable supply of goods and services.

Surat Permohonan Pindah Sekolah merupakan sebuah surat yang dibuat oleh orangtua wali atau siswa untuk memohon kepada pihak sekolah asal agar bersedia memberikan izin atas kepindahan siswa tersebut ke sekolah lain. Percetakan Nasional Malaysia Berhad Jalan Chan Sow Lin. Panduan 1 Import Kastam.

REGISTER LOGIN GST shall be levied and charged on the taxable supply of. KUK melalui ZB ke Luar Negara Borang Kastam. Hanging form untuk Borang Kastam 8 yang telah meningkat setelah pemansuhan penggunaan RFID.

Panduan permohonan lesen import bagi barang dagangan yang dikawal di bawah perintah kas. Borang tersebut terdiri daripada tiga salinan berkarbon dan oleh itu tidak boleh dimuat turun dari laman web. AGENCY Browse other government agencies and NGOs websites from the list.

03-92212022 Fax 03. Apabila konsignasi kayu bakau tiba di pintu masuk atau pelabuhan atau tempat pendaratan yang sah pengimport dikehendaki mengemukakan lesen import JK69 serta dokumen berkaitan jika ada kepada pihak Kastam bagi mendapatkan Borang Kastam No. Satelah mengisi borang tersebut kita hanya perlu mendapatkan AP Approval Permit dari pihak Jabatan Telekom.

Sebelum pergi ke JPJ untuk membuat Grant kereta pastikan anda buat 2 perkara ini. New or stargirl used commercial. Yang boleh di beli dgn harga RM100 di pencetakan nasional atau di Jabatan Telekom dll.

Maklumat ketibaan konsainan komersial diterima daripada Jabatan Kastam secara manual atau elektronik. Puspokum pastikan bawa dokumen K1 JK69grant kereta uk E-daftar call 03-61424577 Drosstech Sdn Bhd utk langkah selanjutnya tunggu email untuk dokumen yg diperlukan untuk mendapatkan borang JPJK1 diperkenalkan dlm beberapa bln lalu. Salinan Sijil Kelulusan Diesel Hijau Daripada SIRIM Jika Berkenaan 4.

Anugerah Kecemerlangan Industri AKI 2020 Kembali Untuk Mengiktiraf Pemain Industri Yang Cemerlang Dan Berdaya Tahan November 01 2021 Media Release. Borang JPJK1 2 Salinan - Cetakan Elektronik 2. REGISTER LOGIN GST shall be levied and charged on the taxable supply of.

The form comes with three carbonised copies. Borang kastam jk69 boleh didapati dari Iv 1 salinan contoh gambar baju kalis peluru beserta risalah. Malaysia Shows Leadership in Driving the Fourth Industrial Revolution 4IR Forward October 05 2021 Notice.

Viii mar 04 shipping your car motorbike back to. Borang tersebut terdiri daripada tiga salinan berkarbon dan oleh itu tidak boleh dimuat turun dari laman web. The JB branch is located at Jalan Datin.

Borang berkenaan boleh dibeli daripada Kedai Percetakan Nasional M Sdn Bhd Jalan Chan Sow Lin Kuala Lumpur Tel. Borang berkenaan boleh dibeli daripada Kedai. Keterangan dokumen 1 surat kelulusan pendaftaran cukai barangan.

Stesen import bukan berstatus ZB ke ZB melalui KUK Borang Kastam No. JK69 can be purchased at. ZB Ke KBC Borang Kastam No.

Dokumen-dokumen yang diperlukan untuk pengimportan adalah mengikut kategori konsainan. Permit Import JK69 7. LAMPIRAN 4 PENGGABUNGAN BORANG KASTAM Bagi memantapkan sistem penyampaian perkhidmatan Kastam DiRaja Malaysia adalah dicadangkan borang-borang kastam yang.

Borang Kastam JK69 boleh. Borang kastam jk69 boleh didapati di percetakannasionalberhad. Laporan Pemeriksaan Puspakom B2 6.

Http Fsis2 Moh Gov My Uploadfosim Bulettin 200616040210b3807prosedur 20pemeriksaan 20konsainan 20makanan 20import 20melalui 20pintu 20masuk Pdf. Sangat penting untuk memperkenalkan perusahaan anda kepada. Bagi mendapatkan kelulusan tersebut pemohon hendaklah memperoleh dan mengisi Borang Kastam JK69.

Satelah mengisi borang tersebut kita hanya perlu mendapatkan AP Approval Permit dari pihak Jabatan Telekom. 1995 - 1998. Information of directors managers and secretary of company MA Forms 24 and 49 are required for first time applications.

Memorandum and Article of Association M A. Borang berkenaan boleh dibeli daripada Kedai Percetakan Nasional M Sdn Bhd Jalan Chan Sow Lin Kuala Lumpur Tel. Borang tersebut terdiri daripada tiga salinan berkarbon dan oleh itu tidak boleh dimuat turun dari laman web.

Pekerja Malaysia yg kerja di oversea Syarat nak apply AP ada dibawah. To get the approval applicant have to purchase and fill the JK69 Form. JK69 is a gazetted Custom Form.

Permit Import JK69 7. Salinan Sijil Kelulusan Diesel Hijau Daripada SIRIM Jika Berkenaan 4. Pada ketika itu kalau kita hendak membawa masuk transceiver dari Singapura kita hanya perlu mengisi borang Kastam JK69.

Dokumen Pengenalan Diri bagi Kategori Bukan Individu 3. Therefore it cannot be downloaded from the website. COMPLAINT.

Setelah dibahas mengenai definisi atau pengertian dari surat penawaran barang dan jasa beserta contohnya kini mari disimak mengenai fungsi dari surat penawaran barang dan jasa. AP Permit Diluluskan - JK69 Borang Kastam Eksais K1 K7 K8 T1 - Sijil Kelulusan Meter Teksi daripada JPJ untuk teksi bermeter sahaja TR2 terkini - Laporan Meter Teksi untuk teksi bermeter sahaja Surat Jualan daripada Pengedar yang Sah Sijil Pembuatan Sijil Berat. Pembekalan perkhidmatan yang disediakan ke KUK dari pembekal.

Kena Isi Borang Kastam JK69. Puspokum pastikan bawa dokumen K1 JK69grant kereta uk E-daftar call 03-61424577 begin_of_the_skype_highlighting 03-61424577 end_of_the_skype_highlighting Drosstech Sdn Bhd utk langkah selanjutnya tunggu email untuk dokumen yg diperlukan untuk mendapatkan borang JPJK1 diperkenalkan dlm beberapa bln lalu. Yang boleh di beli dgn harga RM100 di pencetakan nasional atau di Jabatan Telekom dll.

COMPLAINT. GST Calculator GST shall be levied and charged on. Jk69 Form Fill Online Printable Fillable Blank Pdffiller.

Notification on End-Use Statement EUS Form 5 Strategic Trade. Haiwan Jabatan Perkhidmatan Haiwan menjalankan pemeriksaan dokumen dan fizikal bagi semua pengimportan di pintu masuk pertama. Bagi mendapatkan kelulusan tersebut pemohon hendaklah memperoleh dan mengisi Borang Kastam JK69.

Borang Kastam K1 8. Check With Expert GST shall be levied and charged on the taxable supply of goods and services. Surat Pengesahan dari Bengkel yang Dibenarkan.

Bagi mendapatkan kelulusan tersebut pemohon hendaklah memperoleh dan mengisi Borang Kastam JK69. Borang berkenaan boleh dibeli daripada Kedai Percetakan Nasional M Sdn Bhd Jalan Chan Sow Lin. GST Calculator GST shall be levied and charged on.

Borang tersebut terdiri daripada tiga salinan berkarbon dan oleh itu tidak boleh dimuat turun dari laman web. Jk69 form Telecharger eBook. Once endorsed by MITI the form becomes an Approved Permit AP.

Borang permohonan kelulusan loji pemprosesan rumah sembelih yang baru permohonan pengimportan makanan haiwan kesayangan ternakan berasaskan haiwan ke malaysia 114kb. Jk69 form Free Download PDF. EVENT CALENDAR Check out whats happening.

Pendaftaran dan Resit Jika Berkenaan 5.