Marketing And Kastam

Pemeriksaan Kastam Kuarantin oleh KDRM DOA Sabah. Consequently starting in the amount of electronic marketing strategy is whenever a companys existing website which will be to review the present site and its purpose is to improve the potency of the future.

Domestic marketing of agriculture produce from farmer.

Marketing and kastam. Apart from this KDRM implements 18 by. Suruhanjaya Perkhidmatan Awam Malaysia SPA9 Jawatan Kosong Kerja Kosong cari kerja kosong cari jawatan kosong Jawatan Kosong 2021 Kerja Kosong 2021 Jawatan kosong kerajaan Jawatan Kosong 2021 Jawatan kosong terkini di Malaysia KASTAM JPJ KKM SPA SPA8 UNIVERSITI BOMBA GURU TUDM TLDM IMIGRESEN. Lantik pilih pembekal agen penghantaran syarikat.

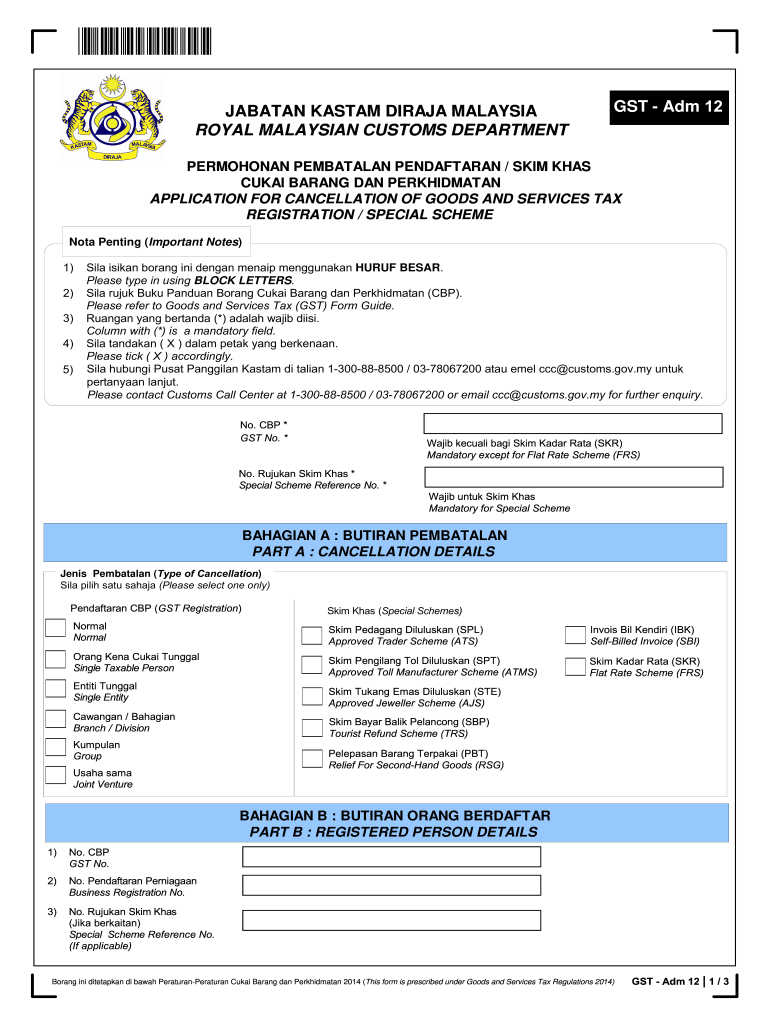

Payment of SST Sales and Service Tax As same as the filing of SST return there are two ways to make the SST payment. However for payment of taxes. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya Hotline.

There is no evidence that the development and implementation of a method to be significantly different way of electronic marketing. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya 1300 888 500 Pusat Panggilan Kastam. Marketing Executive jobs in Kampung Kastam Johor Filter.

Marketing origination with the recognition of a need on the part of a consumer and termination with the satisfaction of that need by the delivery of a usable product at the right time at the right place. 10 May 2011 Facts As a result of a post importation inspection conducted the Royal Malaysian Customs Federal Territory Kuala Lumpur contended that the royalty paid by Colgate-Palmolive Marketing Sdn Bhd the Applicant to. Indeed ranks Job Ads based on a combination of employer bids and relevance such as your search terms and other activity on Indeed.

Indeed may be compensated by these employers helping keep Indeed free for jobseekers. In other words KDRM administers seven 7 main and thirty-nine 39 subsidiary laws. Jabatan Kastam Diraja Malaysia Pusat Pemprosesan Kastam Kompleks Kastam Kelana Jaya No22Jalan SS63 Kelana Jaya 47301 Petaling Jaya Selangor.

With the country celebrating the festive season in full swing they said a dipping COVID-19 graph is only part of the picture and pointed to factors such as the mortality rate the need for a larger vaccination cover and examples of countries such as the UK where numbers are again rising according to a leading news agency. Jabatan Kastam Diraja Malaysia abbreviated RMC or JKDM is the Malaysian Government agency responsible for administrating the nations indirect tax policy border enforcement and narcotic offences. Sort by Relevance Date Job type Any job type Full time Permanent Contract Part time Internship Listed date Any time Last 24 hours Last 7 days Last 14 days Last 30 days.

The Royal Malaysian Customs Department Malay. Customs Quarantine Inspection by RMCD DOA Sabah Pendaftaran dengan FAMA sebagai pengeksport melalui Dagang Net. Colgate-Palmolive Marketing Sdn Bhd v Ketua Pengarah Kastam 2011 HC KL Originating Motion No.

Crisis management planning begins long before an issue arises. Page 1 of 922 jobs. The Thirteenth Edition reflects the latest trends in marketing including new coverage on online social media mobile and other digital technologies.

Displayed here are Job Ads that match your query. However inadequate preparation can have serious operational legal and public relations consequences. Registration With FAMA as an Exporter - through Dagang Net.

I am not sure we are in the endemic state yet. It can be tempting to put off risk management when things are going well. Marketing is a total system of interacting business activities designed to plan promote and distribute need satisfying products and services to existing and potential customers.

You can do it online via the FPX system of the CJP system. Jawatan Kosong jobs in Kedah. Jawatan Kosong di Johor.

Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya 1300 888 500 Pusat Panggilan Kastam. R2-25-259-2008 Date of Judgment.

:max_bytes(150000):strip_icc()/dotdash_final_The_Impact_of_Exchange_Rates_on_Japans_Economy_Jan_2021-01-f43b9e40b4af4c97827fa21bda183e1c.jpg)