No Kastam Malaysia

Apart from this KDRM implements 18 by. 1 Jabatan Kastam Diraja.

Kastam Photos Free Royalty Free Stock Photos From Dreamstime

Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya 1300 888 500 Pusat Panggilan Kastam 1800 888 855 Aduan Penyeludupan 03-8882 21002300 Ibu Pejabat ccccustomsgovmy.

No kastam malaysia. Payment via chequebank draft must be made payable to Ketua Pengarah Kastam Malaysia and mail to. 21 Apr 2017 by Dragon. There are no translations available.

10 pagi tempat. Pengikraran pertama sebelum mendapat kelulusan pengecualian Provisional. Jabatan Kastam Diraja Malaysia Wisma Kastam No.

Menerima dan menghantar bungkusan pos boleh. 603-78802057 60162573610 Whatsapp. Mesyuarat agong tahunan kali ke 5.

12 rows No. Secara maya agenda mesyuarat. The current browser does not support Web pages that contain the IFRAME element.

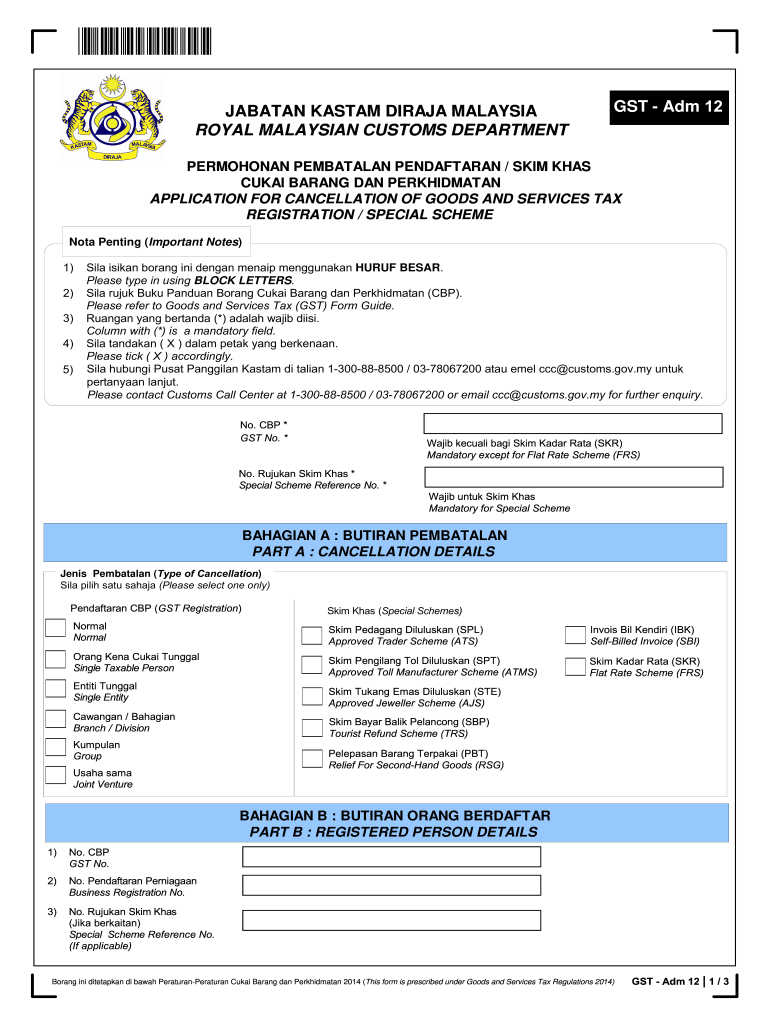

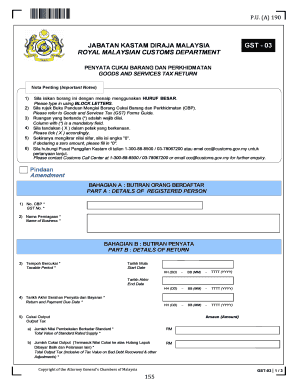

Jabatan Kastam Diraja Malaysia Jalan Dua Pejabat Kerajaan 86000 Kluang. Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy. Semakan Syarikat Berdaftar GST Berdasarkan Pendaftaran Syarikat Nama Syarikat atau Nombor GST Check.

Tahun 2021 tarikh. Portal akses bagi pembayar cukai TaxPayer Access Point. Pemeriksaan ke atas sebuah kontena di Inspection Bay Wisma Kastam Pelabuhan Tanjung Pelepas Johor pada jam 935 pagi menemui kontena.

Ketua Pengarah Kastam Malaysia Jabatan Kastam Diraja Malaysia Pusat Pemprosesan Kastam Kompleks Kastam Kelana Jaya No22 Jalan. All the welfare of members and families is given priority. Portal Rasmi Jabatan Kastam Diraja Malaysia Official Portal of Royal Malaysian Customs Department.

-- Choose -- PDK 2017 PDK 2017 ATIGA ACFTA AHKFTA MPCEPA MJEPA AKFTA AJCEP AANZFTA AINDFTA MNZFTA MICECA D8PTA MCFTA MAFTA MTFTA. As such it is hard to imagine an initial move based. The Royal Malaysian Customs Department Malay.

Persatuan mantan pegawai pengurusan kastam malaysia ppm-003-05-16032015 no 4 rk68 rasah kemayan seremban 2. Malaysia Sales Sales Tax SST. Garis Panduan Pemberian Penerimaan Hadiah JKDM.

14 november 2021 masa. Curtain Shop Malaysia Photo Booth Props 4d Results. Kastam patahkan cubaan seludup dadah lebih RM 10 juta.

Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya. 1 BK1 dibuat sebanyak 2 kali. HS Code Item Description.

The loan facilities provided have succeeded in reducing the financial burden of its members as well as encouraging savings and thrift practices. 03 7884 0800 Faksimili. Kastam No4 Customs No4 KASTAM DIRAJA MALAYSIA ROYAL CUSTOMS MALAYSIAN DAFTAR MUATAN MASUK INWARD MANIFEST Seksyen 52 dan 54 Akta Kastam 1967 Sections 52 and 54 of the Customs Act 1967 Vessel ID Name.

Pelan Antirasuah Organisasi JKDM. Akademi Kastam Diraja Malaysia AKMAL Information Technology Division. WordPress Theme - Total by HashThemes.

Sistem Levi Pelepasan MYDLV adalah salah satu sistem di bawah tadbir urus dan kawal selia Jabatan Kastam DiRaja Malaysia JKDM bagi melaksanakan pengurusan dan pemprosesan data dan aliran kerja bagi Levi Pelepasan. Ketua Pengarah Kastam Malaysia Jabatan Kastam Diraja Malaysia Pusat Pemprosesan GST Kompleks Kastam Kelana Jaya No22 Jalan SS63 Kelana Jaya 47301 Petaling Jaya Selangor. JABATAN KASTAM DIRAJA MALAYSIA ZON TENGAH UNIT I WPKL KOMPLEKS KASTAM WPKL NO22 JALAN SS63 KELANA JAYA 47301 PETALING JAYA SELANGOR.

1 Jln Tun Abdul Razak 30100 Ipoh. Koperasi kastam malaysia berhad 15 NoJ- 2 -1 2 Jalan SS 618 Dataran Glomac Kelana Jaya Peti Surat 9125Pejabat Pos Kelana Jaya46805 Petaling JayaSelangor Telefon. Pengikraran dalam Borang Kastam No.

GST Offices Telephone No. In other words KDRM administers seven 7 main and thirty-nine 39 subsidiary laws. GLOE EVER GLOBE.

CLIENTS CHARTER PRIVACY POLICY SECURITY. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya Hotline. Jabatan Kastam Diraja Malaysia abbreviated RMC or JKDM is the Malaysian Government agency responsible for administrating the nations indirect tax policy border enforcement and narcotic offences.

Payment via chequebank draftmoney order must be made payable to Ketua Pengarah Kastam Malaysia and mail to. Laman Sehenti bagi Sistem uCustoms One Stop Portal for uCustoms System. 14 rows There are no translations vailable.

Tarikh Akhir Dikemaskini. Prosedur pengimportan sebelum dan selepas mendapat Surat Pengecualian Perbendaharaan seperti berikut -A Prosedur Import dengan menggunakan jaminan bank. Koperasi Kastam Malaysia Berhad Kopkastam has succeeded in upgrading the socio-economic status of its members.

:max_bytes(150000):strip_icc()/dotdash_final_The_Impact_of_Exchange_Rates_on_Japans_Economy_Jan_2021-01-f43b9e40b4af4c97827fa21bda183e1c.jpg)